Exploring Three Chinese Dividend Stocks In June 2024

As of June 2024, China's economic landscape presents a mixed picture, with manufacturing indicators pointing to growth headwinds while policy measures aim to stabilize the property sector and bolster domestic demand. In this context, dividend stocks can offer investors potential stability and regular income streams, qualities that are particularly appealing in uncertain economic times.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.06% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.63% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.17% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.24% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.47% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.43% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.07% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.93% | ★★★★★★ |

Click here to see the full list of 194 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

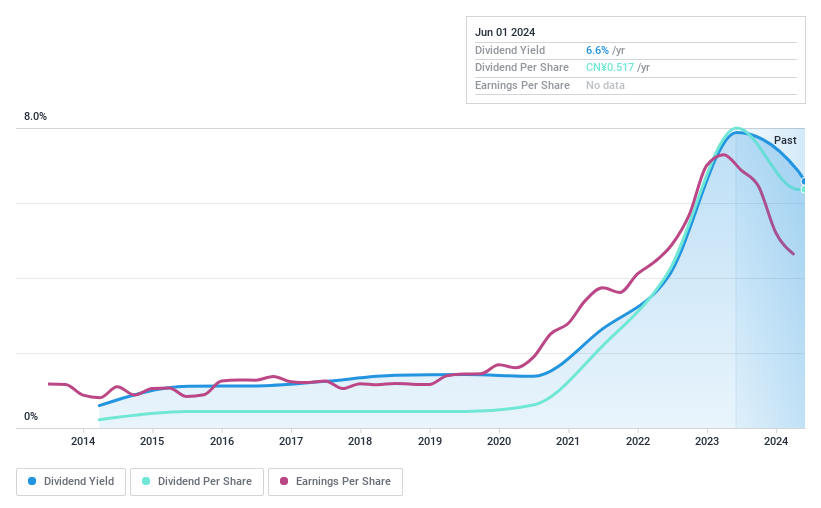

Sichuan Road & Bridge GroupLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sichuan Road & Bridge Group Co., Ltd specializes in the investment, development, construction, and operation of engineering construction projects, mining, clean energy, and new materials both in China and globally, with a market capitalization of approximately CN¥68.50 billion.

Operations: Sichuan Road & Bridge Group Co., Ltd generates revenue through its core activities in engineering construction, mining, clean energy, and new materials.

Dividend Yield: 6.6%

Sichuan Road & Bridge Group Co., Ltd has experienced a decline in both revenue and net income, with first-quarter 2024 revenues dropping to CNY 22.11 billion from CNY 30.89 billion the previous year, and net income falling to CNY 1.76 billion from CNY 2.73 billion. Despite this downturn, the company maintains a dividend yield of 6.58%, ranking in the top quartile of Chinese dividend payers, supported by a reasonable payout ratio of 55.7%. However, its dividends have been inconsistent over the past decade and are not well-covered by cash flows or free cash flow, raising concerns about sustainability amidst financial pressures.

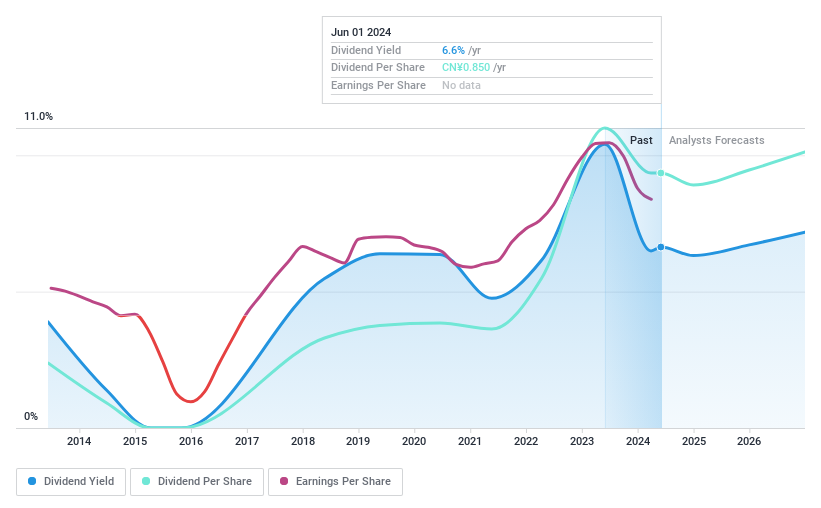

Anhui Hengyuan Coal Industry and Electricity PowerLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Anhui Hengyuan Coal Industry and Electricity Power Co., Ltd is a Chinese company that specializes in the mining, production, washing, sale, and transportation of coal, with a market capitalization of approximately CN¥15.37 billion.

Operations: Anhui Hengyuan Coal Industry and Electricity Power Co., Ltd generates revenue primarily through its industrial operations, which amounted to CN¥7.60 billion.

Dividend Yield: 6.6%

Anhui Hengyuan Coal Industry and Electricity Power Co., Ltd reported a decrease in quarterly sales and net income, with first-quarter 2024 figures showing revenues of CNY 2.05 billion and net income of CNY 431.23 million, down from the previous year. Despite this downturn, the company recently declared a cash dividend of CNY 0.85, payable in May 2024. While Anhui Hengyuan has increased its dividend payments over the past decade, its dividends have been volatile during this period. The firm's dividends are covered by earnings with a payout ratio of 54.9%, suggesting reasonable coverage but raising questions about future sustainability given the recent financial performance.

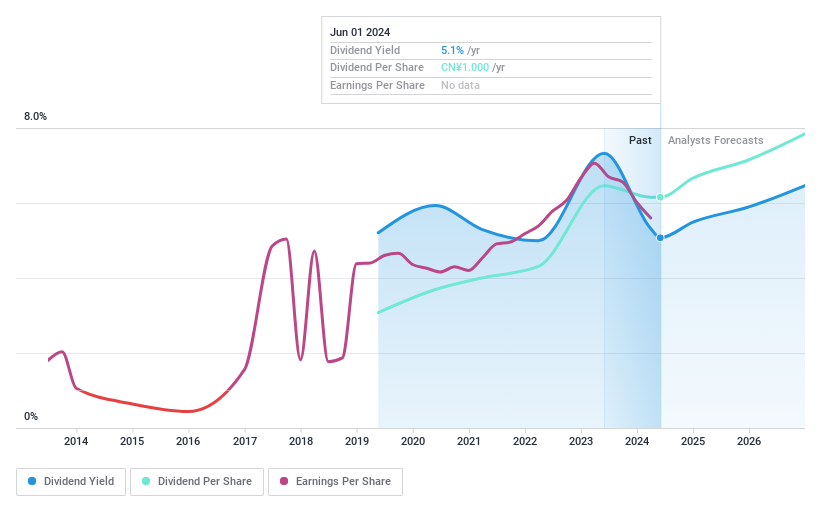

Huaibei Mining HoldingsLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huaibei Mining Holdings Co., Ltd. is a company based in China that focuses on coal mining, washing, processing, sales, and storage, with a market capitalization of approximately CN¥53.11 billion.

Operations: Huaibei Mining Holdings Co., Ltd. generates its revenue primarily from coal-related activities including mining, washing, processing, and sales within China.

Dividend Yield: 5.1%

Huaibei Mining Holdings Ltd., with a dividend yield of 5.07%, ranks in the top 25% of dividend payers in China, offering a competitive return compared to the market average of 2.3%. Despite its relatively short history of dividend payments—only five years—the dividends are well-supported by both earnings and cash flows, with payout ratios of 43.5% and cash payout ratios at 51.3%, respectively. However, recent financial reports indicate a downturn; Q1 2024 saw revenues drop to CNY 17.36 billion from CNY 19.04 billion year-over-year, alongside a decrease in net income to CNY 1.59 billion from CNY 2.11 billion, reflecting potential challenges ahead for sustaining profitability and by extension, dividend growth.

Make It Happen

Take a closer look at our Top Dividend Stocks list of 194 companies by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600039 SHSE:600971 and SHSE:600985.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance