Exploring Shan Xi Hua Yang Group New EnergyLtd Among Three Leading Dividend Stocks

As global markets navigate through varying economic signals, China's recent initiatives to stabilize its property sector reflect a broader effort to bolster economic stability. Amid these developments, dividend stocks like Shan Xi Hua Yang Group New Energy Ltd offer investors potential resilience and steady income in a fluctuating market environment.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.05% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.08% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.44% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.14% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.25% | ★★★★★★ |

Changchun High-Tech Industry (Group) (SZSE:000661) | 4.01% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.42% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.19% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.02% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.76% | ★★★★★★ |

Click here to see the full list of 186 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Shan Xi Hua Yang Group New EnergyLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shan Xi Huayang Group New Energy Co., Ltd. is a company engaged in the coal and chemical industries with a market capitalization of approximately CN¥39.43 billion.

Operations: Shan Xi Huayang Group New Energy Co., Ltd. generates its revenue primarily from the coal and chemical sectors.

Dividend Yield: 6.6%

Shan Xi Hua Yang Group New Energy Co., Ltd. has experienced a decline in revenue and net income as evidenced by its Q1 2024 results, with sales dropping to CNY 6.16 billion from CNY 8.38 billion year-over-year and net income falling to CNY 933.8 million from CNY 1.89 billion. Despite these challenges, the company maintains a high dividend yield of 6.57%, which ranks in the top quartile of Chinese dividend payers but is not well-supported by free cash flow or earnings growth, indicating potential sustainability issues for future dividends especially given the volatility observed over the past decade.

Bank of Shanghai

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Shanghai Co., Ltd. operates primarily in Mainland China, offering a range of personal and corporate banking products and services, with a market capitalization of approximately CN¥113.94 billion.

Operations: Bank of Shanghai Co., Ltd. generates its revenue primarily through personal and corporate banking services within Mainland China.

Dividend Yield: 5.7%

Bank of Shanghai's dividend yield at 5.74% ranks well above the Chinese market average. Despite a relatively short history of dividend payments, under 10 years, the dividends show promising stability and growth prospects. The company's payout ratio stands at a sustainable 30%, ensuring dividends are well covered by earnings, which have grown annually by 3.8% over the past five years and are expected to grow by 5.29% per year moving forward. Recent financials indicate steady performance with Q1 net income rising slightly to CNY 6,150.32 million from CNY 6,043.23 million year-on-year.

Click here to discover the nuances of Bank of Shanghai with our detailed analytical dividend report.

Upon reviewing our latest valuation report, Bank of Shanghai's share price might be too pessimistic.

Trina Solar

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Trina Solar Co., Ltd. is a company involved in the research, development, production, and sales of photovoltaic modules across various global regions including China, Europe, and North America, with a market capitalization of CN¥45.22 billion.

Operations: Trina Solar Co., Ltd. generates its revenue primarily from the production and sales of photovoltaic modules across regions such as China, Europe, North America, South America, Japan, the Asia Pacific, the Middle East, and North Africa.

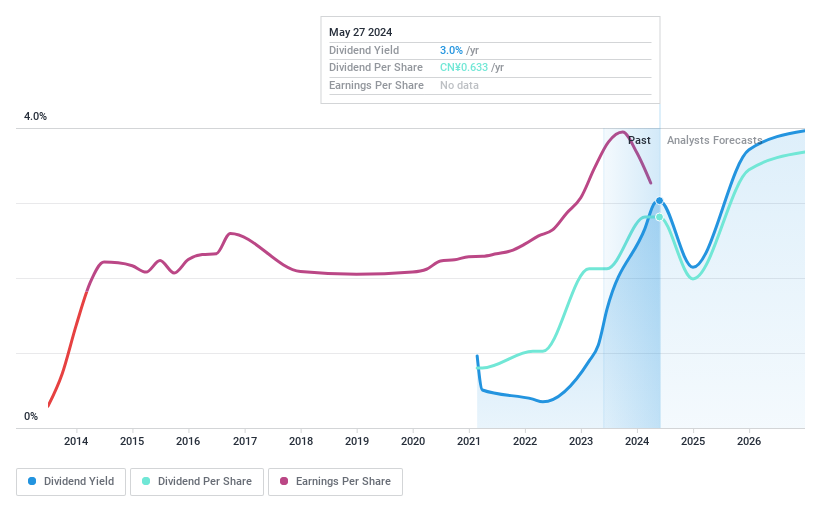

Dividend Yield: 3%

Trina Solar's dividend growth is notable despite its short history of three years in dividend payments, showcasing a stable yet brief track record. Financially, the firm grapples with high debt levels but trades at a significant 43.2% below estimated fair value, suggesting potential undervaluation relative to its earnings forecast growth of 22.7% annually. Dividend sustainability appears robust with coverage ratios well under control; earnings cover dividends at 31.8%, and cash flows at 27.2%. Recent strategic expansions into Pakistan emphasize Trina Solar's focus on enhancing its global footprint and product innovation in high-efficiency solar solutions.

Click to explore a detailed breakdown of our findings in Trina Solar's dividend report.

Our valuation report unveils the possibility Trina Solar's shares may be trading at a discount.

Next Steps

Click this link to deep-dive into the 186 companies within our Top Dividend Stocks screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600348SHSE:601229 SHSE:688599.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance