Exploring The Risks Of MA Financial Group And One Better Option On The ASX

Investing in dividend stocks is a popular strategy for those seeking regular income from their investments. However, it's important to assess the sustainability of these dividends. For instance, MA Financial Group presents a cautionary tale with its high payout ratio, which could signal potential challenges in maintaining its dividend levels.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.09% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.22% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.09% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 4.01% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.11% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.27% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.17% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.56% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Underneath we present one of the stocks filtered out by our screen and one to consider sidestepping.

Top Pick

Fortescue

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is an Australian company that specializes in the exploration, development, production, processing, and sale of iron ore domestically and internationally, with a market capitalization of approximately A$67.43 billion.

Operations: The company generates revenue primarily from metals, particularly iron ore, totaling A$18.47 billion, with an additional segment in energy contributing A$79 million.

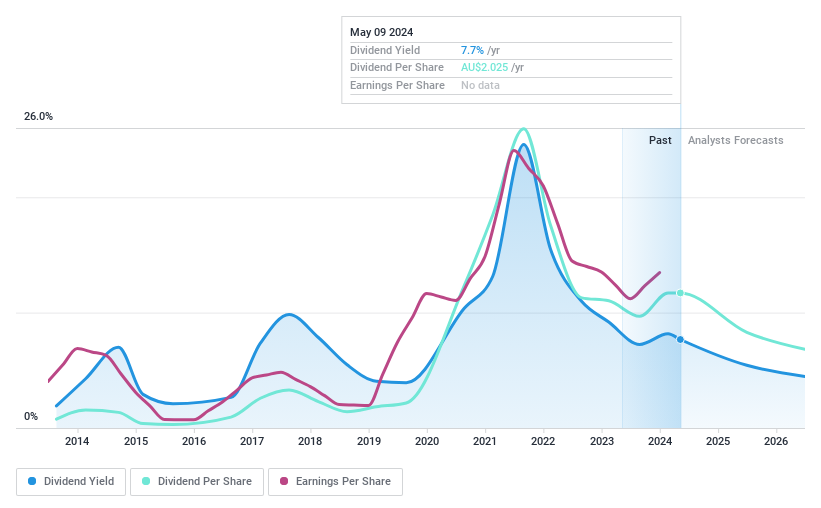

Dividend Yield: 9.1%

Fortescue's dividend yield stands at a robust 9.11%, placing it well within the top quartile of Australian dividend payers. Despite a history of volatility in dividend payments, recent years have shown improvement with dividends now comfortably covered by both earnings and cash flows, with payout ratios standing at 74.2% and 73.1% respectively. This contrasts sharply with some peers struggling with unsustainable payouts. However, investors should note forecasts suggesting an average earnings decline of 18% annually over the next three years, potentially impacting future dividends.

One To Reconsider

MA Financial Group

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: MA Financial Group Limited, operating in Australia, offers a range of financial services with a market capitalization of approximately A$708.64 million.

Operations: The company generates revenue primarily through three segments: Lending (A$44.65 million), Asset Management (A$176.07 million), and Corporate Advisory and Equities (A$48.28 million).

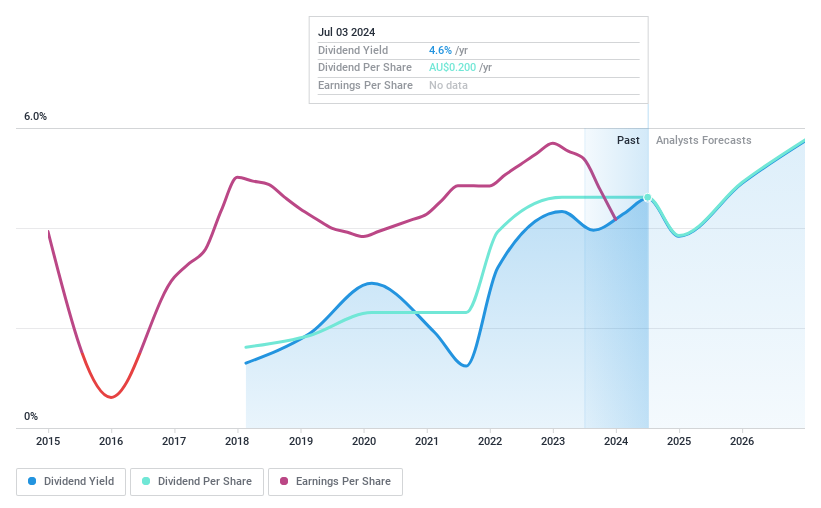

Dividend Yield: 4.6%

MA Financial Group's dividend sustainability is questionable with a payout ratio of 112.3% and a cash payout ratio of 180.3%, indicating dividends are poorly covered by both earnings and cash flows. Despite a dividend yield of 4.6%, it falls below the top quartile benchmark of 6.5% in the Australian market. Although dividends have been reliable, MAF has only been distributing dividends for six years, and its profit margins have declined from last year's 5.9% to this year’s 3.3%.

Unlock comprehensive insights into our analysis of MA Financial Group stock in this dividend report.

Taking Advantage

Take a closer look at our Top ASX Dividend Stocks list of 27 companies by clicking here.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:FMG and ASX:MAF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance