Exploring Japan's Top Dividend Stocks In February 2024

As February 2024 unfolds, Japan's market is showing a robust uptrend with a 1.6% rise in the last week and an impressive 31% increase over the past year, complemented by earnings projected to grow by 9.4% annually. In this dynamic environment, discerning investors may find particular value in dividend stocks that offer potential for steady income and growth prospects aligned with current market conditions.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Sun Frontier Fudousan (TSE:8934) | 3.54% | ★★★★★★ |

Yamato Kogyo (TSE:5444) | 3.56% | ★★★★★★ |

SOLXYZ (TSE:4284) | 3.48% | ★★★★★★ |

Nippon Air conditioning Services (TSE:4658) | 3.37% | ★★★★★★ |

MS&AD Insurance Group Holdings (TSE:8725) | 3.34% | ★★★★★★ |

Shimojima (TSE:7482) | 4.43% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

Innotech (TSE:9880) | 3.66% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.35% | ★★★★★★ |

Global One Real Estate Investment (TSE:8958) | 5.57% | ★★★★★★ |

Click here to see the full list of 477 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

GakkyushaLtd (TSE:9769)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Gakkyusha Co., Ltd. is a Japanese educational service provider specializing in cram school management for students preparing for entrance exams to junior high schools, high schools, and universities, both domestically and internationally, with a market capitalization of approximately ¥22.93 billion.

Operations: Gakkyusha Co., Ltd. generates its revenues primarily through educational services related to preparatory instruction for students aiming to enter various levels of academic institutions.

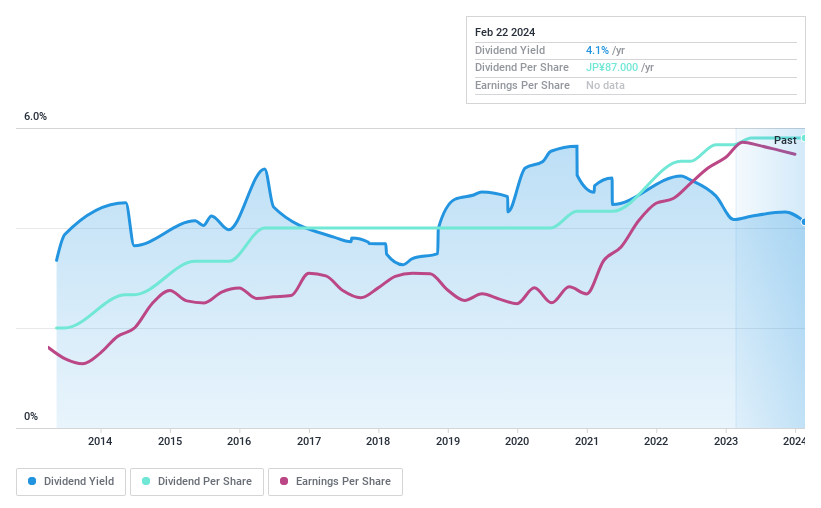

Dividend Yield: 4.1%

Gakkyusha Ltd. presents an intriguing profile for dividend investors, with a history of stable and reliable dividend payments over the past decade, indicating a commitment to shareholder returns. The company's debt has been managed prudently, evidenced by a declining debt to equity ratio and cash reserves exceeding total debt. Moreover, dividends are well-supported by both earnings and cash flow with reasonable payout ratios around 53% and 52.2%, respectively. While Gakkyusha's profit margins have remained flat year-over-year and recent earnings growth has decelerated compared to its five-year average, the robust interest coverage ratio suggests financial flexibility. The dividend yield stands above the market average in Japan, adding to its appeal among income-focused portfolios. However, investors should note the lack of data on expected future profit and revenue growth when considering long-term prospects.

To ensure that you don't miss out on any news or updates around this stock or any of your other holdings, keep them under close view with the insightful analysis available through Simply Wall St's portfolio tool.

SOLXYZ (TSE:4284)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SOLXYZ Co., Ltd. is a Japanese company specializing in the development of software solutions, with a market capitalization of approximately ¥8.39 billion.

Operations: SOLXYZ Co., Ltd. generates its revenues primarily through the development of software solutions within Japan.

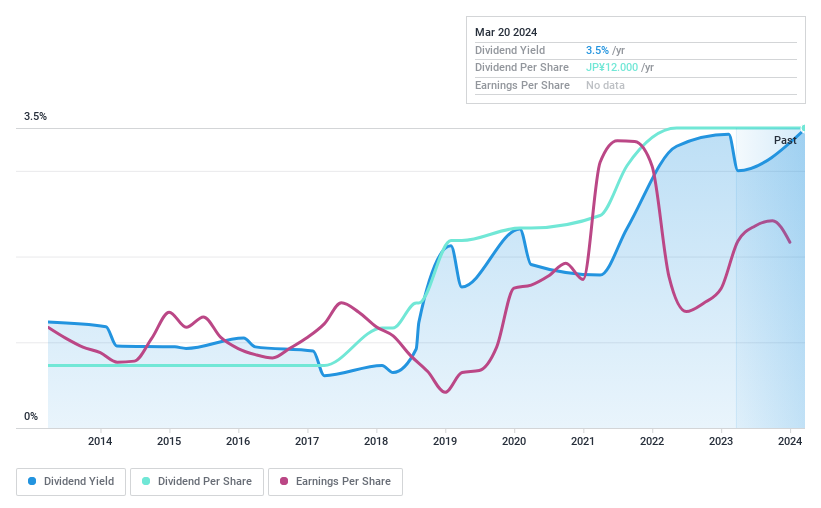

Dividend Yield: 3.5%

SOLXYZ Co. Ltd. has demonstrated a commendable performance in terms of debt management and profitability, which could appeal to dividend investors. The company's significant reduction in debt to equity ratio over five years and a cash position that exceeds its total debt underscore financial stability. Earnings have not only grown consistently but also at an accelerated pace over the past year, surpassing the five-year average growth rate. Dividend sustainability is evidenced by conservative payout ratios from earnings and cash flows, coupled with a decade-long history of reliable and incrementally increasing dividends. The current dividend yield positions SOLXYZ among the higher echelons in the Japanese market, though investors should be aware of the absence of projections for future earnings growth when weighing its potential as a long-term income investment.

Take a closer look at SOLXYZ's potential here in our dividend report.

Our expertly prepared valuation report SOLXYZ implies its share price may be lower than expected.

Having identified potential in an undervalued stock is only part of successful investing as continuous evaluation is also key. Make it effortless with Simply Wall St's portfolio tool.

Yamato Kogyo (TSE:5444)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yamato Kogyo Co., Ltd. is a global enterprise specializing in the production and distribution of steel products, with a market capitalization of approximately ¥536.4 billion.

Operations: Yamato Kogyo Co., Ltd. operates primarily in the steel production and distribution sector, with a significant presence both domestically and internationally.

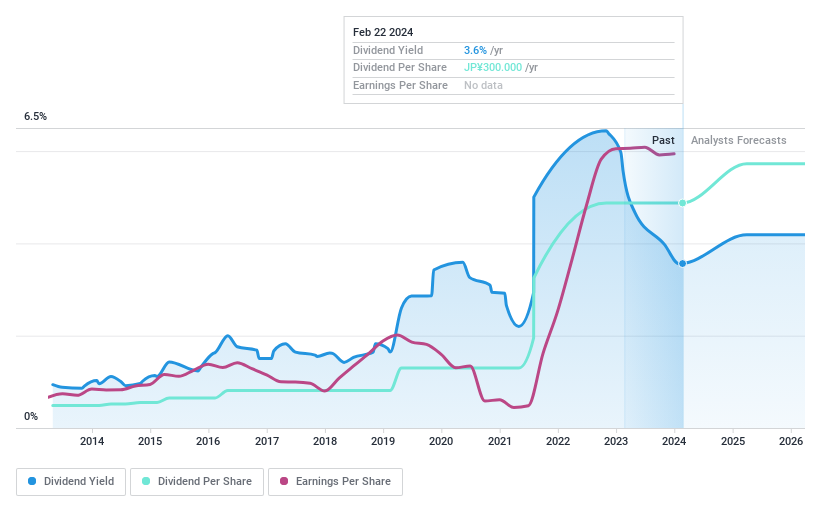

Dividend Yield: 3.6%

Yamato Kogyo emerges as a noteworthy contender for dividend-focused portfolios, with its debt-free balance sheet providing a solid foundation for financial resilience. The company has seen substantial earnings growth over the past five years, reinforcing the sustainability of its dividends, which are well-covered by both earnings and cash flow. Despite lacking in earnings acceleration recently and facing forecasted declines in profit growth, Yamato Kogyo maintains a stable and increasing dividend track record over the last decade. Its dividend yield stands above average in Japan's market, offering an attractive proposition for income investors while signaling caution due to slower anticipated revenue expansion.

Unlock comprehensive insights into our analysis of Yamato Kogyo stock in this dividend report.

Recognizing undervalued stocks is just the first step. To effectively track your investment's performance and make informed decisions, consider utilizing Simply Wall St's portfolio tool.

Final Thoughts

Unlock the door to a world of dividend opportunities with the insightful analysis provided by the Simply Wall St screener. Delve into our full catalog of 477 Top Dividend Stocks here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance