Exploring High Insider Ownership Growth Stocks On The Indian Exchange

The Indian stock market has shown robust growth, rising 5.1% in the last week and an impressive 44% over the past year, with earnings expected to grow by 16% annually. In such a flourishing market, stocks with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.4% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Let's explore several standout options from the results in the screener.

Aether Industries

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aether Industries Limited, operating both in India and internationally, specializes in producing and selling advanced intermediates and specialty chemicals, with a market capitalization of approximately ₹108.76 billion.

Operations: The company generates revenue primarily through three segments: Contract Manufacturing at ₹1.53 billion, Large Scale Manufacturing at ₹3.56 billion, and Contract Research and Manufacturing Services (CRAMS) at ₹0.83 billion.

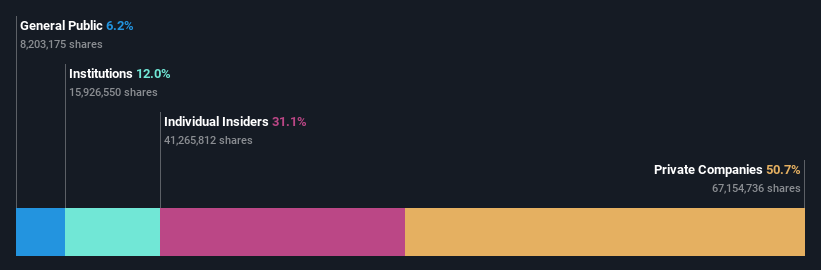

Insider Ownership: 31.1%

Revenue Growth Forecast: 32% p.a.

Aether Industries, a specialty chemicals manufacturer in India, is expected to see significant growth with earnings forecasted to increase by 39.82% annually and revenue projected to grow at 32% per year, outpacing the Indian market averages significantly. Despite this robust growth outlook, the company's return on equity is anticipated to remain low at 12.5%, and profit margins have decreased from last year. Recent strategic alliances, like the collaboration with Novoloop for a pilot plant in Surat that validates innovative recycling technology, underscore Aether's operational strengths and potential for future expansions.

MTAR Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MTAR Technologies Limited is a precision engineering solutions company that develops, manufactures, and sells mission-critical precision assemblies and components both in India and internationally, with a market cap of approximately ₹54.78 billion.

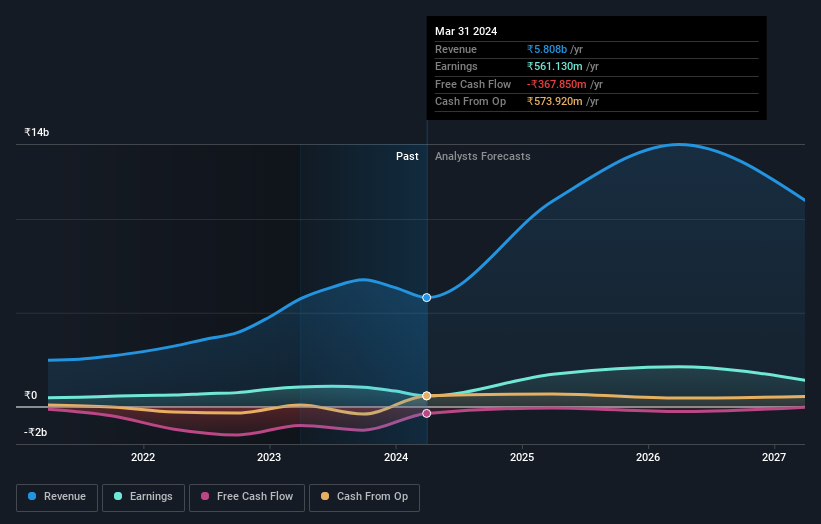

Operations: The company generates ₹5.81 billion from its high precision and heavy equipment, components, and machines segment.

Insider Ownership: 39%

Revenue Growth Forecast: 17.8% p.a.

MTAR Technologies, an Indian precision engineering firm, exhibits a mixed growth outlook with insider buying activity over the past three months. Its revenue is expected to grow at 17.8% annually, slightly underperforming the 20% industry benchmark but still outpacing the broader Indian market's 9.5%. Earnings are projected to increase by 20.11% per year, surpassing market averages. However, recent financials show a decline in profit margins and net income compared to the previous year, signaling potential challenges ahead despite a long-term contract with Israeli Aerospace Industries promising substantial business inflows over 15 years valued between US$90 million and US$120 million.

Pricol

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pricol Limited is an Indian company that manufactures and sells instrument clusters and other automobile components primarily to original equipment manufacturers, with a market capitalization of approximately ₹55.09 billion.

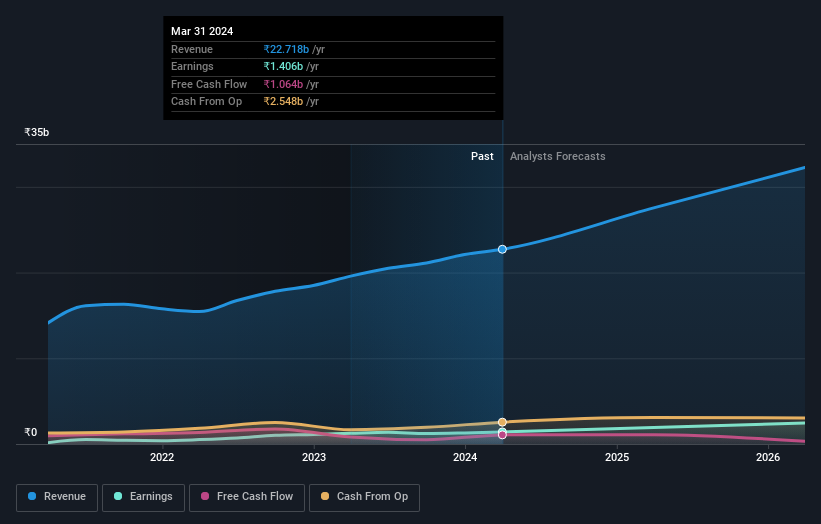

Operations: The company generates ₹22.72 billion in revenue from its automotive components segment.

Insider Ownership: 25.5%

Revenue Growth Forecast: 17.3% p.a.

Pricol Limited, an Indian auto components manufacturer, shows promising growth with high insider ownership. Recently, the company reported a significant increase in yearly sales and net income for FY 2024. Analysts expect Pricol's earnings to grow by 26.9% annually over the next three years, outpacing the Indian market's average of 15.9%. While its revenue growth forecast of 17.3% annually is robust, it falls short of the high-growth benchmark of 20%.

Make It Happen

Access the full spectrum of 80 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:AETHER NSEI:MTARTECH and NSEI:PRICOLLTD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance