Exploring High Insider Ownership In 3 Growth Companies On The Chinese Exchange

As China's economy grapples with deflationary pressures and a sluggish real estate sector, the broader Chinese stock market has shown resilience, underscored by modest gains in major indices. In this context, high insider ownership in growth companies could signal strong confidence from those who know these companies best. High insider ownership is often regarded as a positive indicator as it aligns management’s interests with those of shareholders, especially in volatile market conditions like those currently seen in China.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 64.8% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

We're going to check out a few of the best picks from our screener tool.

3Peak

Simply Wall St Growth Rating: ★★★★★☆

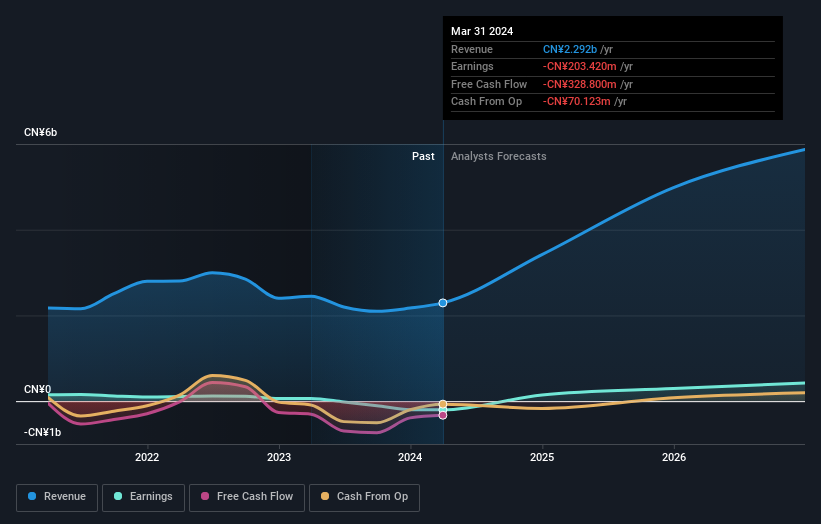

Overview: 3Peak Incorporated is a fabless semiconductor company specializing in a range of analog products and technologies, with a market capitalization of approximately CN¥11.61 billion.

Operations: The company generates its revenue primarily from the integrated circuit industry, totaling CN¥986.27 million.

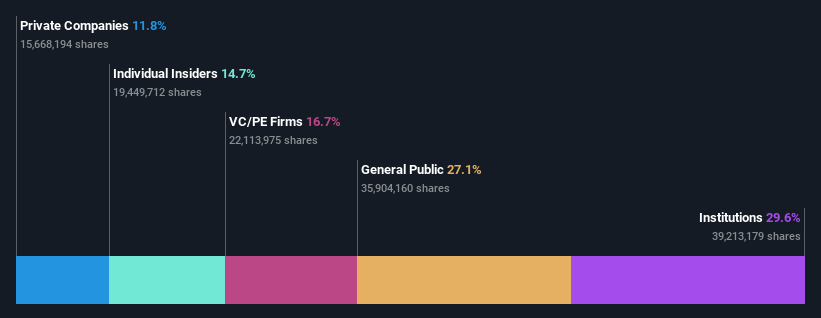

Insider Ownership: 14.7%

Earnings Growth Forecast: 77.6% p.a.

3Peak, despite a challenging fiscal quarter with a net loss of CNY 49.17 million and reduced sales from CNY 307.26 million to CNY 200.01 million, shows promise through its strategic partnership with DigiKey, expanding its global distribution footprint in high-demand tech sectors. The company's revenue is projected to grow at an impressive rate of 35.3% annually, outpacing the Chinese market forecast of 14%. However, its return on equity is expected to remain low at 6.8% over the next three years, reflecting potential concerns about profitability and efficiency amidst growth trajectories.

Unionman TechnologyLtd

Simply Wall St Growth Rating: ★★★★★★

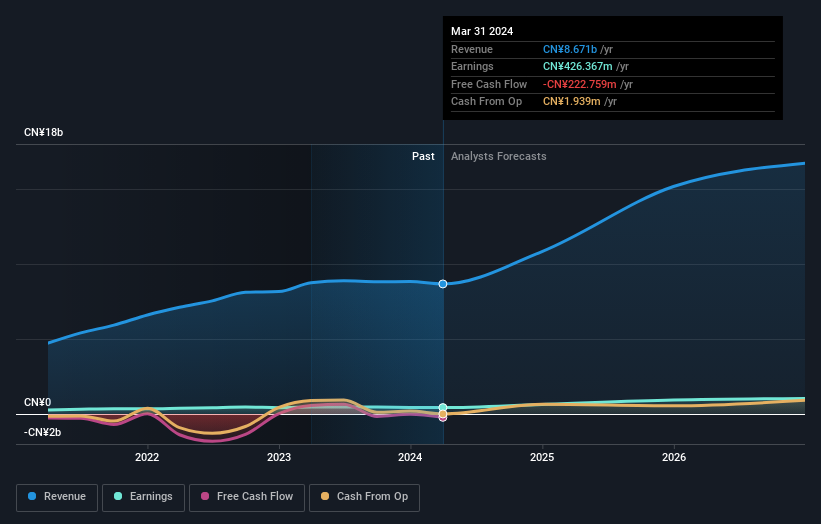

Overview: Unionman Technology Co., Ltd. specializes in the production, sale, and servicing of multimedia information terminals, smart home network communication equipment, and various communication modules, with a market capitalization of approximately CN¥5.49 billion.

Operations: The company generates revenue primarily through the sale and servicing of multimedia information terminals, smart home network communication equipment, and communication modules.

Insider Ownership: 32.5%

Earnings Growth Forecast: 88.1% p.a.

Unionman TechnologyLtd., despite a recent dip in net income to CNY 4.52 million from CNY 8.76 million, is poised for significant growth with revenue projections increasing by 33.1% annually, substantially outpacing the broader Chinese market's 14%. This growth is underpinned by an optimistic earnings forecast, expected to surge by 88.07% per year. However, the company faces challenges with a highly volatile share price and debt not well covered by operating cash flow, which could impact financial stability.

Runjian

Simply Wall St Growth Rating: ★★★★★☆

Overview: Runjian Co., Ltd. is a communication technology service company based in China, specializing in communication network construction and maintenance, with a market capitalization of approximately CN¥9.78 billion.

Operations: The company specializes in communication network services, generating its revenue from construction and maintenance projects in China.

Insider Ownership: 32.7%

Earnings Growth Forecast: 34.1% p.a.

Runjian Co., Ltd. is positioned for robust growth with earnings and revenue expected to increase by 34.14% and 26.1% per year, respectively, outstripping broader market projections in China. Despite this promising outlook, the company's return on equity is anticipated to remain low at 13.6%. Additionally, recent financials show a decline in net income and revenue compared to the previous year, signaling potential challenges ahead despite a forward-looking shareholder return plan spanning up to 2026.

Next Steps

Investigate our full lineup of 410 Fast Growing Chinese Companies With High Insider Ownership right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688536 SHSE:688609 and SZSE:002929.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance