Exploring Hidden Gems on SEHK: 3 Stocks Estimated as Undervalued in June 2024

Amidst a backdrop of fluctuating global markets, the Hong Kong stock exchange has shown resilience, making it a fertile ground for identifying undervalued stocks. In June 2024, discerning investors may find opportunities in overlooked sectors that are poised to benefit from broader economic trends.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Plover Bay Technologies (SEHK:1523) | HK$2.88 | HK$5.73 | 49.7% |

Kuaishou Technology (SEHK:1024) | HK$51.55 | HK$98.82 | 47.8% |

Gaush Meditech (SEHK:2407) | HK$14.20 | HK$26.25 | 45.9% |

Zijin Mining Group (SEHK:2899) | HK$16.32 | HK$29.03 | 43.8% |

China Cinda Asset Management (SEHK:1359) | HK$0.73 | HK$1.29 | 43.5% |

Melco International Development (SEHK:200) | HK$5.84 | HK$11.38 | 48.7% |

REPT BATTERO Energy (SEHK:666) | HK$14.22 | HK$27.22 | 47.8% |

Zhaojin Mining Industry (SEHK:1818) | HK$13.08 | HK$24.83 | 47.3% |

United Energy Group (SEHK:467) | HK$0.59 | HK$1.07 | 45% |

CGN Mining (SEHK:1164) | HK$2.57 | HK$4.86 | 47.1% |

Let's dive into some prime choices out of from the screener

Innovent Biologics

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on developing and commercializing monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune diseases, and cardiovascular and metabolic disorders in China, with a market capitalization of approximately HK$61.95 billion.

Operations: The company generates revenue primarily from its biotechnology segment, totaling CN¥6.21 billion.

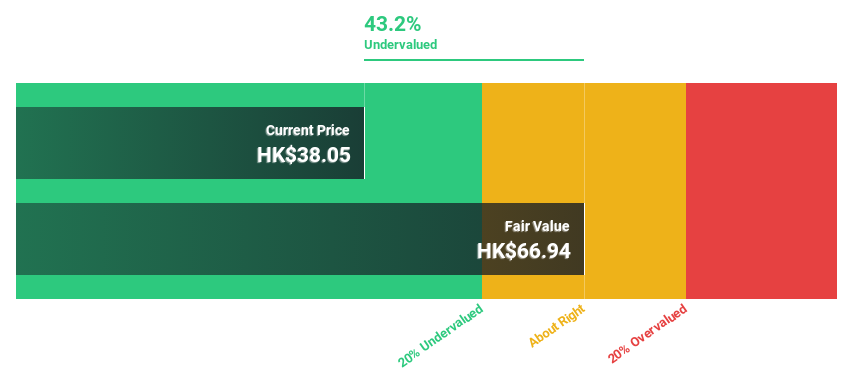

Estimated Discount To Fair Value: 43.2%

Innovent Biologics, currently trading at HK$38.05, is significantly undervalued by 43.2% based on cash flow analysis, with a fair value estimated at HK$66.94. The company's revenue growth is robust at 21.1% annually, outpacing the Hong Kong market average of 7.8%. Despite shareholder dilution in the past year and low forecasted return on equity of 9.4%, Innovent's earnings have surged by 27.1% annually over five years and are expected to grow by 50.8% annually moving forward, signaling strong future profitability and potential market revaluation.

FIT Hon Teng

Overview: FIT Hon Teng Limited, a company based in Taiwan with international operations, specializes in manufacturing and selling mobile and wireless devices as well as connectors, boasting a market capitalization of approximately HK$20.97 billion.

Operations: The company generates revenue from consumer products and intermediate products, totaling approximately $708.26 million and $3.63 billion respectively.

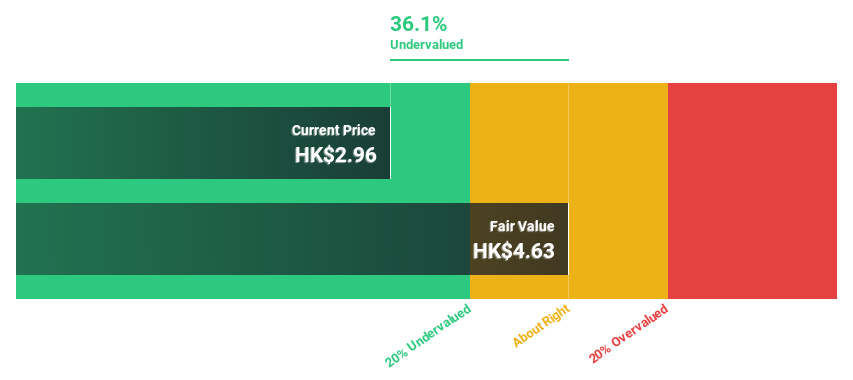

Estimated Discount To Fair Value: 36.1%

FIT Hon Teng, priced at HK$2.96, is substantially below its calculated fair value of HK$4.63, indicating a potential undervaluation. The company recently pivoted from a net loss to a forecasted net profit of US$7 million to US$10 million in Q1 2024, reflecting enhanced management and recovering market demand. Despite high volatility in its share price, FIT Hon Teng's revenue and earnings growth projections outstrip the broader Hong Kong market's averages significantly. However, its expected return on equity remains modest at 12%.

Tencent Holdings

Overview: Tencent Holdings Limited operates as an investment holding company, providing value-added services, online advertising, fintech, and business services both in the People’s Republic of China and globally, with a market capitalization of approximately HK$3.52 trillion.

Operations: Tencent's revenue is derived primarily from Value-Added Services (CN¥297.67 billion), Fintech and Business Services (CN¥207.36 billion), and Online Advertising (CN¥107.02 billion).

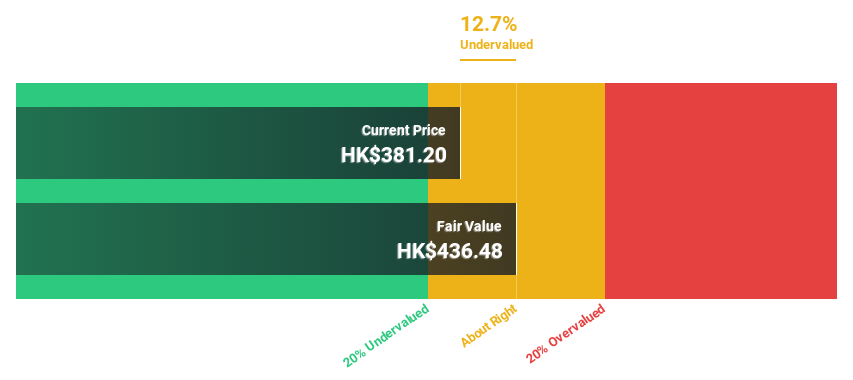

Estimated Discount To Fair Value: 12.7%

Tencent Holdings, with a current share price of HK$381.2, trades below the estimated fair value of HK$436.48, suggesting a potential undervaluation based on cash flow analysis. Recent Q1 2024 results showed revenue at CNY 159.50 billion and net income at CNY 41.89 billion, indicating robust financial health and operational efficiency despite a year-over-year decline in profit margins from 33.5% to 21.2%. The company's strategic share buyback program could further enhance shareholder value, reflecting positive management actions in line with legal and corporate governance standards.

Seize The Opportunity

Take a closer look at our Undervalued SEHK Stocks Based On Cash Flows list of 44 companies by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1801 SEHK:6088 and SEHK:700.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance