Exploring Guangzhou Goaland Energy Conservation Tech And Two More Top Growth Stocks With High Insider Ownership On Chinese Exchanges

As global markets navigate a complex landscape, with China's Shanghai Composite Index and CSI 300 experiencing notable declines amid ongoing economic pressures, investors are closely monitoring shifts in market dynamics. In this context, exploring growth companies like Guangzhou Goaland Energy Conservation Tech that boast high insider ownership may offer valuable insights into firms potentially poised for resilience and informed strategic direction.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 58.6% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

We'll examine a selection from our screener results.

Guangzhou Goaland Energy Conservation Tech

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Goaland Energy Conservation Tech focuses on energy conservation technologies and has a market capitalization of approximately CN¥4.03 billion.

Operations: The company operates primarily in the energy conservation technology sector.

Insider Ownership: 15.5%

Revenue Growth Forecast: 28.0% p.a.

Guangzhou Goaland Energy Conservation Tech is poised for significant growth, with earnings expected to surge by 72.25% annually. Despite a forecasted low return on equity of 5.7% in three years, the company's revenue growth at 28% per year outpaces the Chinese market average of 14%. Recent financial reports show a turnaround from a net loss to a net income of CNY 5.62 million in Q1 2024, signaling improving profitability. However, investor caution is advised due to its highly volatile share price over the past three months.

Jiangsu Kuangshun Photosensitivity New-Material Stock

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Kuangshun Photosensitivity New-Material Stock Co., Ltd. operates in the photosensitive material sector and has a market capitalization of approximately CN¥3.39 billion.

Operations: The company generates revenue from its operations in the photosensitive material sector.

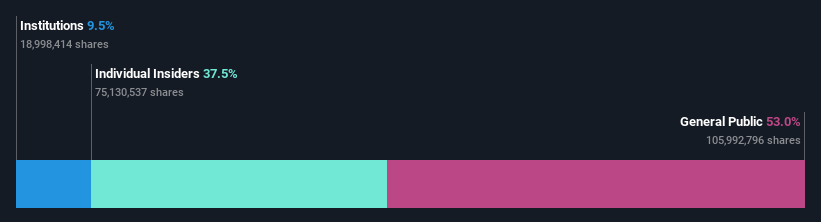

Insider Ownership: 37.5%

Revenue Growth Forecast: 41.2% p.a.

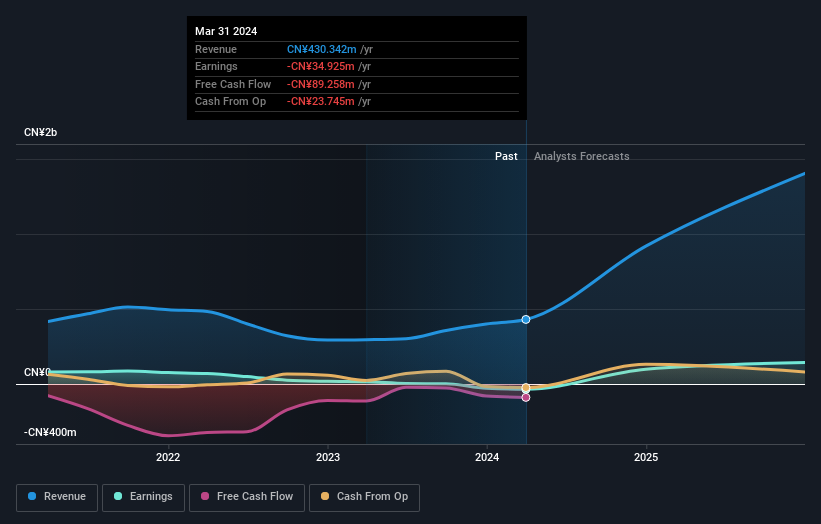

Jiangsu Kuangshun Photosensitivity New-Material Stock Co., Ltd. has shown promising growth, with earnings and revenue forecast to expand by 83.9% and 41.2% per year respectively, outpacing the CN market averages significantly. Recently turning profitable, the company reported a substantial increase in sales to CNY 509.94 million in 2023 from CNY 497.87 million the previous year, alongside a shift from a net loss to a net income of CNY 6.9 million. However, financial results have been impacted by large one-off items and shareholder dilution over the past year raises concerns about equity value erosion.

Qingdao Guolin Technology GroupLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao Guolin Technology Group Co., Ltd. is a company that specializes in environmental technology solutions, with a market capitalization of approximately CN¥2.53 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 29.7%

Revenue Growth Forecast: 60.1% p.a.

Qingdao Guolin Technology GroupLtd has recently completed a share buyback, repurchasing shares worth CNY 30.17 million, signaling confidence from management despite reporting a net loss of CNY 29.14 million for the full year ended December 31, 2023. The company's revenue is projected to grow by 60.1% annually over the next few years, outstripping the Chinese market's growth rate significantly. However, this growth comes amidst high volatility in share price and recent shifts from net income to net loss, highlighting potential risks alongside aggressive growth strategies.

Turning Ideas Into Actions

Click through to start exploring the rest of the 405 Fast Growing Chinese Companies With High Insider Ownership now.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:300499 SZSE:300537 and SZSE:300786.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance