Exploring D'Ieteren Group And Two More Top Growth Companies With Major Insider Ownership

As global markets exhibit a mixed performance with the Dow Jones facing its steepest weekly drop since early April and the Nasdaq hitting new highs, investors are navigating through a landscape marked by varied economic signals and policy adjustments. In such an environment, growth companies with substantial insider ownership can offer unique advantages, as insiders' significant equity stakes often align their interests closely with those of shareholders, potentially driving greater commitment to corporate success amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Modetour Network (KOSDAQ:A080160) | 12.3% | 45.6% |

Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.2% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

D'Ieteren Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: D'Ieteren Group SA is a global investment company with operations in various regions including Belgium, France, Europe, the Middle East, Africa, America, and Asia-Pacific, boasting a market capitalization of €10.78 billion.

Operations: The company's revenue streams include €5.30 billion from D'ieteren Automotive, €6.05 billion from Belron, €1.61 billion from TVH Parts, and €0.13 billion from Moleskine.

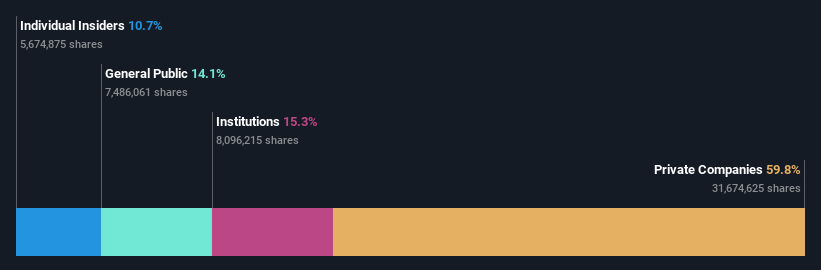

Insider Ownership: 10.7%

Revenue Growth Forecast: 17.1% p.a.

D'Ieteren Group SA has demonstrated robust financial performance, with a significant increase in sales to €7.98 billion and net income rising to €504.7 million as of December 2023. The company's revenue and earnings growth are outpacing the Belgian market, with forecasts indicating continued expansion above regional averages. Despite lacking recent insider buying, D'Ieteren benefits from high expected returns on equity and a consensus that its stock price is poised for upward movement. However, its revenue growth rate, while strong, does not reach the highest industry benchmarks.

Dive into the specifics of D'Ieteren Group here with our thorough growth forecast report.

The valuation report we've compiled suggests that D'Ieteren Group's current price could be inflated.

Eugene TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eugene Technology Co., Ltd. specializes in the manufacture and sale of semiconductor equipment and parts, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.11 billion.

Operations: The company generates its revenue through the production and sales of semiconductor equipment and components, with operations spanning both domestic and international markets.

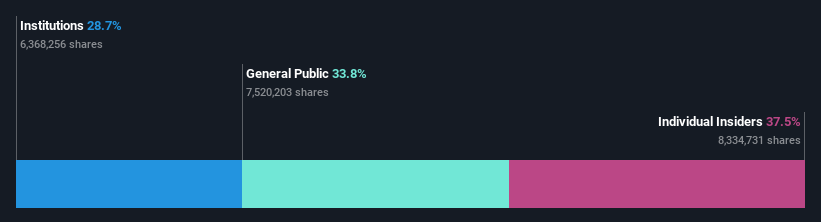

Insider Ownership: 37.5%

Revenue Growth Forecast: 21.1% p.a.

Eugene Technology Ltd. is experiencing rapid growth, with revenue and earnings forecasted to increase by 21.1% and 49.7% per year respectively, outpacing the KR market averages of 10.1% and 27.9%. Despite trading slightly below its estimated fair value and a forecasted modest return on equity of 16%, the company's financial performance shows potential for significant expansion, as evidenced by its first-quarter sales rising to KRW 655.39 million from KRW 568.9 million year-over-year, though net income has decreased compared to the previous period.

Sineng ElectricLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Sineng Electric Co., Ltd. specializes in the research, development, manufacturing, maintenance, and trading of power electronic products both domestically in the People's Republic of China and internationally, with a market capitalization of approximately CN¥9.97 billion.

Operations: Sineng Electric primarily generates revenue through the research, development, manufacturing, maintenance, and trading of power electronic products across both domestic and international markets.

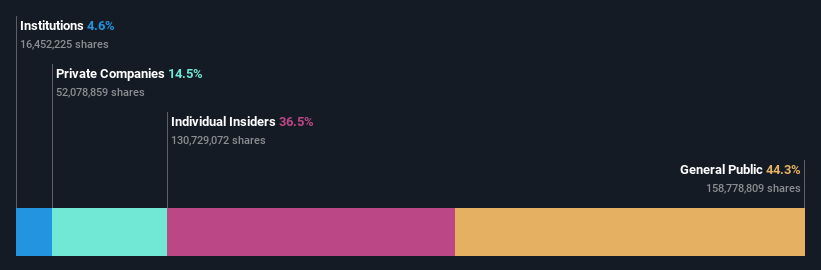

Insider Ownership: 36.5%

Revenue Growth Forecast: 28.6% p.a.

Sineng Electric Co., Ltd. has demonstrated robust financial growth with its recent earnings report showing a significant increase in sales and net income, from CNY 2.34 billion to CNY 4.93 billion and from CNY 81.56 million to CNY 285.87 million respectively year-over-year for the full year ended December 31, 2023. The company's revenue and earnings are expected to grow at an annual rate of approximately 28.6% and 39.8%, significantly outpacing the Chinese market averages of around 14% and 23.3%. Despite some shareholder dilution last year, these strong growth metrics combined with high-quality non-cash earnings suggest potential for continued expansion under substantial insider leadership, although no recent insider trading data is available.

Key Takeaways

Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1497 more companies for you to explore.Click here to unveil our expertly curated list of 1500 Fast Growing Companies With High Insider Ownership.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTBR:DIEKOSDAQ:A084370SZSE:300827 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance