Exploring Cofco Sugar HoldingLTD And Two More Leading Dividend Stocks In China

As global markets navigate through a landscape of fluctuating inflation rates and policy adjustments, China's equity market presents a mixed picture with recent data indicating slight economic contractions amidst growth headwinds. In this context, dividend stocks like Cofco Sugar Holding LTD offer investors potential stability through regular income, which can be particularly appealing in uncertain economic times.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.03% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.64% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.24% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.16% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.19% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.52% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.46% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.00% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.98% | ★★★★★★ |

Click here to see the full list of 198 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

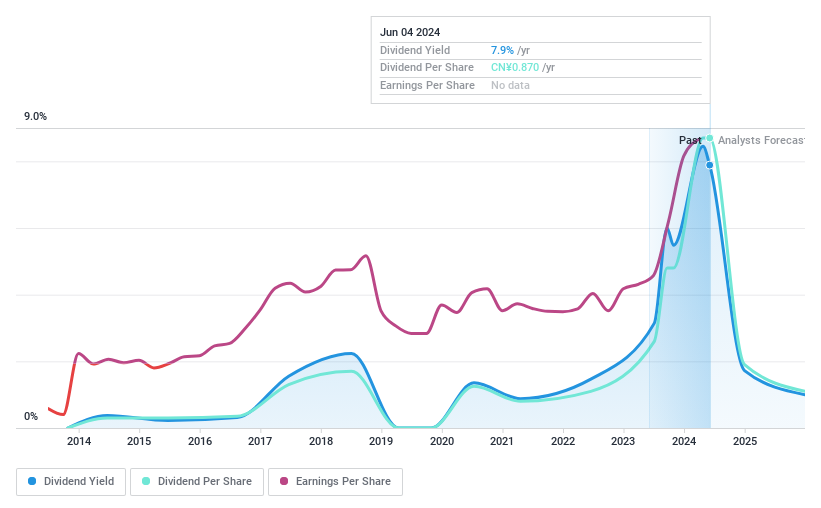

Cofco Sugar HoldingLTD

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cofco Sugar Holding Co., Ltd. operates in sugar and tomato processing both domestically in China and internationally, with a market capitalization of approximately CN¥23.59 billion.

Operations: Cofco Sugar Holding Co., Ltd. generates its revenue primarily through sugar and tomato processing activities across both Chinese and international markets.

Dividend Yield: 7.9%

Cofco Sugar Holding LTD. has demonstrated significant financial growth with its full-year 2023 sales reaching CNY 32.94 billion, a substantial increase from the previous year's CNY 26.43 billion. The company also reported a robust net income of CNY 2.07 billion, up from CNY 748.37 million in the prior year, reflecting improved profitability and operational efficiency. Despite this strong performance, the company’s dividend history remains inconsistent and unreliable, marked by volatility over the past decade and an unstable track record that raises concerns about future dividend sustainability and reliability amidst an expected average earnings decline of 4.2% annually over the next three years.

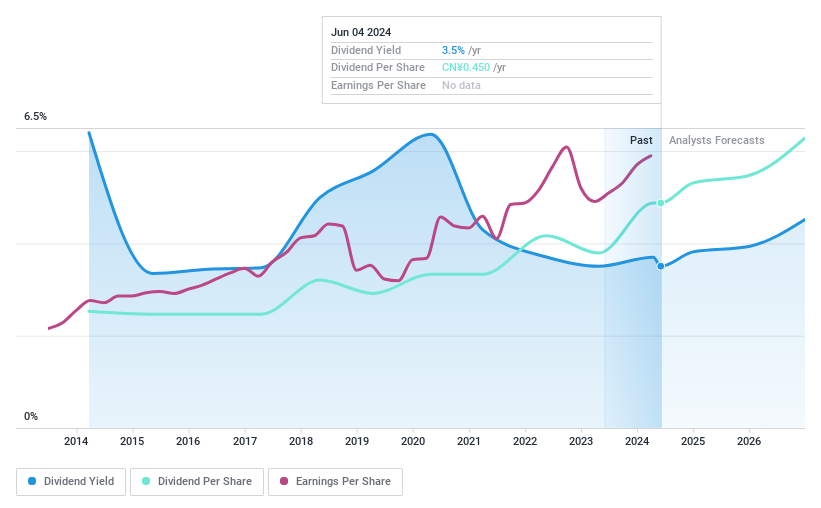

Zhejiang Weixing Industrial Development

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Weixing Industrial Development Co., Ltd. is a company that specializes in the manufacture and sale of garment accessories, with a market capitalization of approximately CN¥15.01 billion.

Operations: Zhejiang Weixing Industrial Development primarily generates revenue from the production and sales of apparel accessories, totaling CN¥4.01 billion.

Dividend Yield: 3.5%

Zhejiang Weixing Industrial Development has maintained a stable dividend history over the past decade, with recent increases approved at its AGM on May 8, 2024, setting the dividend at CNY 4.50 per 10 shares for 2023. Despite a payout ratio of 82.7% indicating earnings cover dividends, a high cash payout ratio of 402.8% suggests potential challenges in sustaining these payments from cash flows alone. The company's earnings have shown growth, with an increase reported in Q1 2024 and forecasted annual growth of approximately 14.73%. However, shareholder dilution over the past year could be a concern for maintaining future dividend levels.

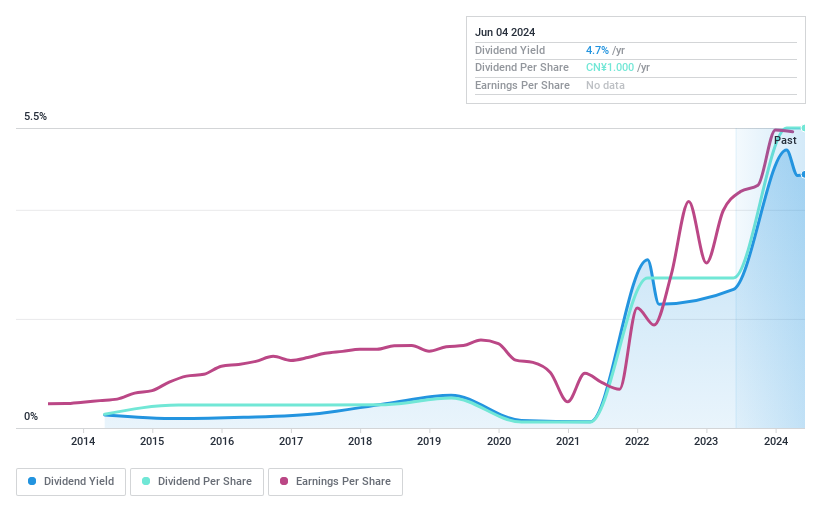

Boai NKY Medical Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both in China and globally, with a market capitalization of approximately CN¥6.63 billion.

Operations: Boai NKY Medical Holdings Ltd. generates its revenue from the fine chemical and medical care sectors.

Dividend Yield: 4.7%

Boai NKY Medical Holdings Ltd. has demonstrated a 30.5% earnings growth over the past year, positioning its dividend yield at 4.65%, higher than the top 25% of dividend payers in the Chinese market. Despite this, both cash flows and earnings inadequately cover its dividends, with a high cash payout ratio of 185.8% and recent volatility in payments over the last decade indicating potential instability. The company's price-to-earnings ratio stands favorable at 13.4x compared to the broader market's 30.7x, suggesting relative undervaluation even amidst financial inconsistencies related to dividend sustainability.

Key Takeaways

Discover the full array of 198 Top Dividend Stocks right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600737 SZSE:002003 and SZSE:300109.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance