Exploring ChoiceOne Financial Services And Two More Top Dividend Stocks

In recent trading sessions, the U.S. stock market has experienced fluctuations, with the Dow Jones Industrial Average briefly surpassing the 40,000 mark before retreating. Amidst this backdrop of moderate optimism following cooler-than-expected inflation data and steady interest rates, investors might consider the stability offered by dividend-paying stocks like ChoiceOne Financial Services as a potential component of their investment strategy.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.08% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.87% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.77% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.83% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.78% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.13% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.81% | ★★★★★★ |

Credicorp (NYSE:BAP) | 5.43% | ★★★★★☆ |

West Bancorporation (NasdaqGS:WTBA) | 5.56% | ★★★★★☆ |

Citizens & Northern (NasdaqCM:CZNC) | 6.23% | ★★★★★☆ |

Click here to see the full list of 196 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ChoiceOne Financial Services

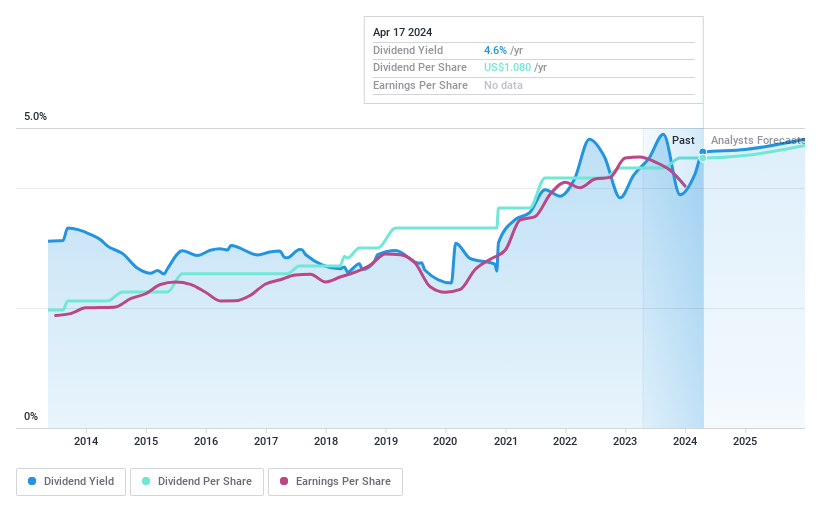

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ChoiceOne Financial Services, Inc., with a market capitalization of $201.69 million, serves as the bank holding company for ChoiceOne Bank which offers banking services to corporations, partnerships, and individuals throughout Michigan.

Operations: ChoiceOne Financial Services, Inc. generates its revenue primarily through banking services, amounting to $80.51 million.

Dividend Yield: 4%

ChoiceOne Financial Services offers a stable 3.96% dividend yield, with a history of reliable payouts over the past decade. The dividends are well-supported by earnings, evidenced by a low payout ratio of 37.6%. Despite trading at 39.6% below estimated fair value and showing potential for modest earnings growth (4.7% per year), its dividend yield is slightly lower than the top US dividend payers' average. Recent financials indicate steady performance with net income and EPS consistent year-over-year as of Q1 2024.

First Community

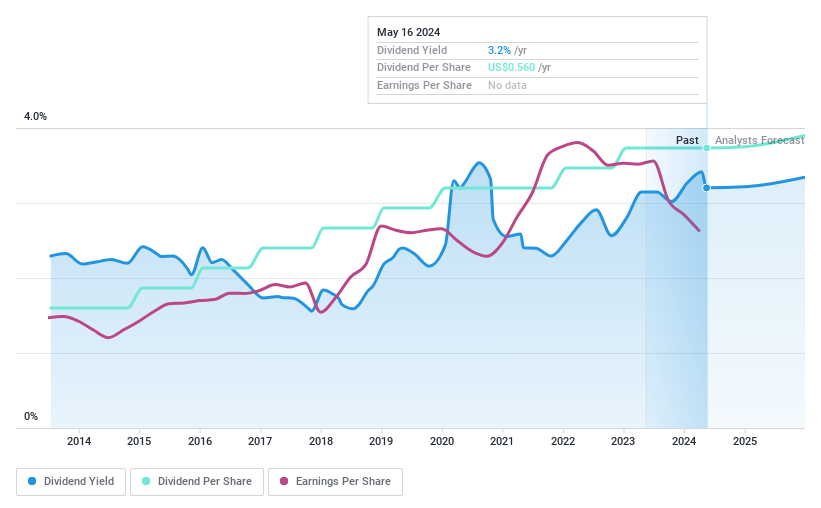

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Community Corporation, serving as the holding company for First Community Bank, offers a range of banking products and services to small-to-medium sized businesses, professionals, and individuals with a market capitalization of approximately $131.68 million.

Operations: First Community Corporation generates its revenue primarily from Commercial and Retail Banking ($50.66 million), supplemented by contributions from Mortgage Banking ($4.18 million), Corporate Segment ($4.23 million), and Investment Advisory and Non-Deposit services ($4.80 million).

Dividend Yield: 3.2%

First Community's dividend yield stands at 3.2%, underperforming the top quartile of US dividend stocks. Despite this, the dividends are sustainable with a payout ratio of 38.7% and have demonstrated reliability and growth over the past decade. Earnings are expected to increase by 14.23% annually, enhancing future dividend potential. Recently, First Community announced a stock buyback program valued at US$7.1 million, effective until May 2025, signaling confidence in its financial health despite a recent dip in quarterly earnings and net income from US$3.46 million to US$2.6 million as reported on April 17, 2024.

Innovative Industrial Properties

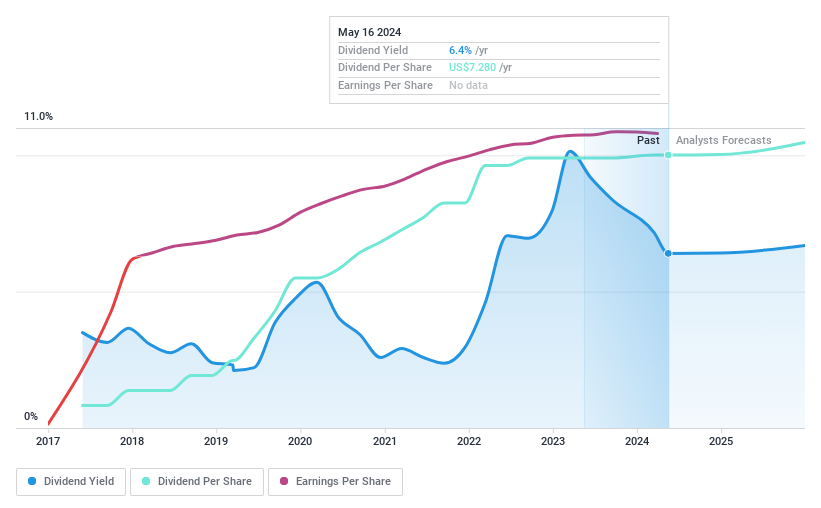

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Innovative Industrial Properties, Inc. is a self-advised Maryland corporation that acquires, owns, and manages specialized properties leased to state-licensed operators for regulated cannabis facilities, with a market cap of approximately $3.20 billion.

Operations: Innovative Industrial Properties generates its revenue primarily through commercial real estate investment trusts (REITs), with earnings of $308.89 million from these operations.

Dividend Yield: 6.4%

Innovative Industrial Properties reported a slight dip in Q1 2024 earnings, with net income at US$39.43 million and revenue at US$75.45 million, reflecting minor declines from the previous year. Despite this, the company maintains a robust dividend profile, declaring a quarterly dividend of US$1.82 per share for common stock and US$0.5625 for preferred stock. With a high dividend yield of 6.4%, it ranks well among U.S dividends but has been paying dividends for under ten years, indicating potential concerns about long-term sustainability despite current stability and coverage by both earnings (89.1% payout ratio) and cash flows (78.6% cash payout ratio).

Key Takeaways

Embark on your investment journey to our 196 Top Dividend Stocks selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:COFS NasdaqCM:FCCO and NYSE:IIPR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance