Exploring Canada's Undervalued Small Caps With Insider Buying In July 2024

As central banks like the Bank of Canada initiate rate cuts in response to softening economic indicators, investors might find opportunities in segments of the market that respond positively to such macroeconomic shifts. In this environment, exploring undervalued small-cap stocks in Canada could be particularly compelling, especially those experiencing insider buying, as these moves can signal confidence in the company's prospects amidst broader economic adjustments.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Dundee Precious Metals | 8.6x | 3.0x | 44.28% | ★★★★★★ |

Primaris Real Estate Investment Trust | 11.5x | 3.0x | 35.25% | ★★★★★☆ |

Nexus Industrial REIT | 2.4x | 3.0x | 19.86% | ★★★★☆☆ |

Guardian Capital Group | 10.6x | 4.1x | 31.11% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -94.01% | ★★★★☆☆ |

Westshore Terminals Investment | 14.2x | 3.8x | 2.86% | ★★★☆☆☆ |

Trican Well Service | 8.1x | 1.0x | -13.88% | ★★★☆☆☆ |

Calfrac Well Services | 2.4x | 0.2x | 4.72% | ★★★☆☆☆ |

Russel Metals | 8.8x | 0.5x | -2.11% | ★★★☆☆☆ |

Freehold Royalties | 15.3x | 6.6x | 48.99% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

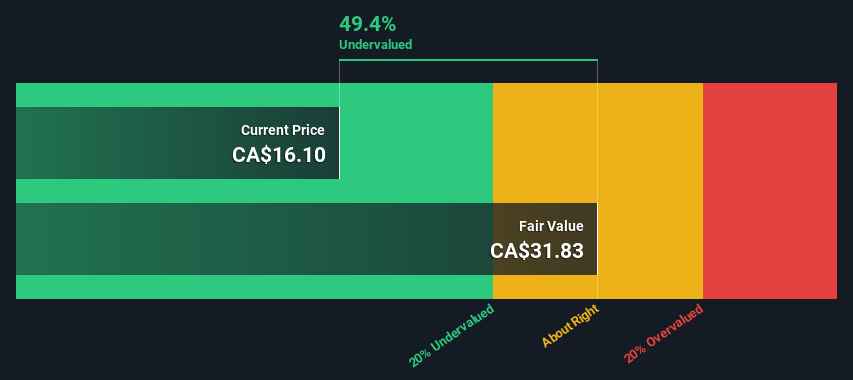

Allied Properties Real Estate Investment Trust

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Allied Properties Real Estate Investment Trust is a company focused on managing and developing urban office environments across major Canadian cities, with a market capitalization of approximately CA$4.2 billion.

Operations: The gross profit margin for the company has shown fluctuations over the periods, starting at 56.56% and experiencing a range of increases and decreases, with notable peaks such as 57.75% in late 2017 and lows reaching around 53.80%. The net income has varied significantly, with some periods showing strong growth while others recorded declines, reflecting diverse operational challenges and financial adjustments across different fiscal quarters.

PE: -4.2x

Allied Properties Real Estate Investment Trust, showcasing a blend of challenges and potential, recently affirmed consistent monthly distributions, underscoring a steady cash flow despite reporting a net loss in Q1 2024. With earnings projected to grow significantly, the company's reliance on higher-risk external borrowing raises some concerns about its financial structure. Insider confidence is evident as they have not engaged in share repurchases recently but maintain their investment positions. This scenario paints Allied as an intriguing player in the market with room for growth amidst financial vigilance.

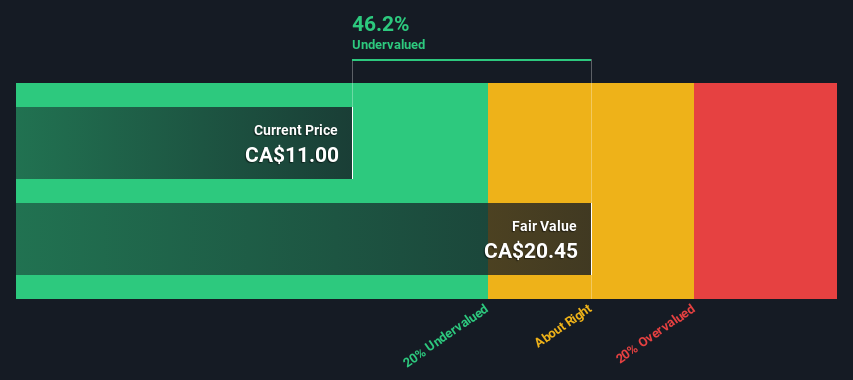

Dundee Precious Metals

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a mining company focused on the extraction and processing of precious metals from its operations at Ada Tepe and Chelopech, with a market capitalization of approximately CA$1.24 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, reflecting the company's diverse operational base. The gross profit margin observed a significant increase over the periods, highlighting improved efficiency or market conditions favorable to pricing strategies.

PE: 8.6x

Dundee Precious Metals, with its recent insider confidence demonstrated through share purchases in May 2024, underscores a strong belief in the company's value. This firm, focusing on gold and copper production, has shown solid operational performance with a reported ore processing of 1457 Kt and production of 130 K oz of gold year-to-date as of June 2024. The appointment of W. John DeCooman Jr., a seasoned executive in corporate development, further strengthens the leadership team, enhancing strategic initiatives and potentially driving future growth.

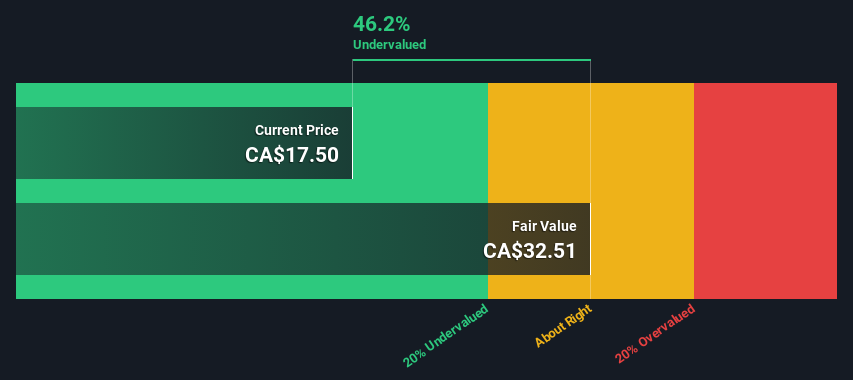

Softchoice

Simply Wall St Value Rating: ★★★★☆☆

Overview: Softchoice is a technology company that specializes in IT solutions and services, with a market capitalization of approximately $1.41 billion.

Operations: From 2018 to 2024, the company saw a notable increase in gross profit margin from 23.91% to 41.82%. Over this period, revenue fluctuated, peaking at $957.49 million in late 2022 before settling at $777.35 million by mid-2024.

PE: 20.1x

Softchoice, reflecting a blend of financial caution and growth potential, recently showcased its dynamics at the CIBC Technology & Innovation Conference. Despite a challenging quarter with a reported net loss of US$1.03 million compared to last year's net income, insider confidence remains evident as they recently purchased shares, signaling belief in long-term value. The firm also increased its quarterly dividend by 18%, underlining commitment to shareholder returns amidst strategic adjustments like electing new board members to steer future directions.

Click to explore a detailed breakdown of our findings in Softchoice's valuation report.

Assess Softchoice's past performance with our detailed historical performance reports.

Taking Advantage

Get an in-depth perspective on all 34 Undervalued TSX Small Caps With Insider Buying by using our screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:AP.UN TSX:DPM and TSX:SFTC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance