Exploring Better Options Beyond Alta Equipment Group With One Superior Dividend Stock

In the search for reliable passive income through dividend stocks, it's crucial to evaluate the growth and sustainability of these payouts. While the average dividend growth in the United States hovered around 9.0% last year, not every company mirrored this trend. For instance, Alta Equipment Group has seen a decline in its dividend payments over time, raising concerns about its financial health and long-term viability as a sound investment.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Interpublic Group of Companies (NYSE:IPG) | 4.70% | ★★★★★★ |

Columbia Banking System (NasdaqGS:COLB) | 7.26% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.25% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.17% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.98% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.91% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.82% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.92% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.32% | ★★★★★☆ |

First Bancorp (NasdaqGS:FNLC) | 5.67% | ★★★★★☆ |

Click here to see the full list of 204 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

Northfield Bancorp (Staten Island NY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northfield Bancorp, Inc. (Staten Island, NY), with a market cap of approximately $420.38 million, serves as the holding company for Northfield Bank, offering a range of banking products and services to individual and corporate customers.

Operations: The revenue for Northfield Bancorp's primary segment, Community Banking, totals approximately $128.70 million.

Dividend Yield: 5.5%

Northfield Bancorp has demonstrated a commitment to returning value to shareholders through consistent dividend payments and share repurchase programs, recently announcing a $10 million buyback. Despite recent drops from several S&P indices, the company maintains a stable dividend history with an attractive yield of 5.46%, significantly outperforming the average market rate. However, it's important to note a decline in net profit margins from 36.5% last year to 25% this year, reflecting some earnings pressure.

One To Reconsider

Alta Equipment Group

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Alta Equipment Group Inc. operates as an integrated equipment dealership in the United States, with a market capitalization of approximately $266.50 million.

Operations: The company generates its revenue primarily through two segments: Material Handling, which brought in $691 million, and Construction Equipment, contributing $1.15 billion.

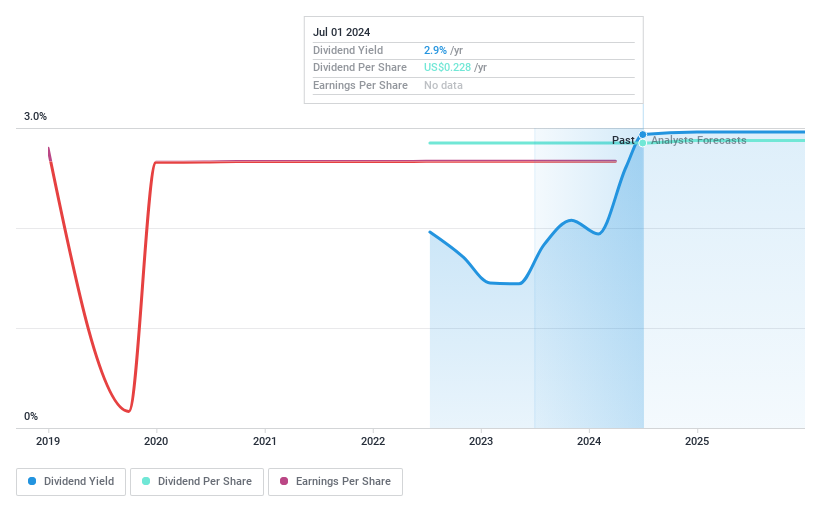

Dividend Yield: 2.9%

Alta Equipment Group Inc. faces challenges as a dividend stock to consider avoiding. Its dividend yield of 2.93% trails behind the top quartile of U.S. dividend payers at 4.7%. The company has been distributing dividends for only two years without any increase, indicating limited growth potential in payouts. Furthermore, its dividends are not adequately covered by earnings or free cash flow, raising concerns about sustainability and reliability in future payments, especially given the company's current unprofitability and lack of positive free cash flow projections for the coming years.

Summing It All Up

Click here to access our complete index of 204 Top Dividend Stocks.

Hold shares in some of these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:NFBK and NYSE:ALTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance