Exploring Better Alternatives To PSI Software With One Attractive Dividend Stock

While high dividend yields can catch the eye of investors, it's crucial to approach them with caution. A substantial yield might not always be a sign of strength; in some cases, it could indicate that the company's dividend cover is stretched too thin, risking future payouts. In this article, we will examine two German stocks: one that presents an attractive dividend opportunity and another that investors might consider avoiding due to its concerning payout ratio.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.28% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.64% | ★★★★★★ |

INDUS Holding (XTRA:INH) | 4.96% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.76% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.71% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 6.39% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.11% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.24% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.04% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

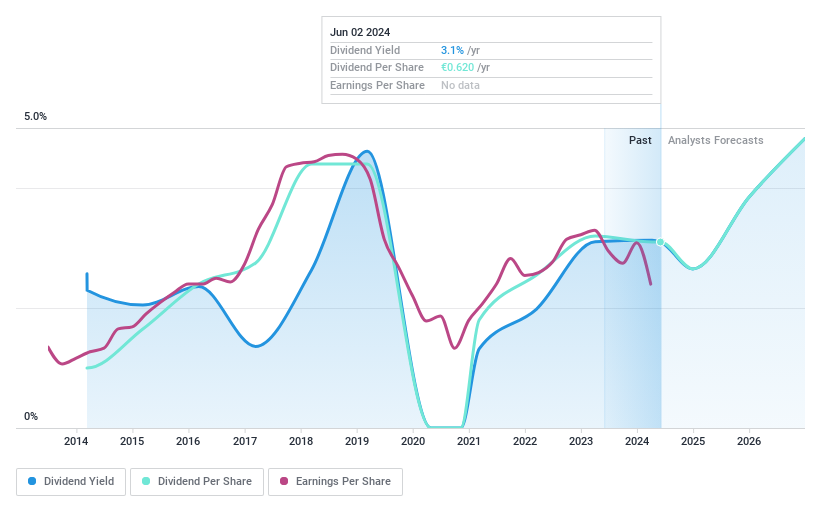

technotrans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Technotrans SE is a global technology and services company with a market capitalization of approximately €127.45 million.

Operations: The company generates revenue primarily through two segments: Technology, which brought in €188.31 million, and Services, contributing €63.04 million.

Dividend Yield: 3.4%

Technotrans SE, with a cash payout ratio of 37.5% and a payout ratio of 64.7%, maintains dividends well-supported by both earnings and cash flows, contrasting sharply with companies burdened by excessive payout ratios. However, its dividend history shows volatility and an unstable track record over the past decade, despite some growth in payments. Recent financials reveal a downturn, with Q1 revenue dropping to €56.04 million from €68.31 million year-over-year and net income falling significantly to €0.059 million from €2.2 million.

Unlock comprehensive insights into our analysis of technotrans stock in this dividend report.

Our valuation report unveils the possibility technotrans' shares may be trading at a premium.

One To Reconsider

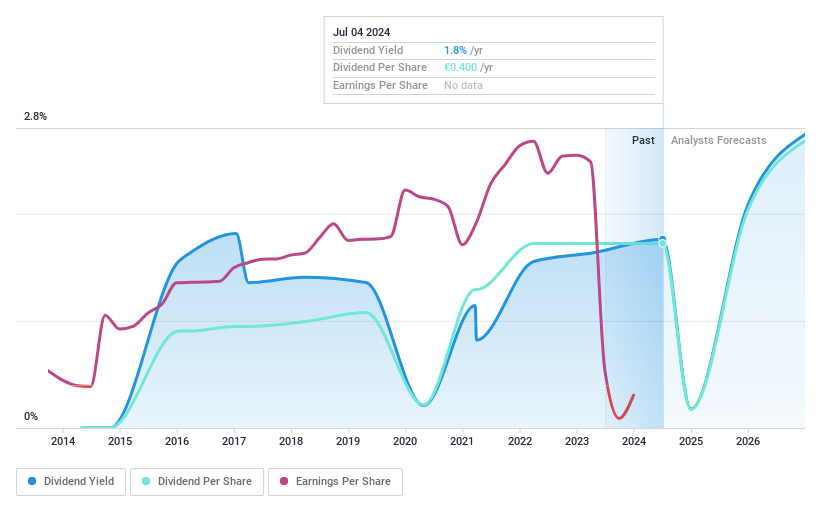

PSI Software

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: PSI Software SE specializes in developing and integrating software solutions for optimizing the flow of energy and materials across utilities and industries globally, with a market capitalization of approximately €351.58 million.

Operations: The company generates its revenues primarily through two segments: Energy Management (€141.78 million) and Production Management (€148.79 million).

Dividend Yield: 1.8%

PSI Software SE's dividend sustainability is questionable due to a high payout ratio, indicating dividends are not well covered by earnings. Despite a dividend yield of 1.83%, which is low compared to the German market average, and only eight years of dividend history marked by volatility, PSI continues payouts. Recent strategic appointments and conference presentations signal a focus on innovation and cloud transformation, yet financial performance shows significant profitability challenges with drastic reductions in net income year-over-year.

Where To Now?

Take a closer look at our Top Dividend Stocks list of 29 companies by clicking here.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:TTR1 and XTRA:PSAN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance