Examining Three UK Stocks That May Be Undervalued In July 2024

As the United Kingdom braces for upcoming elections and financial markets exhibit cautious optimism, investors are closely monitoring shifts in the FTSE 100 and broader economic indicators. In such a climate, identifying stocks that may be undervalued becomes particularly compelling, as these could present opportunities for those looking to invest in potential growth amidst prevailing uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £25.70 | £48.56 | 47.1% |

Gaming Realms (AIM:GMR) | £0.363 | £0.68 | 46.9% |

LSL Property Services (LSE:LSL) | £3.33 | £6.47 | 48.6% |

WPP (LSE:WPP) | £7.244 | £13.96 | 48.1% |

BATM Advanced Communications (LSE:BVC) | £0.17 | £0.33 | 48.4% |

Mercia Asset Management (AIM:MERC) | £0.305 | £0.58 | 47.7% |

Ricardo (LSE:RCDO) | £4.87 | £9.51 | 48.8% |

Entain (LSE:ENT) | £6.30 | £12.19 | 48.3% |

Accsys Technologies (AIM:AXS) | £0.55 | £1.05 | 47.7% |

Tortilla Mexican Grill (AIM:MEX) | £0.60 | £1.11 | 46.1% |

Let's explore several standout options from the results in the screener

Forterra

Overview: Forterra plc specializes in manufacturing and selling building products in the United Kingdom, with a market capitalization of approximately £328.97 million.

Operations: The company generates revenue primarily through two segments: Bespoke Products (£72.70 million) and Bricks and Blocks (£277.40 million).

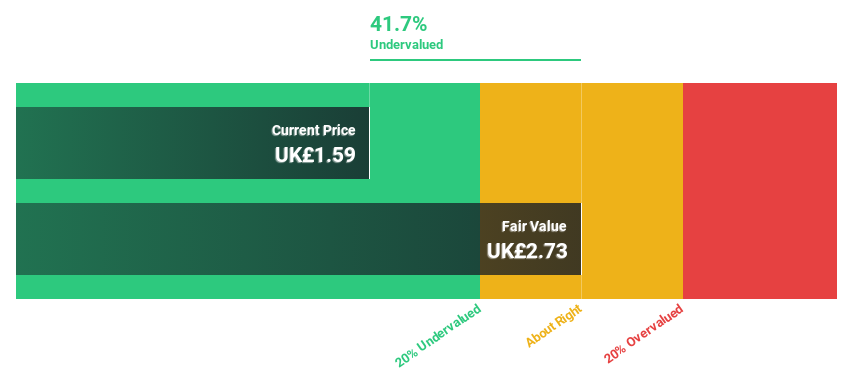

Estimated Discount To Fair Value: 41.7%

Forterra, trading at £1.59, significantly below its fair value estimate of £2.73, appears undervalued based on discounted cash flows. Despite a recent dividend cut to 2 pence per share and a 6% revenue drop over four months ending April 2024, Forterra's earnings are expected to grow significantly at a rate of 26.18% annually over the next three years. However, its debt is poorly covered by operating cash flow and profit margins have declined from last year's levels.

Halfords Group

Overview: Halfords Group plc operates in the UK and the Republic of Ireland, offering a range of motoring and cycling products and services, with a market capitalization of approximately £306.01 million.

Operations: The company generates revenue primarily through two segments: Retail, which brings in £997.10 million, and Autocentres, contributing £699.40 million.

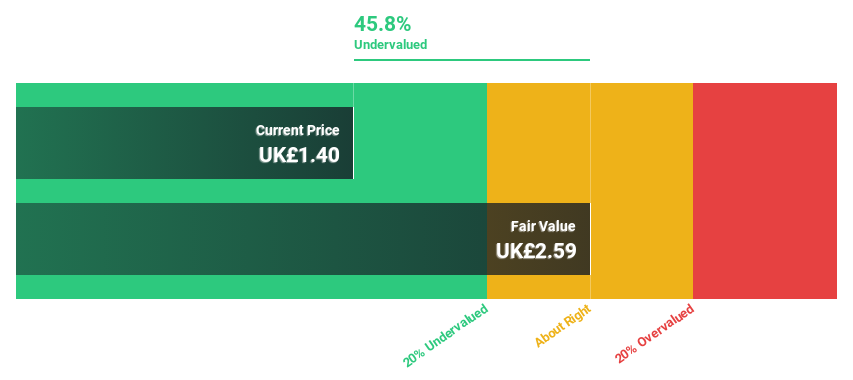

Estimated Discount To Fair Value: 45.8%

Halfords Group, priced at £1.4, is trading below its estimated fair value of £2.59, indicating potential undervaluation based on cash flows. Despite a recent decline in net income to £16.9 million from last year's £28.1 million and unstable dividends, the company's earnings are projected to grow by 27.6% annually over the next three years, outpacing the UK market average growth of 12.6%. This growth is supported by a slight revenue increase to £1,696.5 million this fiscal year.

The growth report we've compiled suggests that Halfords Group's future prospects could be on the up.

Get an in-depth perspective on Halfords Group's balance sheet by reading our health report here.

LSL Property Services

Overview: LSL Property Services plc operates in the UK, offering services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders, with a market capitalization of approximately £341.94 million.

Operations: LSL Property Services generates revenue through three primary segments: Financial Services (£51.69 million), Surveying and Valuation (£67.83 million), and Estate Agency, excluding Financial Services (£24.89 million).

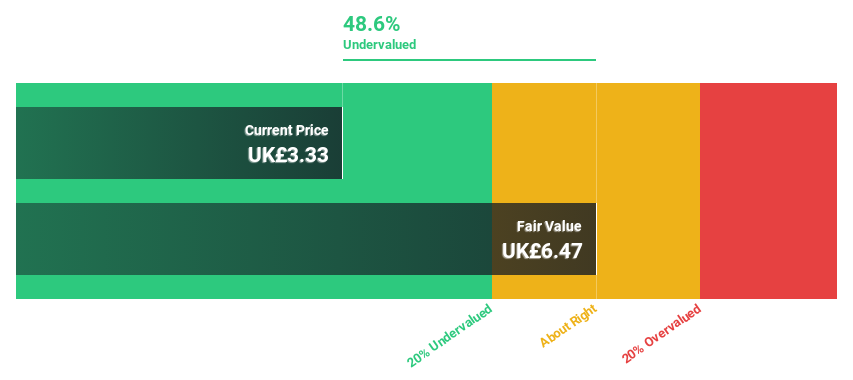

Estimated Discount To Fair Value: 48.6%

LSL Property Services, valued at £3.33, appears undervalued by more than 20% against a fair value estimate of £6.47 based on discounted cash flows. Despite a challenging year with net losses reducing to £38 million from previous larger losses, the company has turned profitable this year and is set for significant earnings growth at 33.32% annually. However, its dividend sustainability is questionable as it's poorly covered by both earnings and cash flows amidst recent executive board changes enhancing strategic oversight.

Summing It All Up

Investigate our full lineup of 58 Undervalued UK Stocks Based On Cash Flows right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:FORT LSE:HFD and LSE:LSL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance