Examining Three Stocks With Intrinsic Discounts Ranging From 16.6% To 47.9%

As global markets navigate through a mix of cooling labor markets and fluctuating interest rates, investors are keenly observing shifts across various indices. In such an environment, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Marriott Vacations Worldwide (NYSE:VAC) | US$85.47 | US$169.56 | 49.6% |

Sachem Capital (NYSEAM:SACH) | US$2.65 | US$5.27 | 49.7% |

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA) | US$20.96 | US$41.92 | 50% |

Eletromidia (BOVESPA:ELMD3) | R$18.42 | R$36.79 | 49.9% |

West China Cement (SEHK:2233) | HK$1.08 | HK$2.15 | 49.9% |

Atrae (TSE:6194) | ¥861.00 | ¥1712.23 | 49.7% |

Wolftank-Adisa Holding (XTRA:WAH) | €11.30 | €22.45 | 49.7% |

Levima Advanced Materials (SZSE:003022) | CN¥13.77 | CN¥27.49 | 49.9% |

Melco International Development (SEHK:200) | HK$5.22 | HK$10.40 | 49.8% |

SiteMinder (ASX:SDR) | A$4.99 | A$9.96 | 49.9% |

Here's a peek at a few of the choices from the screener.

Novo Nordisk

Overview: Novo Nordisk A/S operates in the pharmaceutical industry, focusing on the research, development, manufacture, and distribution of products globally, with a market capitalization of approximately DKK 4.33 trillion.

Operations: The company generates revenue primarily through two segments: Rare Disease, which brought in DKK 16.97 billion, and Diabetes and Obesity Care, accounting for DKK 227.27 billion.

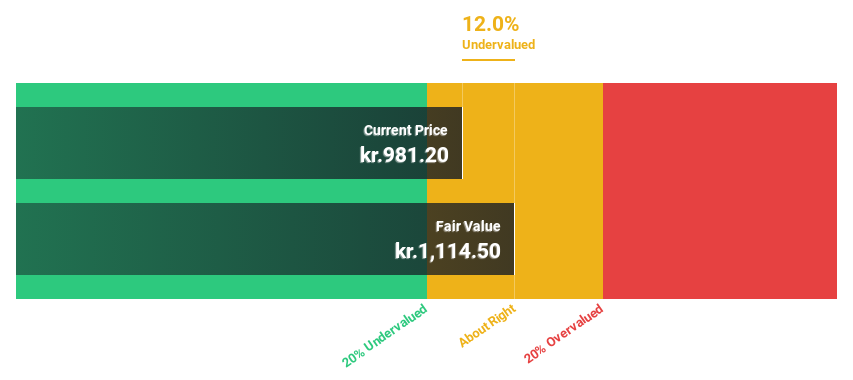

Estimated Discount To Fair Value: 16.6%

Novo Nordisk, trading at DKK976.2, is valued below the estimated fair value of DKK1170.11, suggesting a potential undervaluation based on cash flows. Despite this, its forecasted earnings growth of 14.3% per year outpaces the Danish market's 13.5%, with an exceptionally high projected Return on Equity of 89.1% in three years. However, revenue growth expectations (13.9% annually) do not reach the high-growth threshold of 20%, and recent significant insider selling could raise concerns about its current valuation optimism.

The growth report we've compiled suggests that Novo Nordisk's future prospects could be on the up.

Dive into the specifics of Novo Nordisk here with our thorough financial health report.

AIA Group

Overview: AIA Group Limited, together with its subsidiaries, offers life insurance-based financial services and has a market capitalization of approximately HK$575.76 billion.

Operations: The company generates HK$19.76 billion from its life insurance segment.

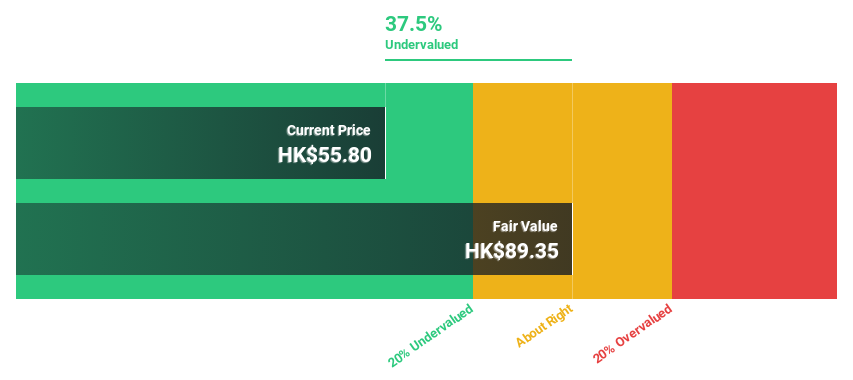

Estimated Discount To Fair Value: 39%

AIA Group, priced at HK$54.25, trades 39% below the estimated fair value of HK$88.94, indicating a significant undervaluation based on cash flows. The company's revenue and earnings growth projections outpace the Hong Kong market averages, with revenues expected to grow by 25.6% annually and earnings by 17.09%. Recent strategic buybacks enhance shareholder value but changes in board committee compositions signal potential shifts in corporate governance focus.

Imeik Technology DevelopmentLtd

Overview: Imeik Technology Development Co., Ltd. specializes in the research, development, production, and transformation of biomedical soft tissue repair materials in China, with a market capitalization of approximately CN¥48.23 billion.

Operations: The company generates CN¥3.05 billion primarily from its surgical and medical equipment segment.

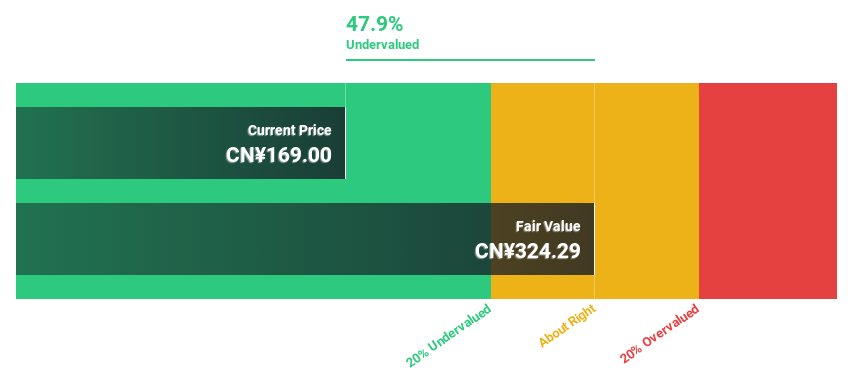

Estimated Discount To Fair Value: 47.9%

Imeik Technology DevelopmentLtd., trading at CN¥169, is valued well below its fair value of CN¥324.29, reflecting a substantial undervaluation based on cash flows. The company's recent earnings report shows robust growth with net income rising to CN¥527.44 million from CN¥414.07 million year-over-year and revenue up significantly to CN¥808.09 million. Forecasts suggest both revenue and earnings will continue to outperform market averages with expected annual growth rates of 26.5% and 25.05%, respectively, bolstered by a strong return on equity projected at 31.7%.

Taking Advantage

Gain an insight into the universe of 949 Undervalued Stocks Based On Cash Flows by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CPSE:NOVO B SEHK:1299SZSE:300896 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance