Everything You Need To Know About HDB’s New Resale Flat Listing Service (RFL)

If you’ve ever tried selling your HDB flat, you know it can be a complex process. Often, you’re facing a mountain of paperwork while hunting down for a reliable property agent. In the midst of it all, you still have to figure out a competitive selling price, market your flat, schedule viewings, and negotiate. That’s a lot of time and effort involved.

Much of the decision paralysis comes in right at the start when you have to choose the right platform—do you go with tried and tested big guys like PropertyGuru and 99.co where you have to pay a fee? Or do you give newer players Ohmyhome and Carousell a shot since they are free to use?

To address these challenges, the Housing Development Board (HDB) has introduced its new Resale Flat Listing (RFL) service. The RFL service is designed to facilitate the buying and selling of resale flats and make it more intuitive with all the necessary information on one platform. RFL officially launched on 30 May 2024. However, it has been up and running since its soft launch on 13 May, with more than 600 resale flats already listed since, says HDB.

Everything You Need To Know About HDB’s New Resale Flat Listing Service (RFL)

What Is HDB’s New Resale Flat Listing Service?

The RFL service conveniently integrates the list of HDB flats for sale on the open market with all the necessary information available on the HDB Flat Portal. This includes:

Details on new BTO flats

A one-stop loan listing service

Customisable financial calculators

Information on the HDB Flat Eligibility (HFE) letter

This means no more going back and forth across different portals to source and scour for information.

So What Exactly Does the RFL Offer?

1. Simplifying HDB Transactions

Buying a property in Singapore is a research and paperwork-intensive task. Having all the information you need on a single platform simplifies the process. Whether you’re a resale seller or buyer, you get to benefit from the convenience. More importantly, it’s FREE!

For sellers, you or your appointed property agent can list your flat and conduct resale transactions on the same platform.

For buyers, the platform streamlines the flat buying process by consolidating all information and services into one hub. Everything you need to know about available flats and tools for financial planning to afford your prospective house is on one site.

2. Promoting A Sustainable Property Market

In case you’re too over your head in what your property can fetch, the RFL is consistently updated against HDB’s internal database. It will alert you when your list price is more than 10% above the highest transacted price of similar units in your neighbourhood sold within the last 6 months.

For instance, you’re selling your 4-room flat for an asking price of S$600,000. If the highest price sold for a similar unit was S$500,000, the system will prompt you to confirm the decision. This promotes more realistic pricing and discourages inflating prices in hopes of higher profits.

Furthermore, if it’s transacted above the evaluated price, HDB will charge for cash over valuation to your buyer on the excess. If your buyer can’t pay the difference upfront, your sale will fall through.

Key Features Sellers Should Take Note Of

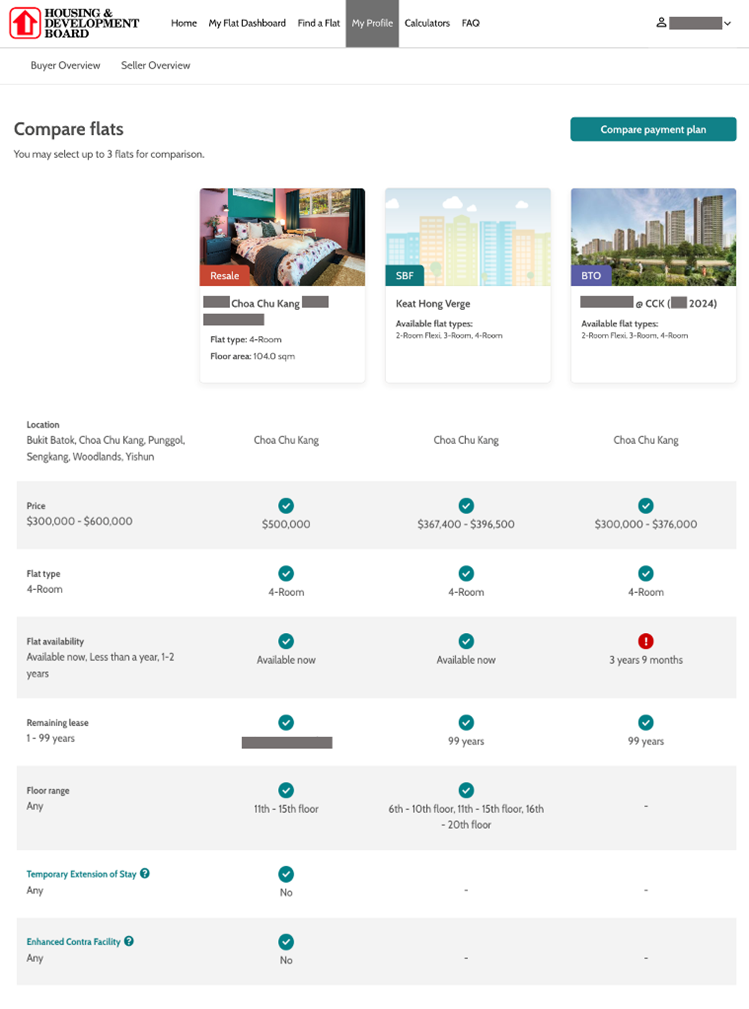

1. Customised Search

The service provides comprehensive information about available flats including current and upcoming new flat launches, and resale flats. Buyers can customise their search based on location, flat type, remaining lease, and criteria under the Ethnic Integration Policy (EIP) and Singapore Permanent Resident (SPR) Quotas.

2. Personalised Alerts and Detailed Information

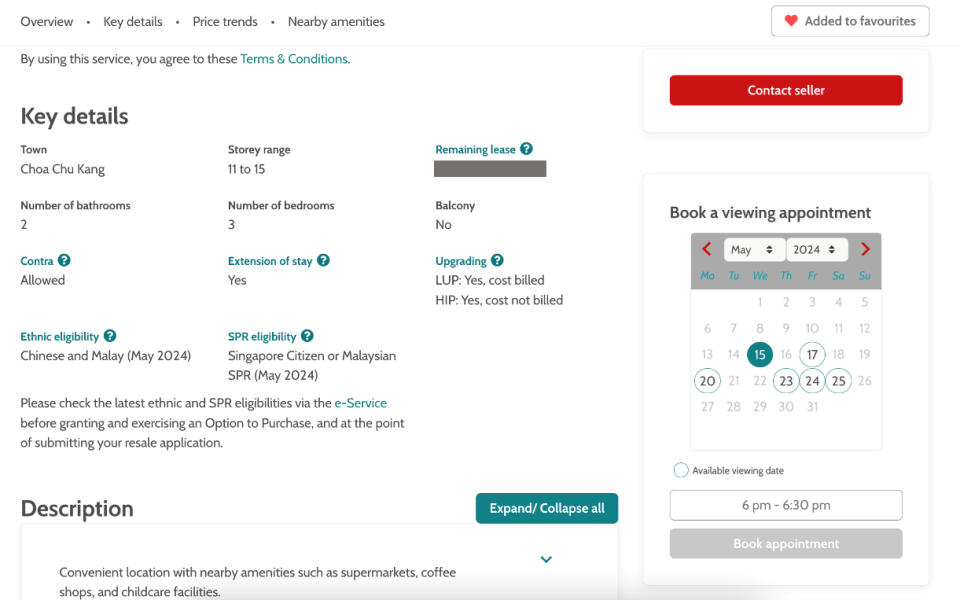

The RFL service allows you to create a personal profile. This way, you’ll receive email notifications when new listings match your preferences. You’ll also get comprehensive details about the flats, including:

floor plans

photos

recent selling prices in the area

local amenities

Moreover, you can be confident that all listed flats are owned by sellers who are authorised to sell. You’ll also receive key information on the EIP and SPR quotas for your prospective neighbourhood, status of any upgrades, and recent selling prices of nearby units.

Moreover, the service provides you with crucial details about enhancements or upgrades, such as improvements under the Home Improvement Programme (HIP) or the Neighbourhood Renewal Programme (NRP), made to the listed flats.

Please note that the billing of upgrade costs is completely transparent. For instance, if a flat has recently undergone upgrades that are still being paid for via a monthly instalment added to the service and conservancy charges, this will be indicated in the listing. This ensures that as a prospective buyer, you are aware of any additional costs that you may need to take over upon purchasing the flat.

3. Financial Planning and Resale Application

The RFL service equips you with financial tools to help in your decision-making process. You can compare different flats, get estimates of monthly loan repayments and cash payments.

If you have a valid HFE letter, you can view personalised payment plans based on your eligible housing grants and HDB loans. Once you made your decision, you can exercise your Option To Purchase and submit your resale application through the HDB Flat Portal.

You might also be interested in these articles

|

What You Need to Prepare Before Using the HDB RFL Service

To access HDB’s new RFL service, both sellers and buyers have to fulfil certain criteria.

1. If you’re selling, you must have a valid Intent to Sell.

You need to register an Intent to Sell before listing your property. After registering, you will have to wait out a mandatory 7-day cooling-off period. Only after this period can you start listing on the platform.

Your Intent to Sell is valid for 12 months. It must remain valid when you grant the Option to Purchase (OTP) to potential buyers and during the submission of the resale application.

A valid Intent to Sell occurs when:

You are the legal owner of the flat and have the legal right to sell the property.

You are not under any legal restrictions that would prevent you from selling.

Legal restrictions that could prevent someone from selling a property may include:

|

Conversely, an “Intent to Sell” is considered invalid if:

It is given verbally or through an unofficial platform.

You are not the legal owner of the property or are under legal restrictions preventing the sale.

The declaration has expired beyond the validity period.

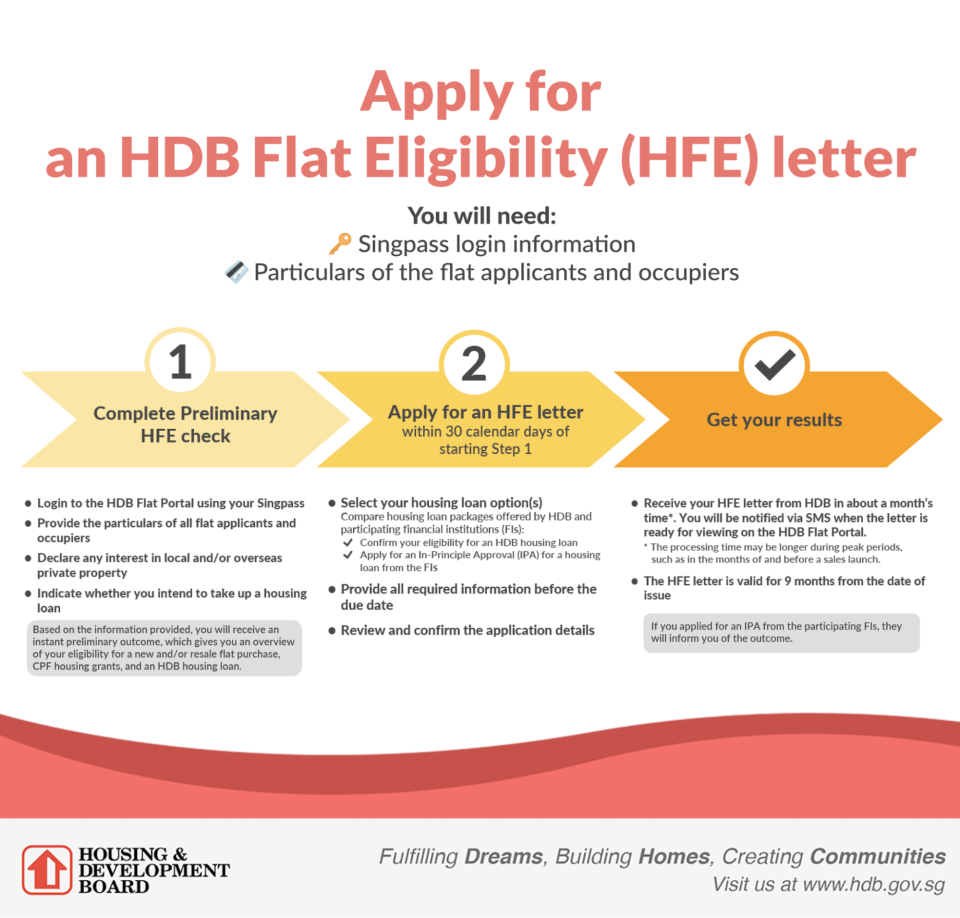

2. If you’re buying, you need a valid HDB Flat Eligibility letter.

You’ll need to submit a request for an “HDB Flat Eligibility letter” as a buyer. It’s the official confirmation from HDB to prove you’re eligible to purchase an HDB flat.

The HFE letter is crucial for your budgeting and planning. It will detail your eligibility for the type of resale flat you can go for and also detail the housing grants available to you (e.g. Family Grant, Proximity Housing Grant, or Singles Grant), and the limit for your borrowable amount for a HDB loan.

If you previously bought a subsidised flat and are looking to buy a resale flat, you may need to pay a resale levy depending on the type and price of your first subsidised flat. The HFE letter will specify the levy that ranges from S$15,000 to S$50,000, allowing you to budget more accurately for your new resale purchase. All these can be accomplished as well on the HDB platform online.

Benefits of the Resale Flat Listing Service

1. Choosing a Property Agent or List Yourself

The RFL service provides flexibility to those intending to sell. As a seller with a valid Intent to Sell, you have the option to:

Engage a property agent on the HDB Flat Portal to manage your flat listing, or

List and market your flat independently on the HDB Flat Portal.

This gives you the autonomy to handle the selling process according to your preference and comfort.

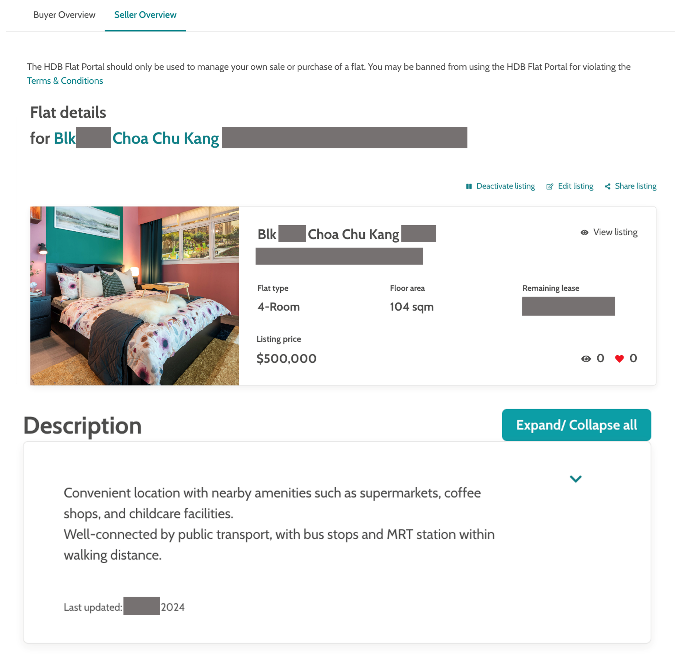

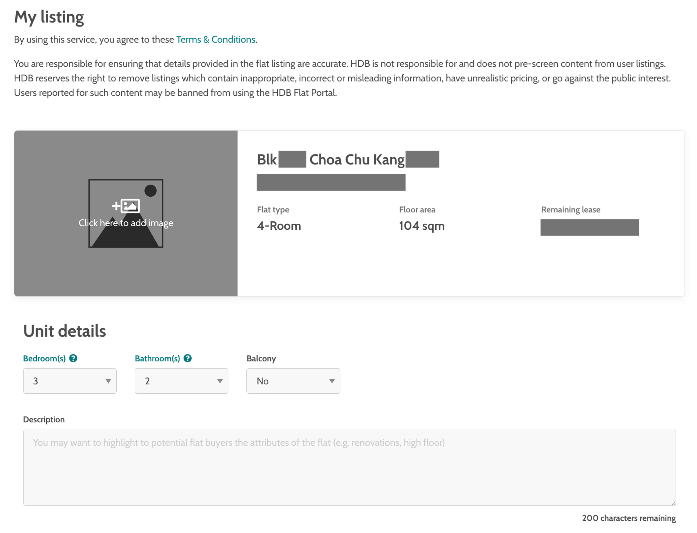

2. Simplified Listing Process

The RFL service streamlines the listing process, eliminating the need to manually input these details, reducing the margin for error and saving time. Key details about your flat such as the address, type of flat, and floor area are automatically filled in based on HDB’s database.

You only need to upload photos and provide descriptions of your flat to market it. You want to highlight the unique features and selling points to fetch a good price for it.

3. Organised Viewing Appointments and Prevention of Duplicate Listings

Once your flat is listed, you can set up viewing appointments for interested buyers; allowing you to manage your available time effectively and ensure an organised viewing process. To maintain the integrity of the platform, each seller can only post one listing per flat. This prevents duplicate listings and confusion for prospective buyers.

4. Confirmation of Buyer’s Eligibility

The RFL service assures you that prospective buyers who express interest meet the basic eligibility criteria to purchase an HDB flat. Only prospective buyers who hold a valid HFE letter can access your contact details and/or schedule viewing appointments. You won’t waste time entertaining visitors who have no intention to buy.

Is There Still a Need for Property Agents?

Even with HDB’s new Resale Flat Listing service, property agents still hold a crucial role in the housing market and can come in handy in several situations:

You Need Expert Advice: Property agents have a deep understanding of the real estate market, including property values, marketing strategies, and negotiation techniques. They offer knowledgeable guidance to navigate the complexities of buying or selling a property.

You Want to Save Time: Property transactions can be time-consuming, with loads of paperwork and legal details. Agents can manage and facilitate these tasks efficiently, saving you precious time.

You Need a Good Negotiator: Property agents are skilled negotiators. They can help you get the best possible price for your property, or negotiate favourable conditions when you’re buying.

You Want Personalised Service: Agents can curate properties that are tailored to your specific needs, preferences, and budget. Instead of fishing through listings online, agents already know firsthand what properties are suitable, arrange viewings, and offer insights you might not have thought about.

You’re Facing Complex Transactions: Some property transactions can be pretty complicated, like ones involving co-owned properties, divorces, or estates. An experienced property agent can navigate these complexities and regulations..

Even HDB’s RFL Service Saves A Spot for Property Agents

If you’re a property agent, the new RFL service by HDB can also be a useful tool that can enhance the services you provide. You get a personalised dashboard on the HDB Flat Portal, which helps you manage client activities more efficiently.

It gives you a clear overview of all your clients and the follow-up for each one. You will be able to focus more on providing value-added services, like offering budgeting advice and guiding your clients through the property transaction process.

ALSO READ: Can We Trust AI With Property Research? Comparing SRX, EdgeProp, PropertyGuru, 99.co, and Ohmyhome

What Are Redditors Saying About the HDB’s New RFL Service?

“Transacting without agent leeches? Big win!”

The new Resale Flat Listing by HDB is getting some serious support. It just cut out all the fuss about needing “agents” and made the whole HDB flat trading process pretty straightforward.

It’s not just about simplifying things. This move is seen as a big step towards making the property market more transparent and efficient. A lot of the chatter is around how this will push agents to areas where they can actually add value instead of just “warming the bench.”

“Excellent. Good step in the right direction to cut off the potential for middle men who are driving up prices of HDB flats. Now make it such that all sales and purchase must go through this.”

One of the big wins here is how this is expected to put a lid on those inflated listing prices. People are hoping this will trim down the bureaucratic red tape and costs that usually come with property transactions.

Concluding Thoughts

Though it hasn’t even been a month, the new Resale Flat Listing service is already receiving considerable attention for its features. This service has made the process of buying and selling flats much simpler. Having to be tied to the HDB database, there is a lot more transparency in pricing and convenience in navigating the regulations. Hopefully, in time to come, we can have a much more user-friendly journey in buying and selling resale flats.

The post Everything You Need To Know About HDB's New Resale Flat Listing Service (RFL) appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Everything You Need To Know About HDB’s New Resale Flat Listing Service (RFL) appeared first on MoneySmart Blog.

Original article: Everything You Need To Know About HDB’s New Resale Flat Listing Service (RFL).

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance