Every portfolio should have an allocation to Swiss assets

Switzerland is recognised for its well-established safe-haven status.

A small, landlocked country in Central Europe, Switzerland is only the 135th largest country in the world in terms of geographical area. If we instead consider the population, with close to nine million inhabitants, Switzerland still only ranks 101st. But punching well above its geographical and demographic weight are its economic strength and the importance of its capital markets.

Unique for its long-standing political stability, sound economic policies, highly developed rule of law, highly skilled workforce, low inflation and strong currency, Switzerland is recognised for its well-established safe-haven status.

With the 20th largest nominal gross domestic product (GDP) in the world, and among the top five in terms of nominal GDP per capita, Switzerland is also home to the sixth largest equity market in the world, accounting for 2.5% of the total global equity market capitalisation at the end of last year.

Central bank’s return to orthodox monetary policy supports the Swiss franc

Looking ahead, while the Swiss services sector should remain relatively resilient over the coming months, the Swiss industrial sector may come under pressure in the near term. Nevertheless, we expect positive real GDP growth for both 2023 (1.1%) and 2024 (0.9%).

The Swiss economy has been subject to elevated levels of inflation in the aftermath of the global pandemic, and while Swiss consumer price inflation peaked at 3.5% y-o-y in August last year, it is currently back down to 1.7% as of June, which is below the eurozone average. As a result, while the Swiss National Bank’s (SNB) rhetoric remains hawkish for now, the Swiss central bank may be finished with rate hikes sooner than its European counterparts.

An early end to the SNB’s rate hike cycle is clearly a drag on the Swiss franc’s strength, but the currency still has the potential to benefit from a slower-growth environment and rising investor risk aversion. The more balanced approach to monetary policy currently adopted by the SNB is reinforcing the Swiss franc’s (CHF) long-standing status as a safe-haven currency.

Since the start of floating exchange rates in 1973, while a CHF investment would have gained in value relatively steadily against virtually all major currencies including the US dollar (USD), gold has tended to experience some short spikes, followed by multi-year consolidations, with most of the yellow metal’s relative outperformance occurring during the commodity super-cycle of the 2000s. Thus, the criterion of low price fluctuation of a store of value investment is met more easily with an investment in short-term Swiss franc deposits than in gold.

Structural conditions for long-term Swiss asset outperformance remain intact

In the medium-to-longer term, Switzerland and hence its risk assets should continue to benefit from very favourable structural conditions. The country enjoys the highest credit rating across all major rating agencies. This reflects its strong public finances (general government debt is at 27.6% of GDP) and its position as a large net external creditor (112.4% of its GDP), which are supported by recurring current-account surpluses.

Switzerland leads the region in labour productivity, and thanks to this flexible labour market, unit labour costs in Switzerland have risen less than those in the eurozone or the US, making Swiss labour competitive despite the higher wages. Switzerland also regularly claims the podium in global competitiveness rankings.

This is helped by a high level of innovation — Switzerland has consistently ranked first in the Global Innovation Index over the past decade. It goes without saying that an environment conducive to innovation is a necessary condition for companies to remain disruptive, thereby providing a fertile ground for high-quality businesses to emerge and grow, compounding returns, and ultimately preserving wealth for generations to come.

Switzerland has consistently been one of the strongest equity markets

The favourable structural characteristics of the Swiss economy spill over into the Swiss equity market. In general, the latter offers defensive characteristics, given its strong exposure to global heavyweights in the healthcare and consumer defensive sectors (60% of the Swiss Market Index) and a bias towards high-quality companies. This mix is particularly beneficial in times of economic slowdowns, as the earnings of high-quality companies usually prove to be comparatively resilient due to market-leading margins and superior pricing power.

On the other hand, the Swiss equity market also tends to preserve value in times of low inflation and economic prosperity, thanks to its thriving small- and mid-cap landscape and its international geographic diversification.

Swiss equities have been able to hold their ground against their US counterparts over the past four decades. When calculating returns in common currency terms, measuring the unhedged performance of the MSCI Switzerland index in USD against the MSCI USA index, the only time that US equities temporarily decoupled in their growth trend from Swiss equities was during the dot-com bubble and in the first two years of the Covid-19 pandemic.

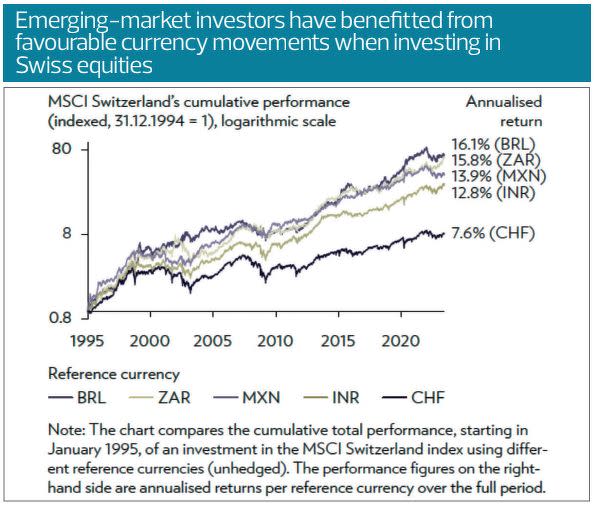

The investment case for Swiss equities is particularly compelling for investors who can benefit from two different exposures at the same time: to a strong equity market and a strong currency. Holding CHF-denominated assets provides a hedge against currency risk, especially in times of global economic uncertainty. In fact, most of the gains made by Swiss equity investors with an emerging market reference currency (on an unhedged basis) have come from favourable currency movements historically.

Swiss real estate can help diversify

The structural support for risk assets denominated in Swiss francs for investors with alternative reference currencies is a reality that extends beyond Swiss equities. For the present decade, we anticipate an investment environment characterised by structurally higher, but contained, inflation. In such a context, investing in real assets is the first line of defence for preserving purchasing power. Thus, we like the Swiss real estate segment, particularly as a means of diversifying investments.

There are several ways to invest in this particular asset class. While institutional investors can build diversified direct real estate portfolios of their own, another lower-maintenance and more liquid way of participating is to hold shares in pooled investment vehicles, either in public or private property funds.

Regardless of how investors choose to gain exposure, the long-term investment case for the Swiss real estate asset class remains compelling, particularly in the residential segment. The market is structurally driven by a growing population, an increasing number of households, more jobs, higher overall income levels, low vacancy rates and subdued supply.

Against the backdrop of a persistent demand-supply imbalance (that is, demand continues to grow, while shortages in supply remain, leading to upward pressure on rents), sustained price declines, particularly among Swiss residential real estate funds, seem unlikely, even if interest rates were to rise further. Also, the average distribution yield of close to 3% for Swiss real estate funds appears attractive.

Switzerland and Swiss assets remain a store of value

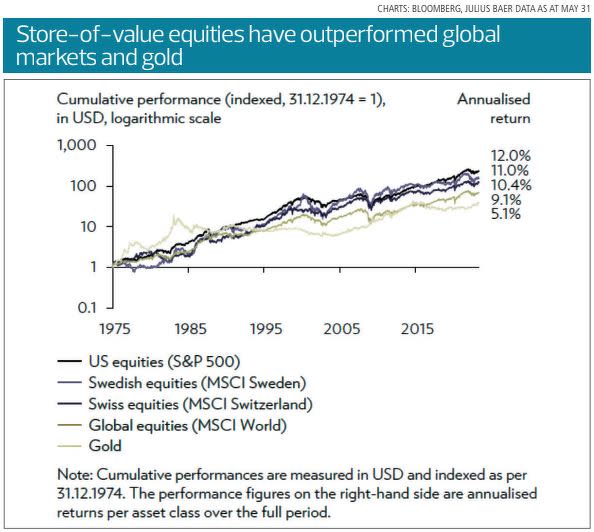

In summary, when geopolitical shocks become the norm rather than the exception, we reiterate our overarching view that investors should focus on “store of value” equity markets. We use this as an umbrella term for markets in countries where shareholder value is well-protected and where there is a strong institutional framework, sound governance and an efficient allocation of capital. In addition to Swiss equity markets, the Swedish and US equity markets also belong to this group, displaying an exceptional track record of creating shareholder value. Their respective flagship stock indices have outperformed both global equities and gold, not just in the last 30 years of neoliberalism but also consistently prior to that, including in the more inflationary and geopolitically intense decades, such as the 1970s and 1980s.

Given the new geopolitical reality since the start of the war in Ukraine, investors should review their geographical footprint and reassess cross-border geopolitical risks. This includes an examination of the actual exposures that are taken on in investment portfolios. The good news is that Switzerland ticks all the “store of value” boxes and it is for this reason that every portfolio should include Swiss assets.

Yves Bonzon is group chief investment officer at Julius Baer

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

UOBAM paves the road to excellence through its key success pillars

A flying start to the year but the bull cycle is playing out

Will the global economy stay stable or tumble like a house of cards?

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance