Even With A 34% Surge, Cautious Investors Are Not Rewarding Zheneng Jinjiang Environment Holding Company Limited's (SGX:BWM) Performance Completely

Zheneng Jinjiang Environment Holding Company Limited (SGX:BWM) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

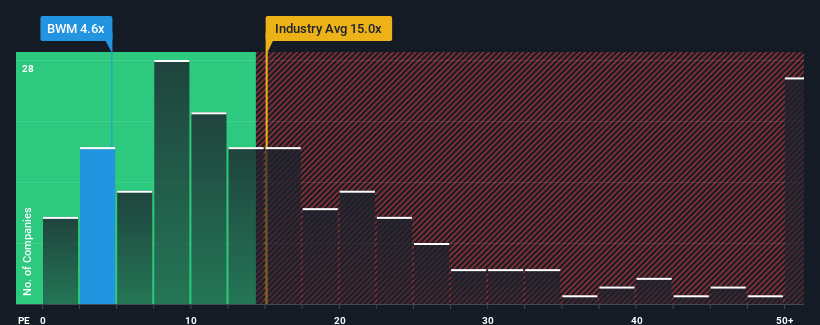

Although its price has surged higher, Zheneng Jinjiang Environment Holding may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.6x, since almost half of all companies in Singapore have P/E ratios greater than 13x and even P/E's higher than 23x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for Zheneng Jinjiang Environment Holding as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Zheneng Jinjiang Environment Holding

Although there are no analyst estimates available for Zheneng Jinjiang Environment Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

How Is Zheneng Jinjiang Environment Holding's Growth Trending?

In order to justify its P/E ratio, Zheneng Jinjiang Environment Holding would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 50% last year. The strong recent performance means it was also able to grow EPS by 89,297% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 9.2% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Zheneng Jinjiang Environment Holding is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Zheneng Jinjiang Environment Holding's recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zheneng Jinjiang Environment Holding currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Zheneng Jinjiang Environment Holding that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance