Europe's automakers fret as China EV tariff fears become reality

By Nick Carey

LONDON (Reuters) - The European Commission's decision to slap tariffs on imported Chinese EVs could have far-reaching effects for European automakers, as a possible trade war would hurt not only their business in China but also their own imports of Chinese-made cars.

Germany's automakers in particular have a lot to lose in China and the announcement on Wednesday leaves them fretting over a decision BMW CEO Oliver Zipse described as the "wrong way to go".

Tariffs on Chinese-made electric vehicles of up to 38.1% - equating to billions of euros - will be levied from July, but that is unlikely to deter China's automakers from exporting to Europe because they can absorb the extra cost and still make a profit.

Most Chinese automakers remained quiet after the tariffs were announced, but EV maker Nio said that while it opposed the decision, in Europe its "commitment to the EV market remains unwavering".

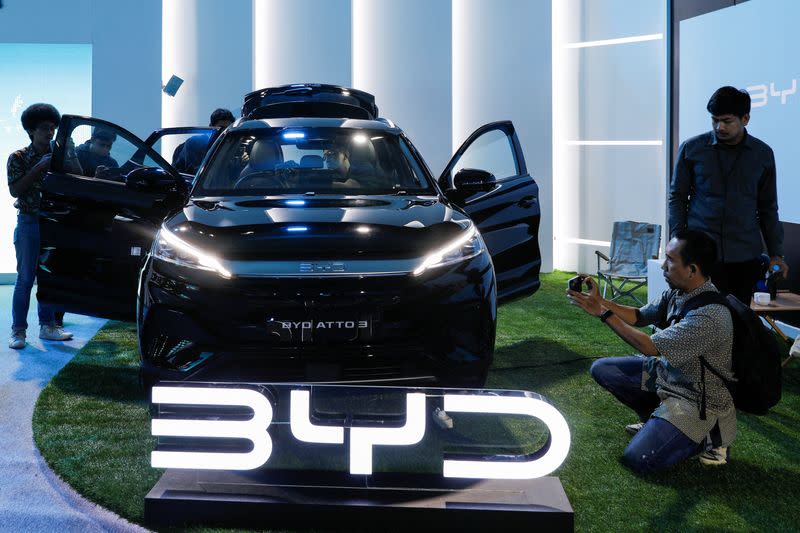

Also, China's BYD and Chery have already announced plans to build cars in Europe, which would avoid the tariffs.

Will Roberts, head of automotive research at Rho Motion, said that while Chinese automakers have room to absorb tariffs, the "true test from today's announcement will be whether Beijing will retaliate in kind".

"Europe's manufacturers still rely on the Chinese market, so declining profits from the East would only slow their ability to transition effectively" to electric vehicles, he added.

HIGH STAKES

It has become a high-stakes game for Germany's automakers.

China accounted for nearly 32% of sales at BMW in the first quarter and around 30% for rivals Volkswagen and Mercedes-Benz.

VW shares fell 1.2% on Wednesday, among the biggest decliners on the euro zone's blue-chip stock index, BMW dropped 0.9% to its lowest since November and Mercedes was down 0.5% at its weakest since February.

Retaliation could thus be painful for those companies and Germany's manufacturing economy, prompting Chancellor Olaf Scholz to warn during a speech at an Opel factory at the weekend that "isolationism and unlawful customs barriers...that ultimately only makes everything more expensive and everyone poorer."

VW said the "negative effects" of the tariffs "outweigh any potential benefits for the European and especially the German automotive industry".

Mercedes CEO Ola Kaellenius said the "dismantling of restrictions and expansion of fair and free trade has led to economic growth. So we shouldn't go in the other direction now".

But the tariffs will also hit the cars that European automakers have made in China for European consumers.

Renault, for instance, imports the affordable Chinese-made Dacia Spring EV into Europe, and its Chinese joint venture partner Dongfeng is on the list of those companies likely to be hit with a 21% tariff.

Renault did not comment on the EU's tariff announcement.

Tesla imports Chinese-made EVs into Europe and BMW imports Mini EVs and the iX3.

Europe's auto industry is also reliant on Chinese components, particularly for EVs as China dominates so much of the supply chain.

Speaking to analysts last month, BMW CEO Zipse warned that sparking a trade war could have dire consequences for the transition to EVs because it is impossible to make cars in Europe without Chinese imports.

"There is no Green Deal in Europe without resources from China," Zipse said.

(Reporting By Nick Carey; additional reporting by Christoph Steitz in Frankfurt and Zhang Yan in Shanghai; Editing by Josephine Mason and Kirsten Donovan)

Yahoo Finance

Yahoo Finance