Euronext Paris Stocks That May Be Priced Below Estimated Value In June 2024

Amidst a backdrop of political uncertainty and fluctuating bond yields, the French market has shown resilience, though it remains sensitive to broader European economic shifts. In such an environment, identifying stocks that may be undervalued involves a careful analysis of fundamentals against current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Airbus (ENXTPA:AIR) | €145.80 | €219.16 | 33.5% |

Kaufman & Broad (ENXTPA:KOF) | €27.75 | €53.08 | 47.7% |

Lectra (ENXTPA:LSS) | €27.50 | €43.13 | 36.2% |

Wavestone (ENXTPA:WAVE) | €55.30 | €88.37 | 37.4% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | €19.42 | €34.21 | 43.2% |

Vivendi (ENXTPA:VIV) | €9.518 | €15.42 | 38.3% |

MEMSCAP (ENXTPA:MEMS) | €5.48 | €8.55 | 35.9% |

Tikehau Capital (ENXTPA:TKO) | €21.30 | €32.17 | 33.8% |

Thales (ENXTPA:HO) | €152.05 | €259.22 | 41.3% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.90 | €6.72 | 42% |

Let's uncover some gems from our specialized screener

Esker

Overview: Esker SA is a company that operates a cloud platform for finance and customer service professionals globally, with a market capitalization of approximately €1.05 billion.

Operations: The company generates revenue primarily through its Software & Programming segment, amounting to €190.92 million.

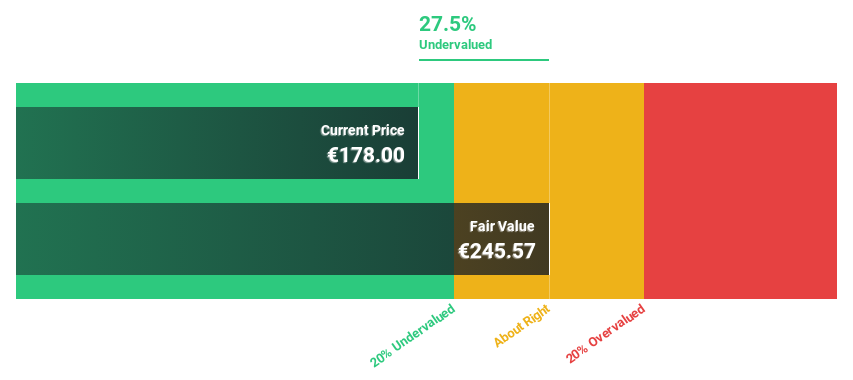

Estimated Discount To Fair Value: 27.5%

Esker is currently trading at €178, significantly below its estimated fair value of €245.57, suggesting a potential undervaluation. The company's revenue and earnings are expected to grow by 11.8% and 25.76% per year respectively, outpacing the French market averages of 5.8% for revenue and 11.1% for earnings growth. Additionally, Esker's forecasted Return on Equity is high at 32.8%. Despite a recent dip in net income as reported for the full year ended December 31, 2023, Esker anticipates sales growth of 12-14% for FY2024 with profitability between 12-13%.

Vivendi

Overview: Vivendi SE, a company based in France, operates globally in the entertainment, media, and communication sectors with a market capitalization of approximately €9.75 billion.

Operations: The primary revenue segments for the company include Canal + Group at €6.06 billion, Havas Group at €2.87 billion, Lagardère at €0.67 billion, Gameloft at €0.31 billion, and Prisma Media at €0.31 billion.

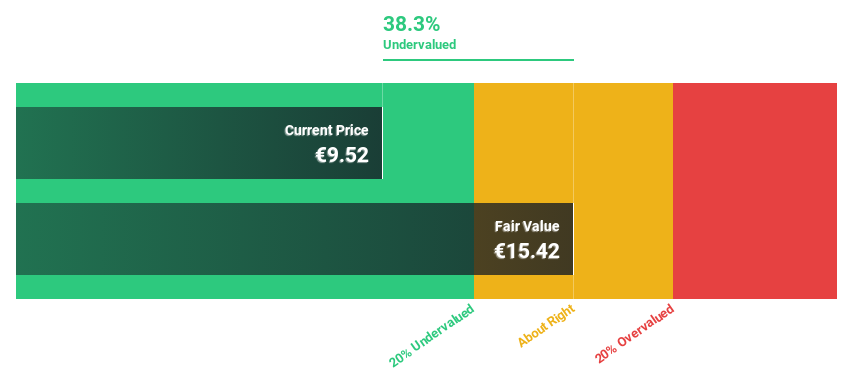

Estimated Discount To Fair Value: 38.3%

Vivendi SE, priced at €9.52, is substantially below its calculated fair value of €15.42, indicating potential undervaluation based on cash flows. Analyst consensus suggests a significant price increase potential of 41.3%. Despite a low forecasted Return on Equity of 6%, earnings are expected to grow by 29.26% annually over the next three years, surpassing the French market's growth rate. However, its dividend history remains inconsistent despite recent affirmations and revenue growth projections lag behind earnings at 18.3% annually.

According our earnings growth report, there's an indication that Vivendi might be ready to expand.

Click here to discover the nuances of Vivendi with our detailed financial health report.

Wavestone

Overview: Wavestone SA is a technology consulting firm operating mainly in France and globally, with a market capitalization of approximately €1.36 billion.

Operations: The firm generates €701.06 million from management consulting and information system services.

Estimated Discount To Fair Value: 37.4%

Wavestone SA, trading at €55.3, appears undervalued by over 20% compared to its estimated fair value of €88.37, reflecting a positive outlook based on cash flow analysis. Recent earnings reports show a substantial increase in sales to €701.06 million and net income to €58.2 million, indicating robust financial health. Analysts predict a 22% price rise and forecast earnings growth of approximately 22% annually over the next three years, outpacing the French market's expected growth. However, its Return on Equity is projected to remain low at around 13.3%.

The analysis detailed in our Wavestone growth report hints at robust future financial performance.

Unlock comprehensive insights into our analysis of Wavestone stock in this financial health report.

Seize The Opportunity

Access the full spectrum of 15 Undervalued Euronext Paris Stocks Based On Cash Flows by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALESKENXTPA:VIV and ENXTPA:WAVE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance