Euronext Paris Stocks Estimated to be Trading Below Value in June 2024

As global markets experience varied trends, France's CAC 40 Index has shown notable resilience, advancing by 1.67% amid easing monetary policy expectations and diminishing political uncertainties. In this context of market optimism, identifying stocks that are potentially undervalued becomes particularly compelling for investors looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Airbus (ENXTPA:AIR) | €130.64 | €239.53 | 45.5% |

Vente-Unique.com (ENXTPA:ALVU) | €15.40 | €29.97 | 48.6% |

Lectra (ENXTPA:LSS) | €27.80 | €43.16 | 35.6% |

Wavestone (ENXTPA:WAVE) | €52.20 | €88.53 | 41% |

Arcure (ENXTPA:ALCUR) | €5.10 | €7.47 | 31.7% |

Vivendi (ENXTPA:VIV) | €9.78 | €15.52 | 37% |

MEMSCAP (ENXTPA:MEMS) | €5.50 | €8.56 | 35.7% |

Tikehau Capital (ENXTPA:TKO) | €21.35 | €32.36 | 34% |

Thales (ENXTPA:HO) | €150.50 | €254.03 | 40.8% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.84 | €6.72 | 42.9% |

Below we spotlight a couple of our favorites from our exclusive screener

Esker

Overview: Esker SA is a company that provides a cloud-based platform for finance and customer service professionals globally, with a market capitalization of approximately €1.04 billion.

Operations: The company generates €190.92 million from its software and programming segment.

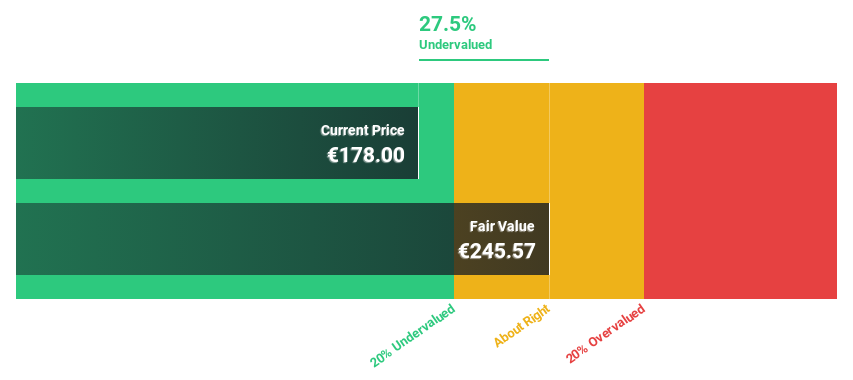

Estimated Discount To Fair Value: 28.3%

Esker, a French company, appears undervalued based on cash flow analysis, trading at €175.8 against an estimated fair value of €245.03—a 28.3% discrepancy. Despite a recent dividend cut to €0.65 per share, reflecting a 15% decrease, Esker's earnings are expected to grow by 25.76% annually over the next three years, outpacing the French market's average growth rate significantly. Additionally, its revenue growth forecast of 11.8% yearly exceeds the market norm (5.8%), supported by robust governance and expansion strategies as evidenced by recent board appointments and global conference presentations.

Antin Infrastructure Partners SAS

Overview: Antin Infrastructure Partners SAS is a private equity firm that focuses on infrastructure investments, with a market capitalization of approximately €1.98 billion.

Operations: The firm generates revenue primarily from its asset management segment, totaling approximately €282.87 million.

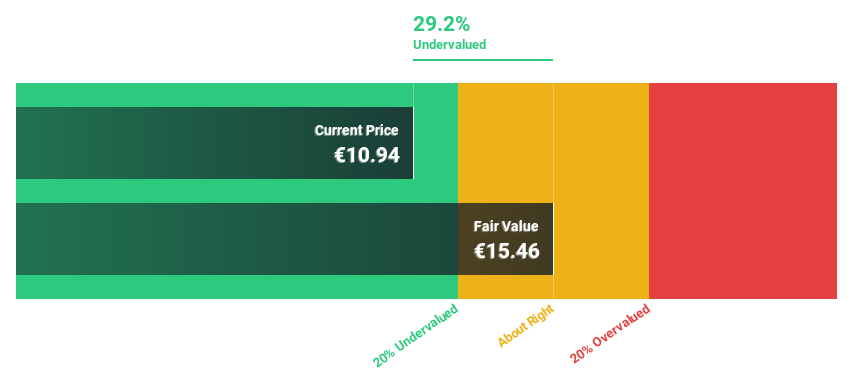

Estimated Discount To Fair Value: 28.8%

Antin Infrastructure Partners SAS, priced at €11.08, is perceived as undervalued with a fair value estimate of €15.56, reflecting a 28.8% potential upside. The company's earnings are anticipated to increase by 25.9% annually over the next three years, surpassing the French market's growth forecast significantly. Despite recent shareholder dilution and dividends not well covered by earnings or cash flows, revenue growth projections remain strong at 12.7% per year, outpacing the French market average of 5.8%.

Lectra

Overview: Lectra SA, with a market cap of €1.05 billion, offers industrial intelligence solutions across the fashion, automotive, and furniture sectors in regions including Northern Europe, Southern Europe, the Americas, and Asia Pacific.

Operations: The company generates revenue from the Americas and Asia-Pacific regions, amounting to €170.33 million and €110.28 million respectively.

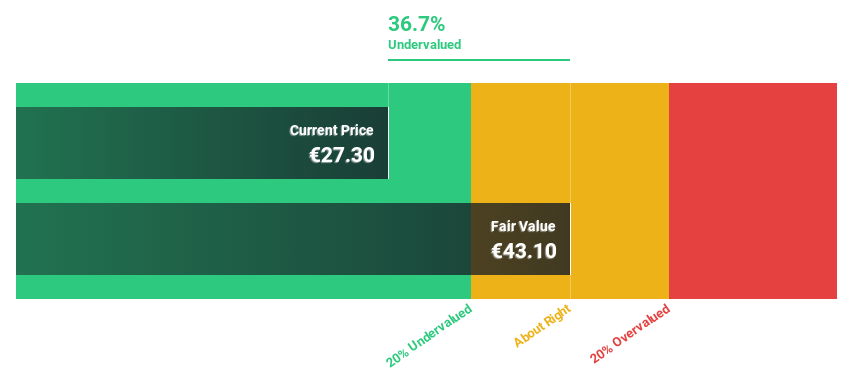

Estimated Discount To Fair Value: 35.6%

Lectra SA, currently priced at €27.8, is assessed as undervalued with a fair value estimate of €43.16, indicating significant potential upside. The company's earnings are expected to grow by 28.6% annually over the next three years, outperforming the French market forecast of 10.9%. Despite a slight decline in net income and EPS in Q1 2024 compared to the previous year, analysts predict a substantial price increase of 28.4%. Revenue growth is also strong at an annual rate of 11.3%, exceeding the market average of 5.8%.

Our growth report here indicates Lectra may be poised for an improving outlook.

Delve into the full analysis health report here for a deeper understanding of Lectra.

Key Takeaways

Reveal the 13 hidden gems among our Undervalued Euronext Paris Stocks Based On Cash Flows screener with a single click here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALESKENXTPA:ANTIN and ENXTPA:LSS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance