Euronext Paris Showcases Three Prominent Dividend Stocks

As the French market navigates through a period of political uncertainty with upcoming elections, investors are closely monitoring shifts in economic indicators and bond yields. In this context, identifying dividend stocks that offer potential stability and consistent returns can be particularly appealing to those looking to invest in Euronext Paris.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.47% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.17% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.78% | ★★★★★★ |

SCOR (ENXTPA:SCR) | 7.52% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.00% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.09% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.41% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.17% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.19% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.87% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

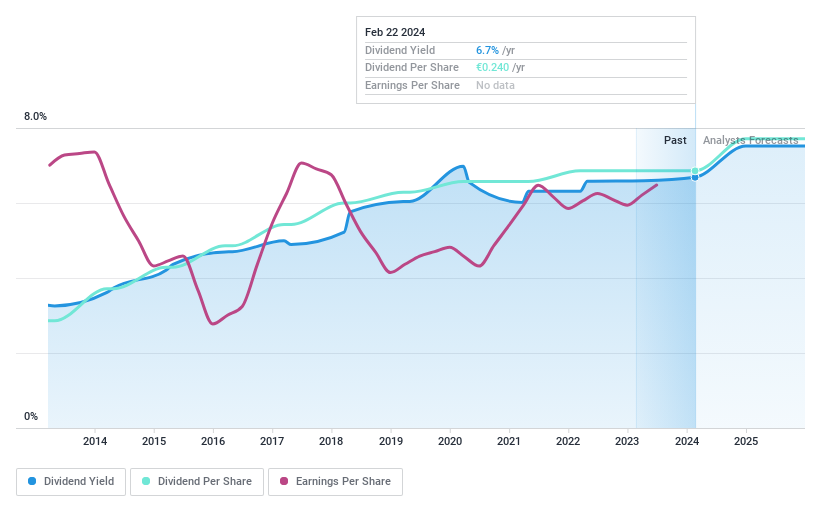

CBo Territoria

Simply Wall St Dividend Rating: ★★★★★★

Overview: CBo Territoria SA is a French company focused on urban planning and development, as well as property development and investment, with a market capitalization of €126.77 million.

Operations: CBo Territoria SA generates revenue primarily through land sales and promotion activities, totaling €25.51 million and €58.08 million respectively.

Dividend Yield: 6.8%

CBo Territoria maintains a solid track record with a consistent dividend yield of 6.82%, placing it in the top 25% of French dividend payers. The company's dividends are well-supported, evidenced by a payout ratio of 61% and cash flows covering dividends at 25.4%. Despite its high level of debt, CBo Territoria offers an attractive price-to-earnings ratio at 8.9x, below the French market average. Recent board changes could influence future governance and policy directions.

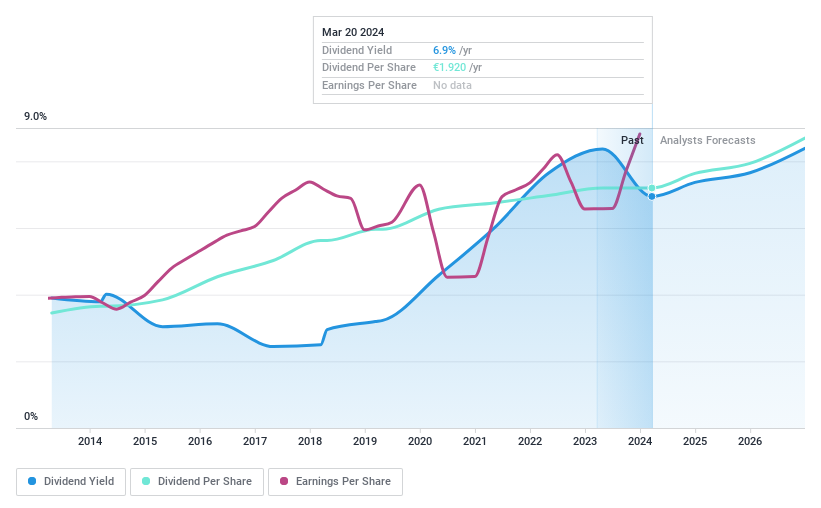

Rubis

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial clients across Europe, Africa, and the Caribbean, with a market capitalization of approximately €2.88 billion.

Operations: Rubis generates revenue primarily through Energy Distribution, which totaled €6.58 billion, and Renewable Electricity Production, contributing €48.64 million.

Dividend Yield: 7.2%

Rubis offers a compelling dividend yield of 7.31%, ranking it among the top quartile in France. Its dividends, growing steadily over the last decade, are well-supported by earnings with a payout ratio of 57.7% and cash flows at 73.8%. Despite high debt levels, Rubis trades at an attractive price-to-earnings ratio of 8x, below the market average of 15.6x. Recent affirmations in corporate guidance suggest stable net income for 2024, despite new tax impacts estimated between €20 million and €25 million.

Navigate through the intricacies of Rubis with our comprehensive dividend report here.

Our valuation report here indicates Rubis may be undervalued.

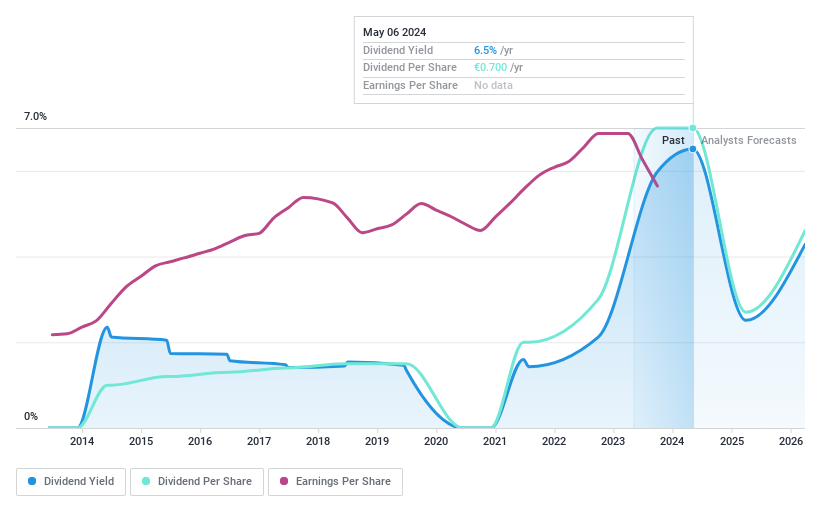

Oeneo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA is a global company engaged in the wine industry with a market capitalization of approximately €701.90 million.

Operations: Oeneo SA generates revenue through two primary segments: Closures, which brought in €211.60 million, and Winemaking, contributing €94.20 million.

Dividend Yield: 3.2%

Oeneo's recent financial performance shows a decline, with sales dropping to €305.73 million and net income falling to €28.85 million. Despite this, Oeneo maintains a dividend yield of 3.27%, which is below the top quartile in France at 5.48%. The company has a mixed record on dividends; although they are covered by earnings and cash flows with payout ratios of 77.8% and 83.3% respectively, the dividend track record over the past decade has been unstable and volatile.

Click here and access our complete dividend analysis report to understand the dynamics of Oeneo.

Our valuation report here indicates Oeneo may be overvalued.

Taking Advantage

Embark on your investment journey to our 35 Top Euronext Paris Dividend Stocks selection here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CBOT ENXTPA:RUI and ENXTPA:SBT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance