Euronext Paris Showcases Three Premier Dividend Stocks

Amidst a backdrop of political shifts and economic fluctuations in Europe, France's stock market has shown resilience, with the CAC 40 Index climbing 2.62%. This positive momentum sets an intriguing stage for investors considering dividend stocks in this dynamic market environment. In assessing potential investments, it is crucial to consider not only the yield but also the stability and growth prospects of dividend-paying companies, especially in light of current economic conditions.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 7.12% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 9.58% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.81% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.64% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.29% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.96% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.09% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.44% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.40% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our Top Euronext Paris Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Amundi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market capitalization of approximately €12.77 billion, specializing in asset management services.

Operations: Amundi generates its revenue primarily through asset management services, amounting to €6.03 billion.

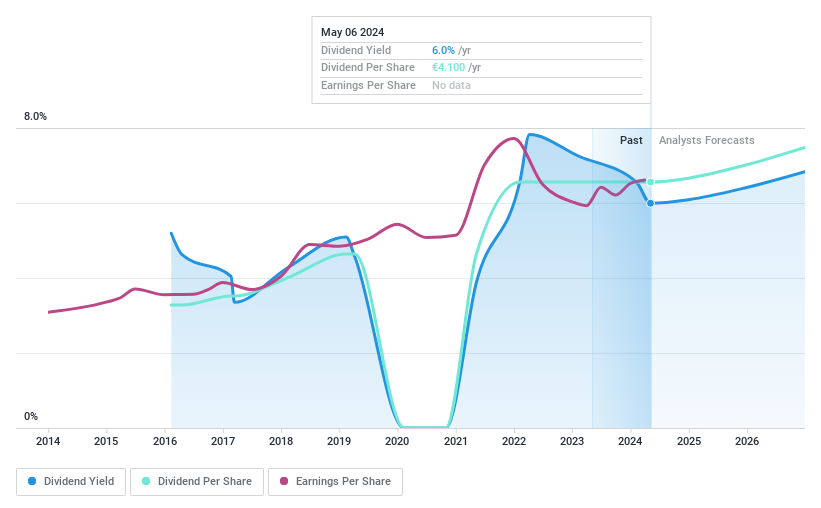

Dividend Yield: 6.5%

Amundi's dividend yield stands at 6.53%, ranking in the top 25% of French dividend payers. Despite a relatively short history of dividend payments, recent affirmations include a €4.10 per share payout, with dividends adequately covered by both earnings (71.9% payout ratio) and cash flows (56% cash payout ratio). However, its track record shows volatility in payouts over its eight-year history. Analysts predict potential stock price growth of 23.6%, and it trades at a 9.4% discount to estimated fair value.

Eiffage

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in various sectors including construction, property and urban development, civil engineering, metallic construction, roadworks, energy systems, and concessions both in France and internationally with a market capitalization of approximately €8.44 billion.

Operations: Eiffage SA's revenue is primarily generated from its Infrastructures segment at €8.43 billion, followed by Energy Systems at €5.99 billion, Construction at €4.29 billion, and Concessions contributing €3.90 billion.

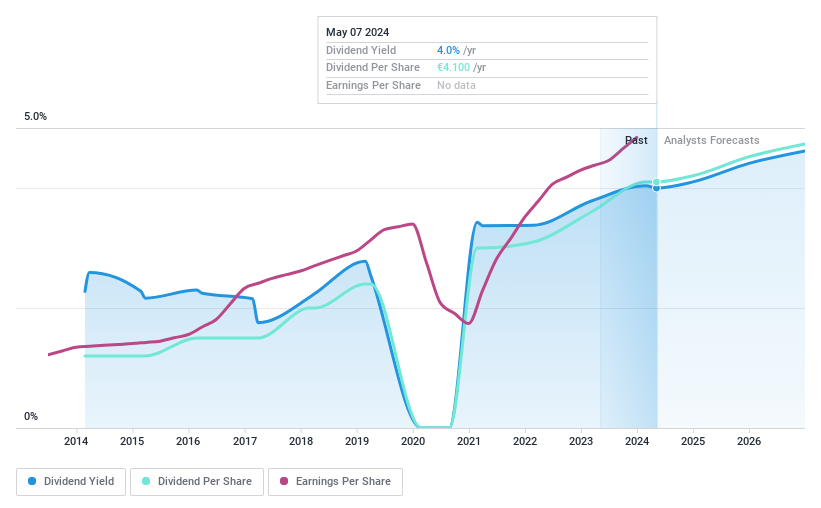

Dividend Yield: 4.6%

Eiffage, while maintaining a low cash payout ratio of 15.6% and an earnings payout ratio of 38.5%, shows a mixed dividend history with volatile payments over the past decade. Recent strategic moves like partnering with Google Cloud to enhance operational efficiency using AI, and securing a significant construction project for the Valby cloudburst tunnel, underline its proactive approach in securing growth avenues. However, its dividend yield at 4.57% remains below the top quartile of French dividend stocks at 5.35%.

Navigate through the intricacies of Eiffage with our comprehensive dividend report here.

The valuation report we've compiled suggests that Eiffage's current price could be quite moderate.

CFM Indosuez Wealth Management

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA operates primarily in Monaco, offering banking and financial solutions to private investors, businesses, institutions, and professionals globally, with a market capitalization of €630.30 million.

Operations: CFM Indosuez Wealth Management SA generates its revenue primarily through its wealth management segment, which accounted for €196.38 million.

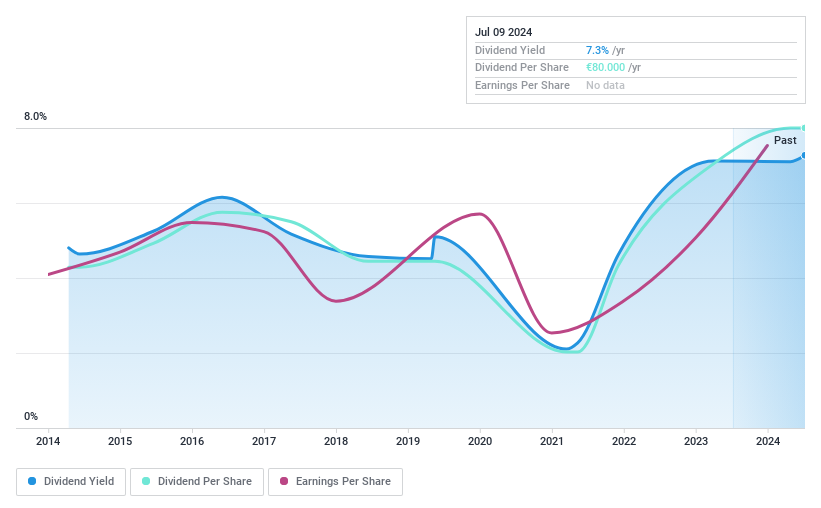

Dividend Yield: 7.3%

CFM Indosuez Wealth Management has exhibited a volatile dividend history over the past decade, with payments not consistently growing. Despite this, its recent performance shows promise; earnings increased by 40.1% last year, and its payout ratio stands at 70.8%, indicating that dividends are well-covered by earnings. However, with a low allowance for bad loans at 34%, there's financial risk involved. The firm's dividend yield is robust at 7.27%, outperforming the French market average of 5.35%.

Turning Ideas Into Actions

Explore the 38 names from our Top Euronext Paris Dividend Stocks screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AMUN ENXTPA:FGR and ENXTPA:MLCFM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance