Euronext Paris Showcases Three Growth Companies With High Insider Ownership

As the French market navigates through heightened political uncertainty with upcoming elections, investors are keenly watching how these developments might impact economic indicators and market sentiments. Amidst this backdrop, examining growth companies with high insider ownership on Euronext Paris could offer valuable insights into firms that potentially possess a robust alignment of interests between shareholders and management, which is particularly reassuring in turbulent times.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

Munic (ENXTPA:ALMUN) | 29.4% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.4% | 72.7% |

We're going to check out a few of the best picks from our screener tool.

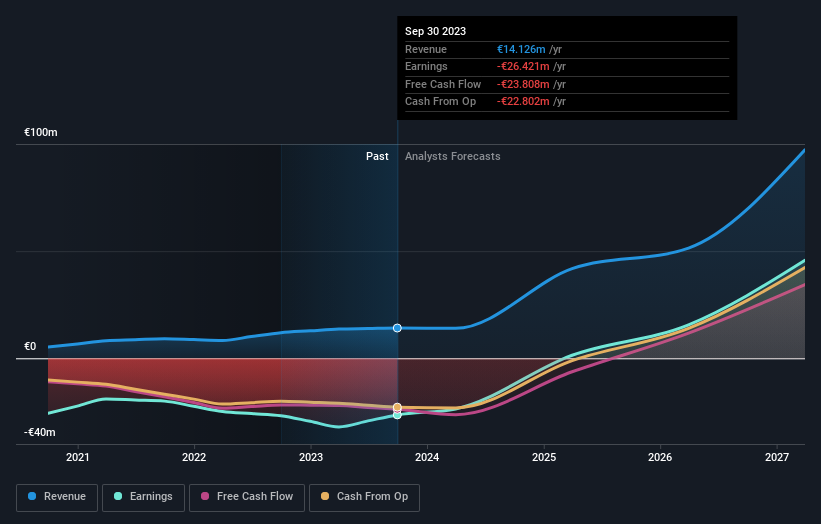

MedinCell

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a France-based pharmaceutical company specializing in the development of long-acting injectable medications across various therapeutic areas, with a market capitalization of approximately €386.51 million.

Operations: The company generates its revenues primarily from the pharmaceuticals segment, totaling €11.95 million.

Insider Ownership: 16.4%

Earnings Growth Forecast: 72.7% p.a.

MedinCell, a French biotech firm, has seen a decline in sales and revenue as reported in its latest earnings, with sales dropping to €9.03 million from €9.89 million year-over-year and revenue falling to €11.95 million from €13.66 million. Despite this downturn, the company reduced its net loss significantly to €25.04 million from €32.01 million previously. MedinCell is actively engaged in high-profile collaborations and innovative drug trials, such as the recent partnership with AbbVie potentially worth up to $1.9 billion plus royalties on future sales, highlighting its strategic initiatives despite current financial challenges and market volatility.

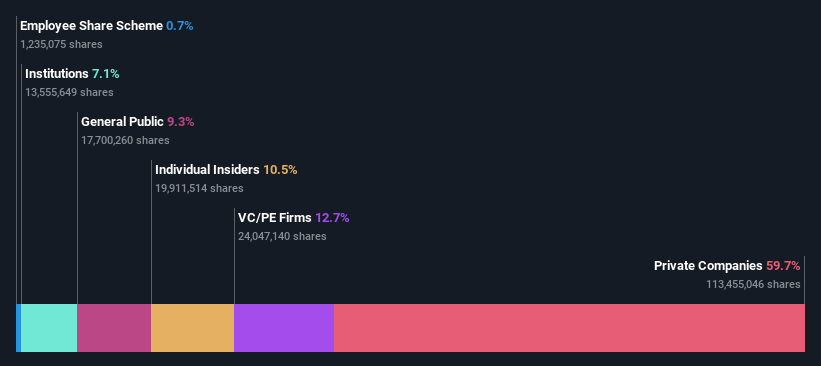

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. operates globally, offering public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.11 billion.

Operations: The company generates revenue through three primary segments: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud (€185.43 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.5% p.a.

OVH Groupe, a French tech company, is navigating a path to profitability with its revenue expected to grow at 10.9% annually, outpacing the French market's 5.7%. Despite a forecast of low return on equity at 1.8% in three years and a highly volatile share price recently, OVH's internal advancements and market strategies—like the launch of new AMD-powered Bare Metal Advance servers—demonstrate robust growth potential and innovation strength. However, earnings are only anticipated to rise significantly without surpassing very high thresholds.

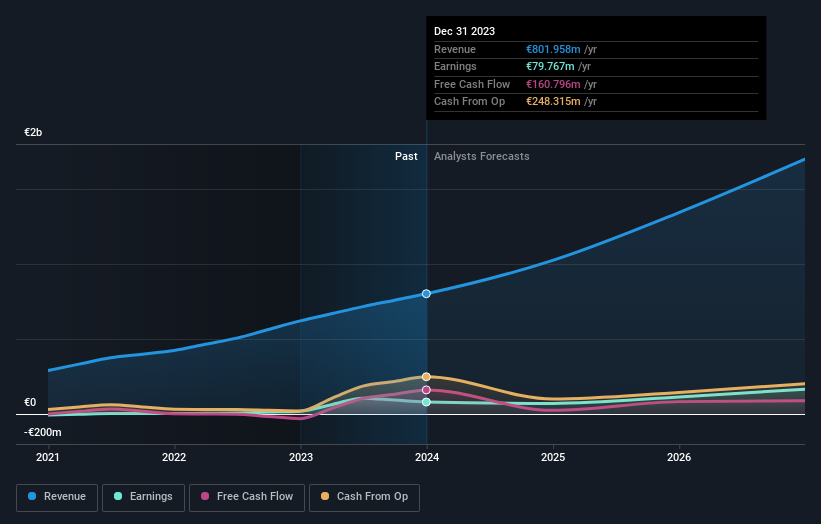

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. operates in providing digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.07 billion.

Operations: VusionGroup S.A. generates €801.96 million in revenue from the installation and maintenance of electronic shelf labels.

Insider Ownership: 13.5%

Earnings Growth Forecast: 25.2% p.a.

VusionGroup S.A. has demonstrated robust growth, with earnings increasing by a very large percentage over the past year and forecasted to grow at 25.24% annually. Despite a highly volatile share price recently, revenue is expected to outpace the French market significantly, growing at 21.9% per year. Analyst consensus suggests a potential stock price increase of 49.8%. Recent activities include presenting at an international conference and hosting a significant shareholders meeting in Paris, underscoring its active engagement in strategic developments.

Summing It All Up

Click through to start exploring the rest of the 19 Fast Growing Euronext Paris Companies With High Insider Ownership now.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:MEDCL ENXTPA:OVH and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance