Euronext Paris Highlights 3 Growth Companies With Insider Ownership Up To 19%

Amid a generally positive trend in European markets, with France's CAC 40 Index showing notable gains, investors are increasingly attentive to growth opportunities within the region. In this context, companies with high insider ownership can be particularly compelling, as significant insider stakes often align shareholder interests with management, potentially leading to enhanced corporate governance and performance.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 34.2% |

Munic (ENXTPA:ALMUN) | 29.4% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.4% | 72.7% |

Let's dive into some prime choices out of from the screener.

Lectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture sectors across Northern Europe, Southern Europe, the Americas, and Asia Pacific, with a market capitalization of approximately €1.05 billion.

Operations: The company generates revenue across various regions, with €170.33 million from the Americas and €110.28 million from the Asia Pacific.

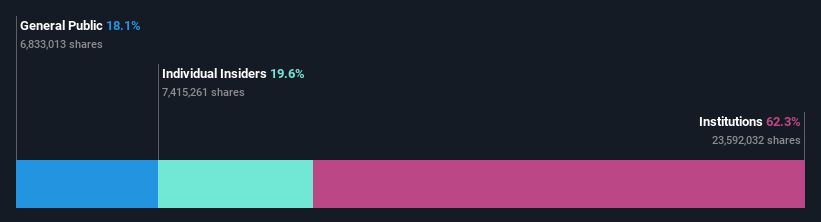

Insider Ownership: 19.6%

Lectra, a France-based company, displays strong growth potential with its earnings forecasted to increase by 28.6% annually. Despite a slight decline in net income and EPS as reported in its recent Q1 2024 results, the company's revenue is rising, outpacing the French market with an expected annual growth of 11.3%. Trading at 35.6% below its estimated fair value and with anticipated substantial earnings growth over the next three years, Lectra appears undervalued relative to peers. However, it's projected Return on Equity is considered low at 13.3%.

Unlock comprehensive insights into our analysis of Lectra stock in this growth report.

The valuation report we've compiled suggests that Lectra's current price could be quite moderate.

MedinCell

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across various therapeutic areas, with a market capitalization of approximately €385.34 million.

Operations: The company generates €11.95 million in revenue from its pharmaceuticals segment.

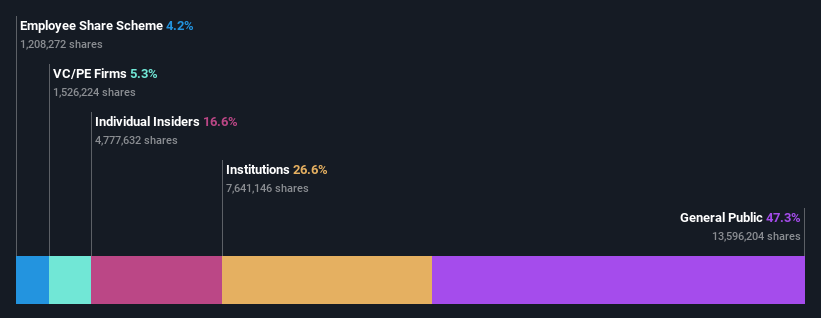

Insider Ownership: 16.4%

MedinCell, a French growth company, is expected to see substantial revenue growth at 43.4% annually, outpacing the national market's 5.8%. Despite recent financial setbacks with a net loss of €25.04 million and declining sales, MedinCell's future appears promising with forecasts indicating profitability within three years. The stock is currently valued at 73.9% below its estimated fair value, highlighting potential for appreciation. However, its cash runway of less than a year raises concerns about short-term financial stability.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.15 billion.

Operations: The company generates revenues from three main segments: public cloud (€140.71 million), private cloud (€514.59 million), and web cloud services (€179.45 million).

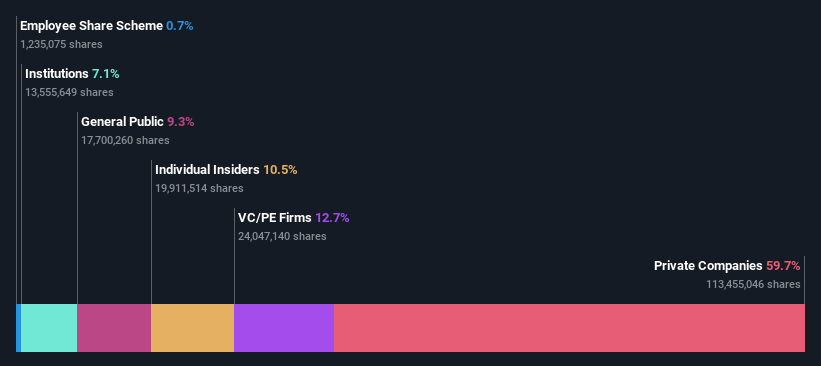

Insider Ownership: 10.5%

OVH Groupe, a French growth company with high insider ownership, is navigating through a transformative phase. While its revenue growth at 10.9% annually is commendable and outpaces the French market's average, its profitability timeline extends over the next three years, reflecting a gradual but positive trajectory. Recent product launches like the ADV-Gen3 Bare Metal servers underscore innovation but come amidst financial challenges marked by a net loss reduction from €26.59 million to €17.24 million year-over-year for H1 2024. Despite these hurdles and a volatile share price, OVH's strategic focus on advanced server technology and international expansion suggests resilience and potential for long-term growth.

Next Steps

Investigate our full lineup of 22 Fast Growing Euronext Paris Companies With High Insider Ownership right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:LSS ENXTPA:MEDCL and ENXTPA:OVH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance