Euronext Paris Highlights 3 Dividend Stocks With Yields Up To 6.2%

Amidst a backdrop of cautious optimism in global markets, France's economy shows resilience, with the CAC 40 Index modestly climbing. This environment underscores the appeal of dividend stocks, which can offer investors both income and potential for capital appreciation in a landscape marked by mixed economic signals.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.02% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.44% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.28% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.33% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.14% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.81% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.91% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.13% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.06% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.17% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

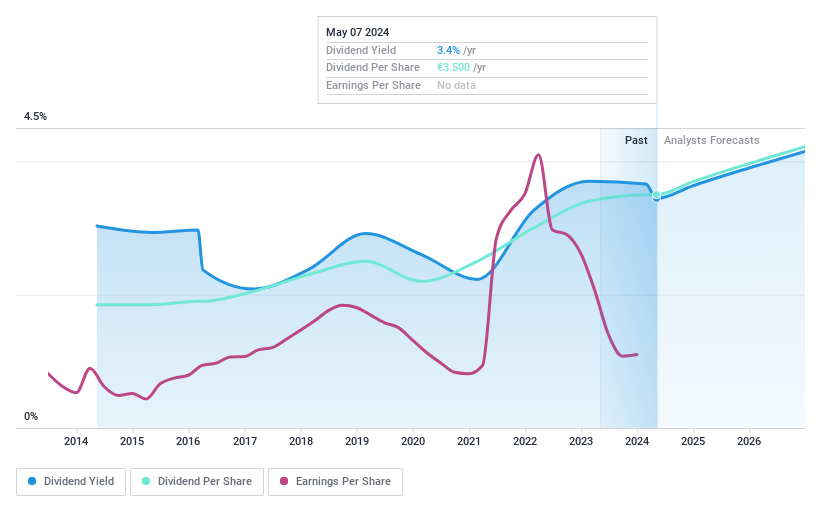

Arkema

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arkema S.A. is a global manufacturer and seller of specialty chemicals and advanced materials, with a market capitalization of approximately €6.70 billion.

Operations: Arkema S.A.'s revenue is primarily generated from Advanced Materials at €3.50 billion, followed by Adhesive Solutions at €2.70 billion, Coating Solutions at €2.36 billion, and Intermediates contributing €737 million.

Dividend Yield: 3.9%

Arkema's dividend yield stands at 3.91%, positioned below the top quartile of French dividend payers at 5.24%. Despite a dip in Q1 earnings to €79 million from €132 million year-over-year, dividends remain sustainable with a payout ratio of 74.9% and cash payout ratio of 45.9%. The firm's decade-long history of reliable and growing dividends underscores its commitment, although recent profitability challenges are noted with profit margins falling to 3.7% from last year’s 6.7%.

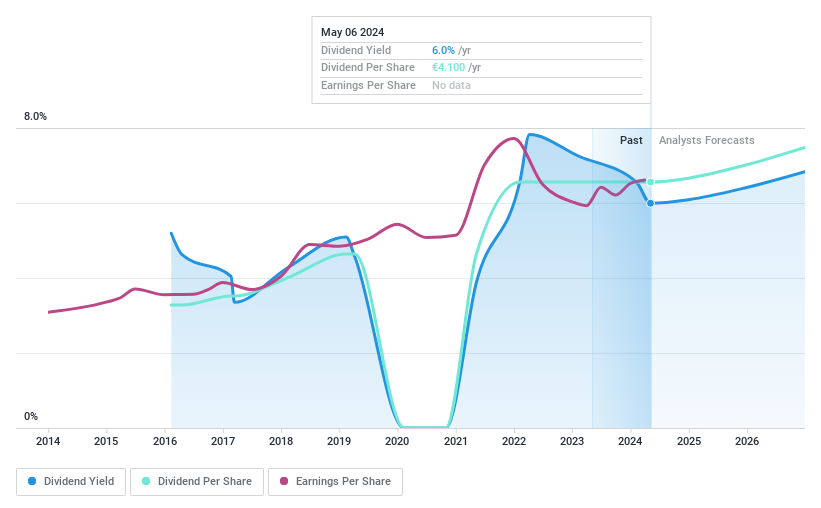

Amundi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market capitalization of approximately €13.41 billion, specializing in asset management services.

Operations: Amundi generates revenue primarily through asset management, totaling approximately €6.03 billion.

Dividend Yield: 6.2%

Amundi S.A. recently affirmed a dividend of €4.10 per share, reflecting a commitment to shareholder returns amid steady financial growth, with Q1 revenue up to €824 million from €794 million year-over-year and net income rising to €318 million. Despite this, the firm's dividend history is marked by instability over its 8-year payout period, with a payout ratio at 71.9% suggesting earnings coverage but an uneven track record in dividend reliability. New leadership under Barry Glavin could signal strategic shifts, potentially impacting future dividends and investment strategies.

Click here and access our complete dividend analysis report to understand the dynamics of Amundi.

Our valuation report here indicates Amundi may be undervalued.

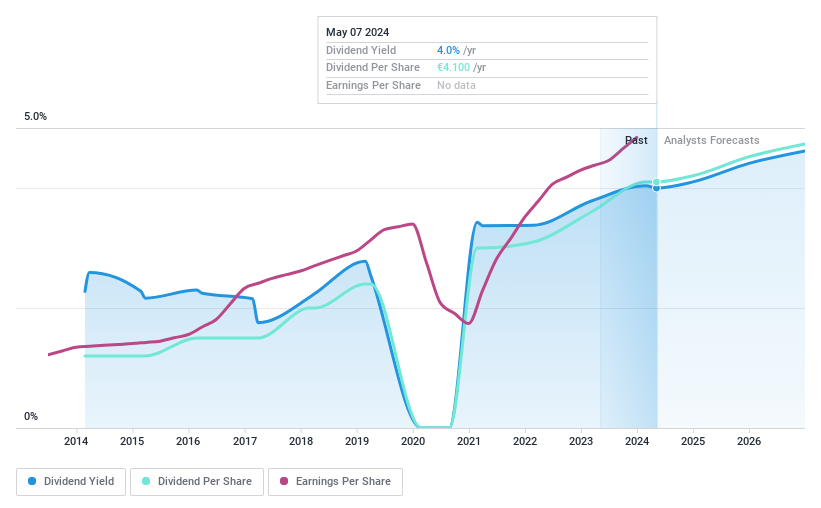

Eiffage

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in various sectors including construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions both in France and internationally with a market capitalization of approximately €9.36 billion.

Operations: Eiffage SA generates revenue through its diverse operations, with €8.43 billion from Infrastructures, €5.99 billion from Energy Systems, €4.29 billion from Construction, and €3.90 billion from Concessions.

Dividend Yield: 4.1%

Eiffage's dividend sustainability faces challenges despite a covered payout ratio of 38.5% and cash payout ratio of 15.6%. Earnings have grown by 13.1% over the past year, with projections set at a 5.44% annual increase. However, dividends have shown volatility and unreliability over the last decade, with current yields at 4.12%, below the French market's top quartile of 5.24%. Recently, Eiffage partnered in a €66 million project for flood prevention infrastructure in Copenhagen, indicating strategic expansion but also significant debt levels that may impact future financial flexibility.

Make It Happen

Embark on your investment journey to our 33 Top Euronext Paris Dividend Stocks selection here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AKE ENXTPA:AMUN and ENXTPA:FGR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance