Euronext Amsterdam Showcases Three Prime Dividend Stocks

Amid a backdrop of economic resilience and cautious optimism in European markets, the Netherlands continues to present intriguing opportunities for dividend-seeking investors. As global uncertainties persist, the stability and potential for steady income from Euronext Amsterdam's prime dividend stocks become increasingly attractive.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.76% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.88% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.37% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.70% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.23% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.68% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

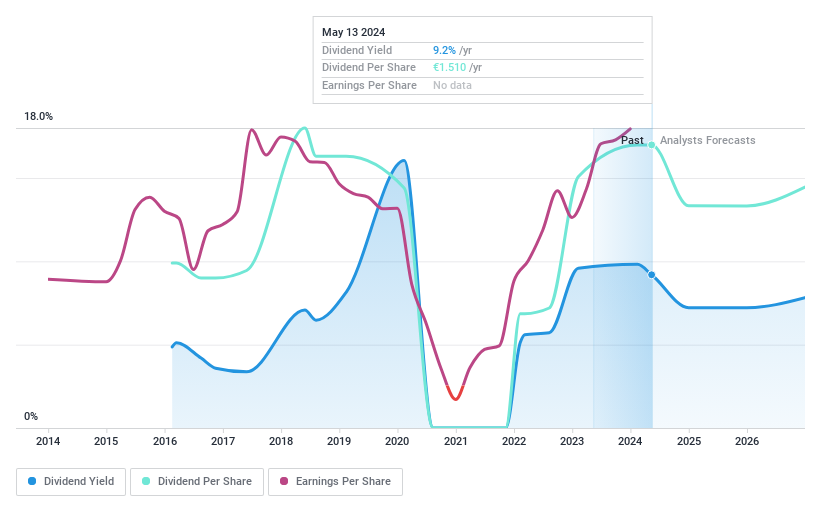

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of approximately €12.74 billion.

Operations: ABN AMRO Bank N.V. generates revenue primarily through three segments: Corporate Banking (€3.50 billion), Wealth Management (€1.59 billion), and Personal & Business Banking (€4.07 billion).

Dividend Yield: 9.9%

ABN AMRO Bank's dividend sustainability is currently supported by a payout ratio of 47.9%, with expectations to maintain similar coverage in three years. Despite this, the bank's dividends have shown volatility over the past eight years, indicating some level of unpredictability in its payments. Recent strategic expansions into Germany through acquisitions, such as Hauck Aufhaeuser Lampe for €672 million and potential acquisition of HSBC's German private bank, are set to increase assets under management significantly, which could impact future financial stability and dividend policies.

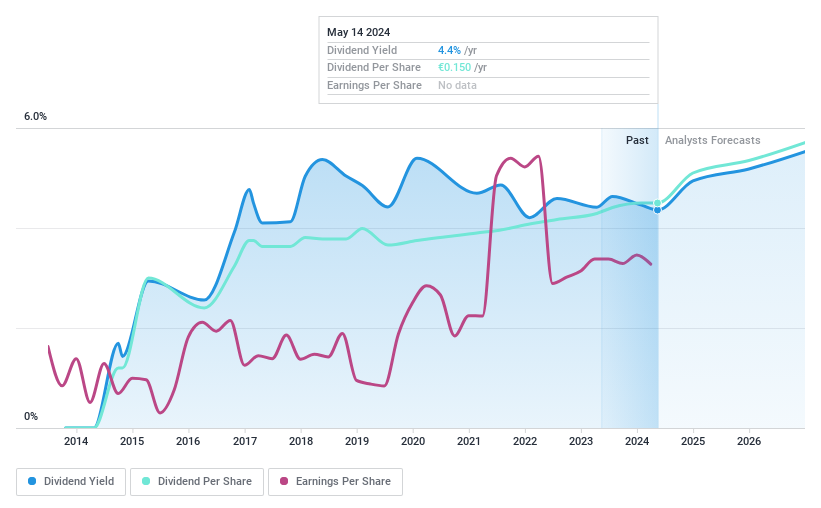

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. operates as a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €13.95 billion.

Operations: Koninklijke KPN N.V. generates revenue through three primary segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.2%

Koninklijke KPN's recent strategic moves, including a €498.41 million fixed-income offering and the creation of TowerCo with Dutch pension fund ABP, underscore its efforts to enhance infrastructure and shareholder value. Despite these initiatives, KPN's dividend yield of 4.23% trails behind top Dutch dividend payers. The company maintains a payout ratio of 78.4%, supported by earnings and cash flows (cash payout ratio: 59.6%), yet its dividend history shows instability over the past decade, reflecting some risk in consistency of returns to shareholders.

Navigate through the intricacies of Koninklijke KPN with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Koninklijke KPN's share price might be too pessimistic.

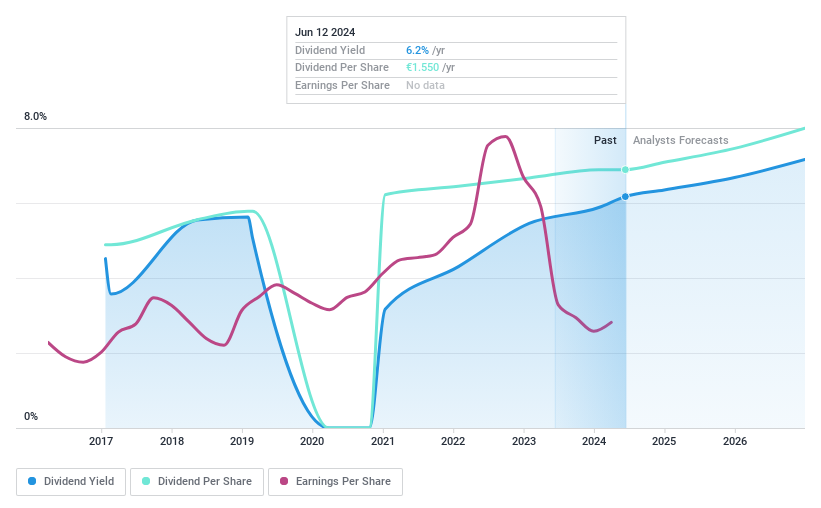

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. operates globally, offering a range of lighting products, systems, and services across Europe, the Americas, and other regions, with a market capitalization of approximately €2.92 billion.

Operations: Signify N.V. generates revenue from its conventional segment, totaling €0.56 billion.

Dividend Yield: 6.7%

Signify's recent share buyback, completed for €11.9 million, aligns with its strategy to manage share dilution from employee incentive plans. Despite a robust dividend yield of 6.7%, among the top 25% in the Dutch market, Signify's dividend history is marked by volatility over its 7-year payout period. Financially, Q1 sales dropped to €1.47 billion from €1.68 billion year-on-year, but net income improved to €44 million from €25 million, reflecting some resilience amidst challenges.

Click to explore a detailed breakdown of our findings in Signify's dividend report.

The valuation report we've compiled suggests that Signify's current price could be quite moderate.

Seize The Opportunity

Access the full spectrum of 6 Top Euronext Amsterdam Dividend Stocks by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ABNENXTAM:KPN and ENXTAM:LIGHT

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance