Euronext Amsterdam Showcases 3 Dividend Stocks With Yields Up To 6.4%

As global markets navigate through fluctuating economic signals, the Euronext Amsterdam stands out with its offering of robust dividend stocks, appealing to those seeking steady income in uncertain times. In this environment, understanding the characteristics that define a strong dividend stock—such as stable earnings, a solid track record of payouts, and resilience in various market conditions—is more crucial than ever.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.45% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.66% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.37% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.31% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.24% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.15% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

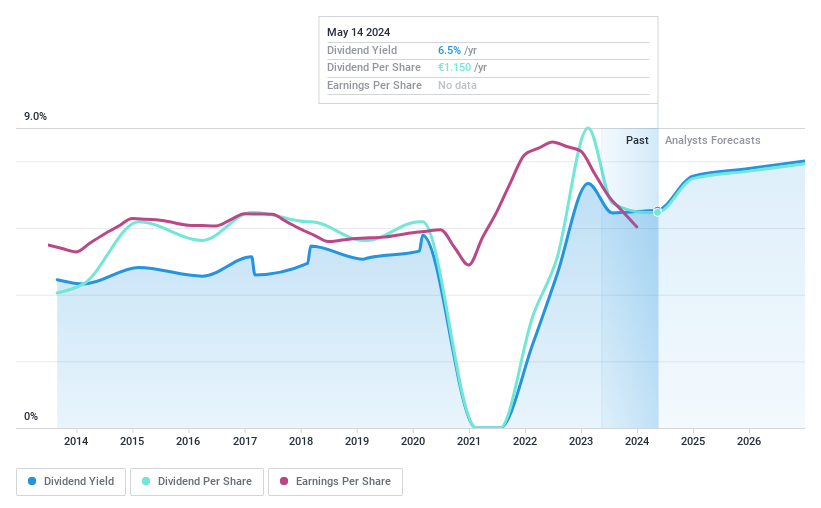

Acomo

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acomo N.V. operates in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients for the food and beverage industry across multiple regions including the Netherlands, other European countries, and North America with a market cap of €528.38 million.

Operations: Acomo N.V. generates revenue primarily through its segments in Edible Seeds (€257.29 million), Spices and Nuts (€429.96 million), Organic Ingredients (€436.38 million), Tea (€120.62 million), and Food Solutions (€24.07 million).

Dividend Yield: 6.4%

ACOMO has demonstrated a capacity to grow its dividend over the past decade, currently offering a yield of 6.45%, which ranks in the top 25% within the Dutch market. Despite this, its dividend history shows volatility with significant annual fluctuations exceeding 20%. Financially, ACOMO trades at a substantial discount, estimated at 52.1% below fair value, and maintains a sustainable cash payout ratio of 26.1%. However, it is burdened by high debt levels and an earnings payout ratio of 85.7%, suggesting potential pressure on future dividend sustainability if earnings falter.

Dive into the specifics of Acomo here with our thorough dividend report.

Our valuation report here indicates Acomo may be undervalued.

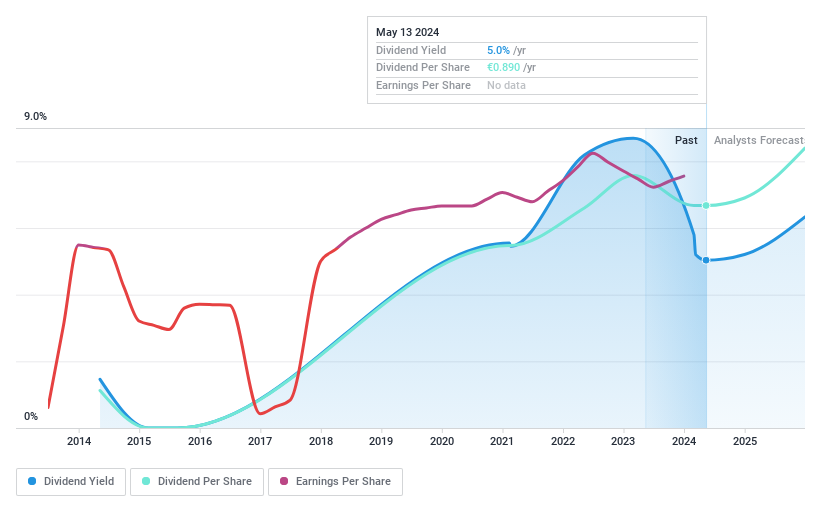

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company involved in property development, construction, and infrastructure projects both domestically and internationally, with a market capitalization of approximately €563.34 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology segments (€1.08 billion).

Dividend Yield: 4.2%

Koninklijke Heijmans has seen its dividend increase over the last decade but faces challenges with volatility, including a significant annual drop exceeding 20%. Its current dividend yield of 4.24% is below the Dutch market's top quartile. Earnings have expanded by 19.4% annually over five years, and forecasts suggest a future growth rate of 10.21% per year. Dividends are reasonably covered by earnings and cash flows, with payout ratios at 37.1% and 59%, respectively, though recent shareholder dilution raises concerns about future payouts.

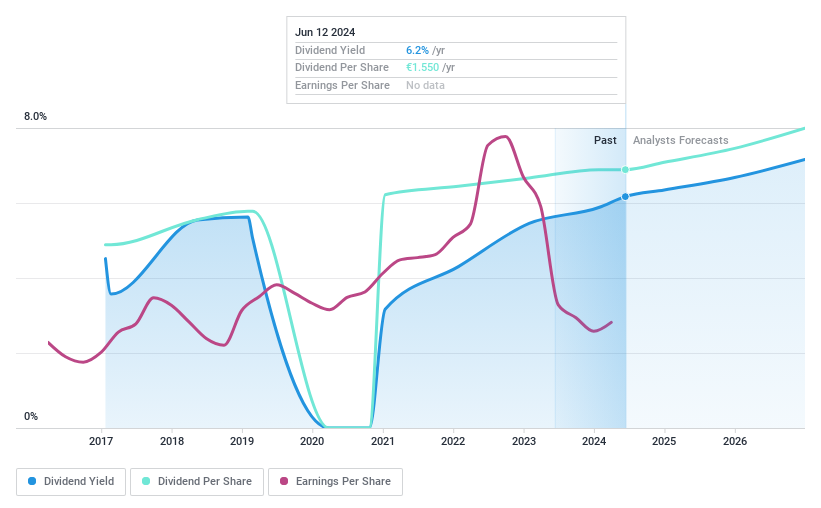

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. operates globally, offering a range of lighting products, systems, and services with a market capitalization of approximately €3.07 billion.

Operations: Signify N.V. generates revenue primarily from its conventional lighting products, totaling €0.56 billion.

Dividend Yield: 6.4%

Signify's dividend yield of 6.37% ranks in the top 25% in the Dutch market, though its history of dividend payments is marked by instability over its short 7-year span with significant fluctuations. Despite this, dividends are well-supported by earnings and cash flows with payout ratios at 88.1% and 32.4%, respectively. Recent strategic moves include a partnership with Mercedes-AMG PETRONAS F1 Team to enhance sustainability and technological innovation, alongside completing a share buyback for €11.9 million to cover employee share plans.

Taking Advantage

Reveal the 6 hidden gems among our Top Euronext Amsterdam Dividend Stocks screener with a single click here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ACOMO ENXTAM:HEIJM and ENXTAM:LIGHT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance