Eugene TechnologyLtd And Two More KRX Stocks Considered Below Estimated Value

In the past year, South Korea's market has seen a modest increase of 5.0%, with expectations for annual earnings growth set at an impressive 30% in the near future. In such an environment, identifying stocks that are priced below their estimated value could offer investors potential opportunities for growth.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Caregen (KOSDAQ:A214370) | ₩22450.00 | ₩44549.16 | 49.6% |

Anapass (KOSDAQ:A123860) | ₩25250.00 | ₩48541.20 | 48% |

KidariStudio (KOSE:A020120) | ₩4080.00 | ₩7404.33 | 44.9% |

Global Tax Free (KOSDAQ:A204620) | ₩3565.00 | ₩6215.37 | 42.6% |

Revu (KOSDAQ:A443250) | ₩10990.00 | ₩20987.95 | 47.6% |

Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

SK Biopharmaceuticals (KOSE:A326030) | ₩77500.00 | ₩149728.31 | 48.2% |

Genomictree (KOSDAQ:A228760) | ₩23400.00 | ₩39870.28 | 41.3% |

Ray (KOSDAQ:A228670) | ₩12010.00 | ₩20596.36 | 41.7% |

NEXON Games (KOSDAQ:A225570) | ₩17900.00 | ₩28212.32 | 36.6% |

Here's a peek at a few of the choices from the screener

Eugene TechnologyLtd

Overview: Eugene Technology Co., Ltd. specializes in manufacturing and selling semiconductor equipment and parts, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.06 trillion.

Operations: The company generates revenue primarily through two segments: semiconductor equipment, which brings in ₩257.39 billion, and industrial gas for semiconductors, contributing ₩10.01 billion.

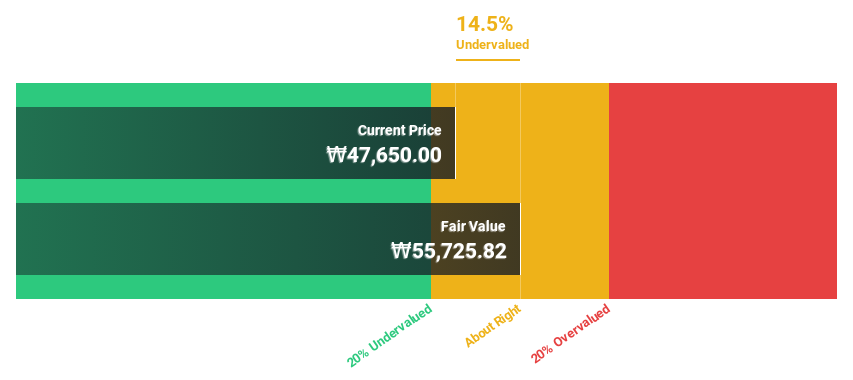

Estimated Discount To Fair Value: 14.5%

Eugene TechnologyLtd, currently trading at ₩47,650, is valued below our fair value estimate of ₩55,725.82. Despite a recent dip in net income and earnings per share as reported in its Q1 2024 results, the company is poised for robust growth with revenue and earnings expected to increase by 21% and 47.7% per year respectively. However, its return on equity is anticipated to remain low at 16.5%, and the stock has experienced high volatility over the past three months.

Our growth report here indicates Eugene TechnologyLtd may be poised for an improving outlook.

Dive into the specifics of Eugene TechnologyLtd here with our thorough financial health report.

ISU Petasys

Overview: ISU Petasys Co., Ltd. is a global manufacturer of printed circuit boards (PCBs), with a market capitalization of approximately ₩3.64 billion.

Operations: The company's operations focus on the global manufacture and sale of printed circuit boards (PCBs).

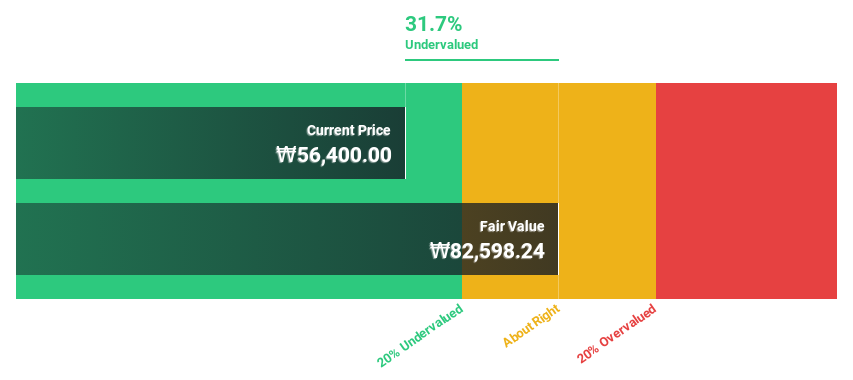

Estimated Discount To Fair Value: 35%

ISU Petasys, priced at ₩57,400, is significantly undervalued against our fair value estimate of ₩90,930.23. The company's revenue and earnings are expected to grow by 16.2% and 41.5% per year respectively, outpacing the South Korean market averages. Despite this growth potential, concerns include a high volatility in share price and insufficient debt coverage by operating cash flow. Additionally, profit margins have declined from last year's 15.1% to 7%.

Cosmax

Overview: Cosmax, Inc. is a company engaged in the research, development, production, and manufacturing of cosmetic and health function food products both in Korea and globally, with a market capitalization of approximately ₩2.03 trillion.

Operations: The company operates in the cosmetics and health function food sectors, generating revenue internationally.

Estimated Discount To Fair Value: 28.2%

Cosmax, with a current price of ₩179,000, is valued below our fair value estimate of ₩250,409.13, suggesting it is undervalued. Its earnings have surged by 467.9% over the past year and are forecast to grow by 26.74% annually. Despite its robust revenue growth projection of 13.1% per year—surpassing the Korean market average—the company's earnings growth lags behind the market rate of 29.6%. Additionally, a high level of debt could pose financial risks moving forward.

Make It Happen

Click through to start exploring the rest of the 34 Undervalued KRX Stocks Based On Cash Flows now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A084370 KOSE:A007660 and KOSE:A192820.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance