With EPS Growth And More, Westinghouse Air Brake Technologies (NYSE:WAB) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Westinghouse Air Brake Technologies (NYSE:WAB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Westinghouse Air Brake Technologies with the means to add long-term value to shareholders.

View our latest analysis for Westinghouse Air Brake Technologies

Westinghouse Air Brake Technologies' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Westinghouse Air Brake Technologies has managed to grow EPS by 34% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

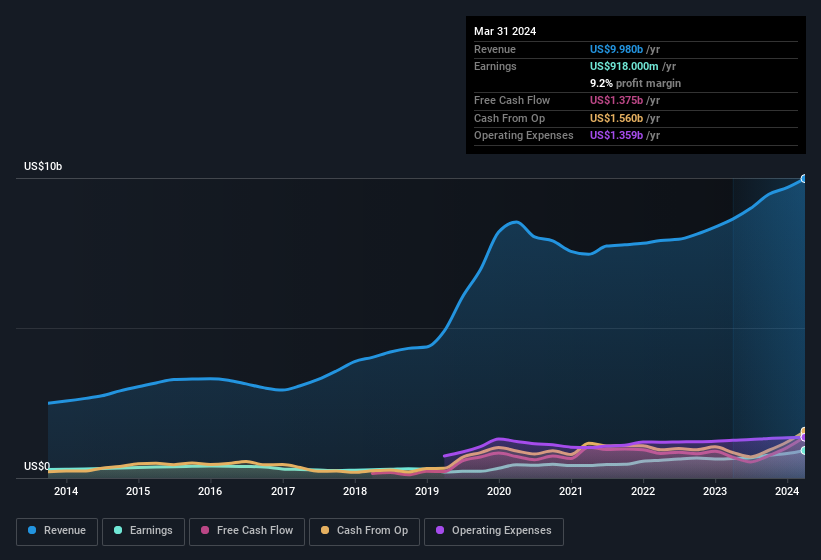

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Westinghouse Air Brake Technologies maintained stable EBIT margins over the last year, all while growing revenue 16% to US$10.0b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Westinghouse Air Brake Technologies?

Are Westinghouse Air Brake Technologies Insiders Aligned With All Shareholders?

Since Westinghouse Air Brake Technologies has a market capitalisation of US$28b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. We note that their impressive stake in the company is worth US$186m. We note that this amounts to 0.7% of the company, which may be small owing to the sheer size of Westinghouse Air Brake Technologies but it's still worth mentioning. This should still be a great incentive for management to maximise shareholder value.

Does Westinghouse Air Brake Technologies Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Westinghouse Air Brake Technologies' strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Still, you should learn about the 1 warning sign we've spotted with Westinghouse Air Brake Technologies.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance