With EPS Growth And More, Fugro (AMS:FUR) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Fugro (AMS:FUR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Fugro with the means to add long-term value to shareholders.

Check out our latest analysis for Fugro

How Fast Is Fugro Growing Its Earnings Per Share?

Over the last three years, Fugro has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Fugro's EPS skyrocketed from €0.80 to €1.02, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 27%.

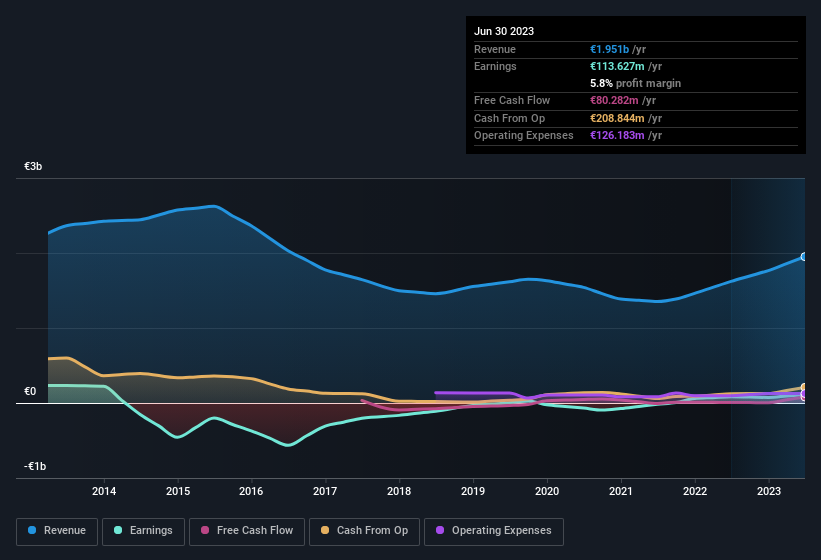

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Fugro shareholders is that EBIT margins have grown from 4.8% to 7.8% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Fugro?

Are Fugro Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Fugro insiders did net €94k selling stock over the last year, they invested €606k, a much higher figure. This overall confidence in the company at current the valuation signals their optimism. Zooming in, we can see that the biggest insider purchase was by Chairman of Management Board & CEO Mark Rembold Heine for €123k worth of shares, at about €12.28 per share.

Along with the insider buying, another encouraging sign for Fugro is that insiders, as a group, have a considerable shareholding. Indeed, they hold €36m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Fugro Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Fugro's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. Now, you could try to make up your mind on Fugro by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Fugro, you'll probably love this curated collection of companies in NL that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance