Emerson (EMR) Reportedly Nearing $8B Buyout Deal With NI

Emerson Electric Co. EMR is in advanced talks to acquire National Instruments Corp or NI (NATI) for about $8 billion or $60 per share, Reuters reported.

Headquartered in Austin, TX, National Instruments produces automated test equipment and virtual instrumentation software.

A deal between the two companies could be announced this week itself, the report stated. However, there remains uncertainty about the talks falling apart in the eleventh hour.

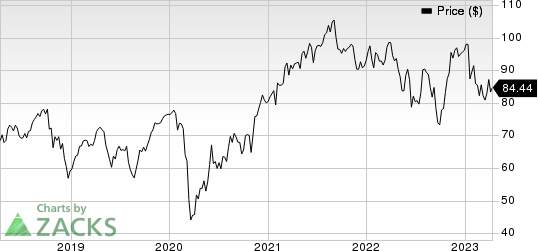

Emerson Electric Co. Price

Emerson Electric Co. price | Emerson Electric Co. Quote

News of Emerson’s interest in acquiring NI first surfaced in January. Back then, EMR revealed that a proposal for a $7.6 billion (or $53 per share) deal was submitted to NI on Nov 3, 2022, and was an improvement over the initial offer of $48 per share made on May 25, 2022.

In a detailed statement, EMR, carrying a Zacks Rank #3 (Hold), confided that it had been trying to engage with NI privately over a deal since May 16, 2022, and how the latter resisted any meaningful discussions for months. As a matter of fact, in January, NATI, carrying a Zacks Rank #3, announced a strategic review process to explore acquisition interests from other companies.

Emerson’s move to acquire NI is aligned with its focus on global automation to drive growth and profitability. In an attempt to transform into a global automation company, EMR has lately divested several non-core businesses. In November 2022, the company divested its InSinkErator business, a food waste disposers and instant hot water dispensers manufacturer, for $3 billion. In October 2022, EMR sold a majority stake in its Climate Technologies business to private equity funds managed by Blackstone in a $14 billion deal.

Key Picks

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Deere & Company DE currently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 4.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Deere has an estimated earnings growth rate of 31% for the current fiscal year. The stock has gained around 5% in the past six months.

Ingersoll Rand IR presently flaunts a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 8.5%, on average.

Ingersoll Rand has an estimated earnings growth rate of 7% for the current year. The stock has rallied 23% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance