Emeren (SOL), Matrix Renewables to Co-Develop Storage Facility

Emeren Group Ltd. SOL recently entered into a partnership with Matrix Renewables, a global platform for renewable energy, to build a portfolio of Battery Energy Storage Systems (BESS), with a generation capacity of up to 1.5 gigawatts (GW), in Italy. The joint venture, signed under a proprietary Development Service Agreement, is expected to open a new capacity market auction in late 2023, bolstering Italy’s solar storage output.

Emeren’s Prospects in the European Market

Europe is an important market for Emeren’s expansion. Notably, the company derived 73% of its revenues from the continent in the first quarter of 2023. As of Mar 31, 2023, Emeren had mid-to-late-stage projects of 2,272 megawatts (MW) in Europe and operated 60 MW of Independent Power Producers (IPP) projects there.

In September 2022, Emeren acquired a solar farm named Branston with a generation capacity of 50 megawatt-peak, further boosting its footprint in the European solar market.

SOL remains engaged in project developments across Poland, Spain, France, Germany, the United Kingdom and Italy. The latest collaboration with Matrix Renewables is an example of that. The company plans to build a total of 100 MW of IPP assets in Europe by the end of 2023.

Per a report from McKinsey & Company, published in December 2022, as part of its “EU solar energy strategy,” the region has announced a 750 gigawatt-direct current target of installed solar-PV capacity by 2030. This reflects a significant improvement from 224 GW of installed capacity in 2022. This entails significant growth opportunities for companies like SOL, which is a renowned solar project developer.

Peer Moves

To reap the benefits of the growing European solar market, solar players other than SOL that are also expanding their footprint in the region are:

SolarEdge Technologies SEDG: The company recently unveiled two offerings from its product portfolio at Intersolar Europe – a Commercial Storage System and an Electric Vehicle charger – thereby strengthening its position in Europe’s solar market. The highly-efficient DC-coupled CSS provides 58 kilowatt-hours of battery capacity, while its Bi-Directional DC-Coupled EV Charger has been tailored to provide charging of up to 24 kilowatts.

SolarEdge has a long-term (three-to-five years) earnings growth rate of 33.4%. The Zacks Consensus Estimate for SEDG’s 2023 sales implies an increase of 32.6% over 2022’s reported figure.

Canadian Solar CSIQ: At the beginning of June 2023, the company announced that its subsidiary, CSI Energy Storage, has entered into an agreement to deliver 49.5MW/99MWh of turnkey battery energy storage solutions to Cero Generation and Enso Energy (Enso). The BESS, which is co-located with the Larks Green solar PV project in South Gloucestershire, the United Kingdom, is the country’s first transmission-connected solar farm.

The Zacks Consensus Estimate for Canadian Solar’s 2023 earnings per share suggests an increase of 67.4% from 2022’s reported figure. The Zacks Consensus Estimate for CSIQ’s 2023 sales implies a rise of 24.4% over 2022’s reported figure.

Enphase Energy ENPH: In May 2023, Enphase announced that it has expanded its relationship with Natec to distribute its IQ Microinverters and IQ Batteries across Europe. Enphase began production shipments of microinverters from its contract manufacturer Flex in Romania earlier this year, another step toward expanding its European market.

ENPH has a long-term earnings growth rate of 24.7%. The Zacks Consensus Estimate for ENPH’s 2023 sales indicates an increase of 33.1% over 2022’s reported figure.

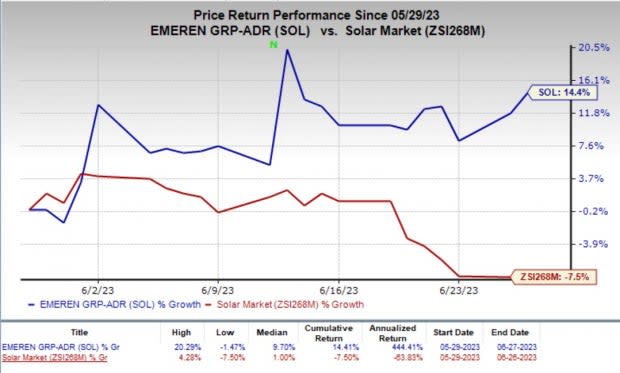

Price Performance

Over the past month, shares of SOL have gained 14.4% against the industry’s 7.5% decline.

Image Source: Zacks Investment Research

Zacks Rank

Emeren currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emeren Group Ltd. Sponsored ADR (SOL) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance