EmbedWay Technologies (Shanghai) And Two More High Insider Ownership Growth Stocks On Chinese Exchange

In recent trading sessions, Chinese equities have faced downward pressure, with both the Shanghai Composite and CSI 300 indices recording slight declines amid concerns about economic slowdown and subdued industrial profits. This cautious market backdrop makes it particularly pertinent for investors to consider companies like EmbedWay Technologies (Shanghai), where high insider ownership might signal strong confidence in long-term growth prospects from those most familiar with the company's inner workings.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Let's uncover some gems from our specialized screener.

EmbedWay Technologies (Shanghai)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EmbedWay Technologies (Shanghai) Corporation, a network visibility infrastructure and intelligent system platform vendor in China, has a market capitalization of approximately CN¥7.85 billion.

Operations: The company generates revenue primarily from its computer, communication, and other electronic equipment manufacturing segment, totaling CN¥865.61 million.

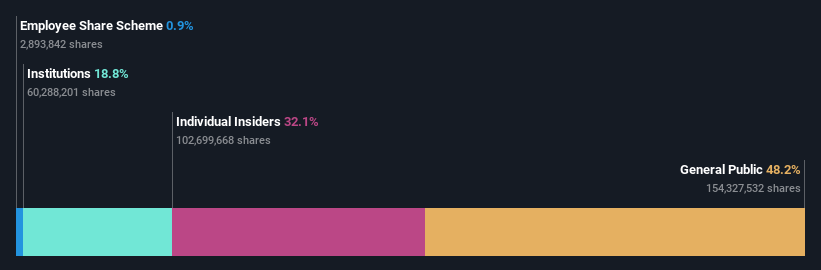

Insider Ownership: 32.1%

Revenue Growth Forecast: 22.9% p.a.

EmbedWay Technologies (Shanghai) exhibits strong growth potential with earnings and revenue forecasted to outpace the Chinese market significantly, growing at 33.9% and 22.9% per year respectively. Despite a robust past year performance with earnings up by 39.9%, the company's Return on Equity is expected to remain low at 13%. Recent financials show a substantial increase in quarterly sales and net income, highlighting its upward trajectory amidst no significant insider trading activity reported in the last three months.

Zhongman Petroleum and Natural Gas GroupLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhongman Petroleum and Natural Gas Group Corp., Ltd. is an oil and gas company based in China, specializing in drilling and completion engineering services as well as petroleum equipment manufacturing, with a market capitalization of approximately CN¥9.49 billion.

Operations: The company primarily generates revenue through drilling and completion engineering services alongside petroleum equipment manufacturing.

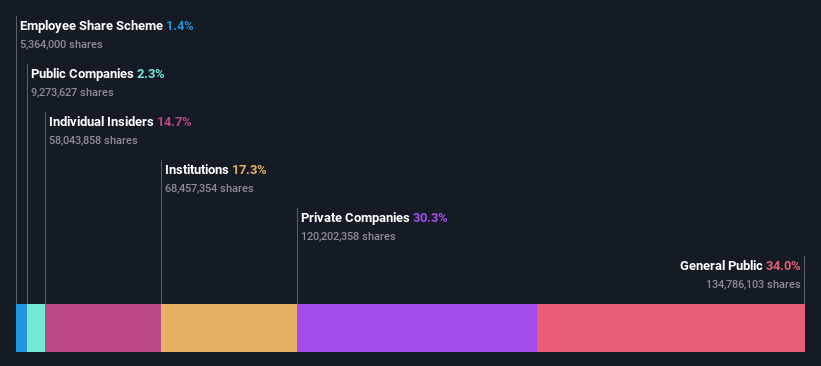

Insider Ownership: 12.6%

Revenue Growth Forecast: 24% p.a.

Zhongman Petroleum and Natural Gas GroupLtd, a growth-oriented company with high insider ownership in China, is navigating through a complex financial landscape. Recent transactions include a significant stake acquisition by TTCO Trust for approximately CNY 430 million, reflecting confidence from institutional investors. Despite this, the company's high level of debt poses challenges. However, Zhongman's revenue and earnings are expected to grow at 24% and 28.6% per year respectively, outpacing the Chinese market averages of 13.7% and 22.3%. This robust growth projection is tempered by concerns over its dividend coverage and valuation discrepancies indicating potential undervaluation at 65.6% below fair value estimates.

Zhejiang Xinhua ChemicalLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Xinhua Chemical Co., Ltd is a company based in China that manufactures and trades a variety of chemicals and chemical raw materials, both domestically and internationally, with a market capitalization of approximately CN¥4.45 billion.

Operations: The company operates in the production and international trade of a diverse range of chemicals and chemical raw materials.

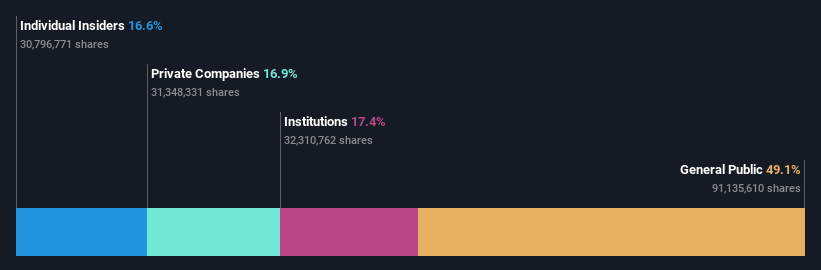

Insider Ownership: 16.6%

Revenue Growth Forecast: 18.6% p.a.

Zhejiang Xinhua Chemical Ltd, a Chinese growth company with high insider ownership, is showing promising financial trends despite some challenges. Recently reported first-quarter earnings showed a slight dip in net income to CNY 76.12 million from CNY 78.33 million year-over-year, amidst an increase in sales to CNY 743.8 million from CNY 662.06 million. The company's earnings are expected to grow by 26.7% annually, outperforming the broader Chinese market's growth forecast of 22.3%. However, its dividend coverage remains weak and its revenue growth rate of 18.6% yearly lags behind the desired benchmark of over 20%, though it still exceeds the market average of 13.7%.

Turning Ideas Into Actions

Dive into all 365 of the Fast Growing Chinese Companies With High Insider Ownership we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603496 SHSE:603619SHSE:603867 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance