Eli Lilly: The Party Is Over

Eli Lilly and Co. (NYSE:LLY) is an American pharmaceutical company that is one of the leaders in the global diabetes drugs market and is also beginning to take a leading position in the treatment of patients with various types of cancer and autoimmune disorders.

Thesis

Since early March, the company's share price has risen more than 90% despite increased competition in the global autoimmune disease therapeutics market, driven by label expansions of AbbVie's (NYSE:ABBV) Skyrizi, Johnson & Johnson's (NYSE:JNJ) Tremfya and UCB's Bimzelx and the negative impact of the Inflation Reduction Act, which would require patients on Medicare to pay no more than $35 for a month's supply of insulin.

Source: TradingView

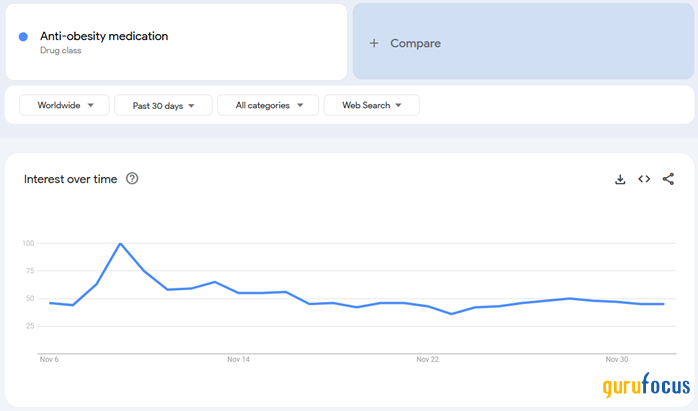

The key reason for the significant increase in interest among investors and traders in Eli Lilly is the hype around medicines aimed at combating the growing epidemic of obesity, which is one of the root causes of health problems for most people. However, public interest in anti-obesity drugs continues to decline, partly due to their high prices and side effects that can lead to a significant deterioration in people's quality of life.

Source: Google Trends

Meanwhile, the company's crown jewel is Mounjaro (tirzepatide), whose mechanism of action is based on the activation of GIP and GLP-1 receptors, which ultimately helps improve insulin secretion and also reduces glucagon levels. The drug received its first Food and Drug Administration approval in May 2022 to treat adults with type 2 diabetes, which affects tens of millions of people in the United States. Moreover, on Nov. 8, Zepbound (tirzepatide) became the first and only dual GIP and GLP-1 receptor agonist approved by the regulatory authority for the treatment of people with obesity.

Based on Phase 3 clinical results, Mounjaro is currently one of the most effective drugs in reducing weight and HbA1c levels, enabling it to capture a significant share in the global glucagon-like peptide 1 (GLP-1) market. But at the same time, Eli Lilly's management will strive to transfer patients to Mounjaro from its other drugs, negatively affecting their sales.

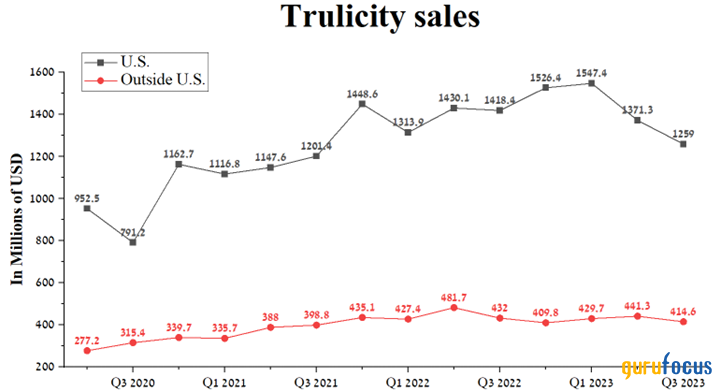

One such drug is Trulicity (dulaglutide), whose compound patent expires in 2027. The FDA has approved this medicine for the treatment of patients with type 2 diabetes and the reduction of major adverse cardiovascular events in certain adults with type 2 diabetes. Its sales were about $1.67 billion in the third quarter of 2023, down 9.6% from the prior year.

Author's elaboration, based on quarterly securities reports.

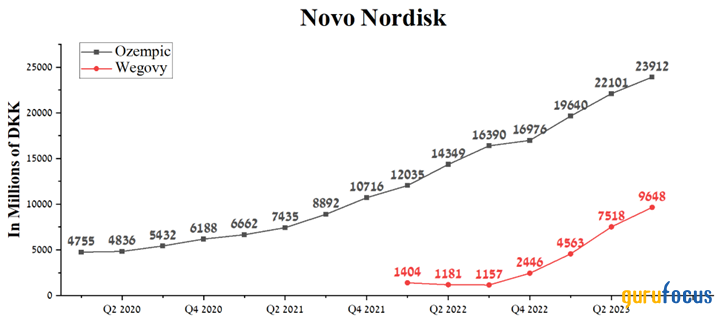

In addition, we would like to note that sales of Novo Nordisk's (NYSE:NVO) Ozempic (semaglutide), Mounjaro's key competitor, continue to grow quarterly and yearly, indicating that many doctors prefer the Danish company's product, even though its effectiveness may be lower. Sales of Ozempic amounted to 23.9 billion Danish krone ($3.45 billion), an increase of 45.9% compared to the previous year. At the same time, sales of Wegovy (semaglutide), a weight loss medication, amounted to 9.65 billion krone for the three months ended Sept. 30, an increase of 733.9% compared to the third quarter of 2022.

Author's elaboration, based on quarterly securities reports

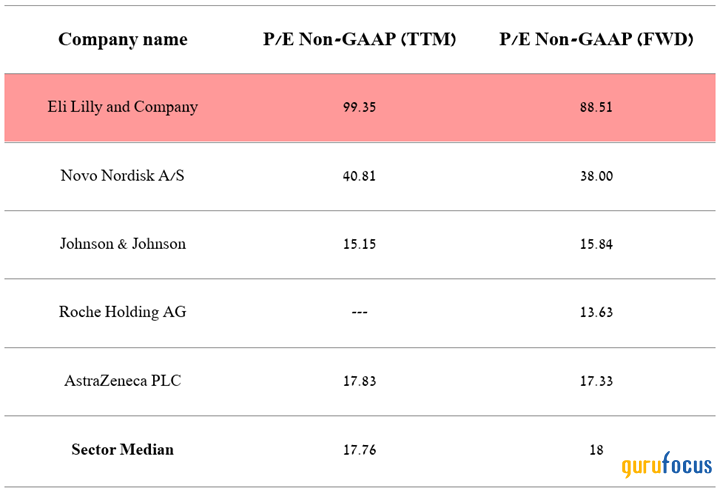

On the other hand, even though the Danish company's revenue growth rate is similar to the growth rate of Eli Lilly's revenue year on year, they have radically different multipliers. So Eli Lilly's forward non-GAAP price-earnings ratio is 88.51, which is 391.65% higher than the sector average and 177.48% higher than the average for the last five years, which is one of the factors indicating excessive optimism of Mr. Market during the period when the hype around anti-obesity drugs began to decline.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

We initiate our coverage of Eli Lilly with an "underperform" rating for the next 12 months.

The financial position of Eli Lilly and its prospects

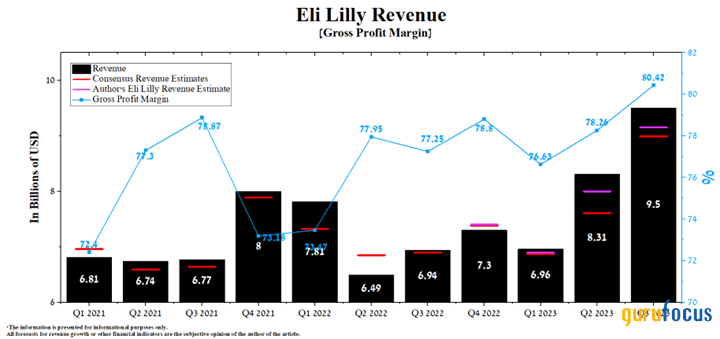

Eli Lilly's revenue for the third quarter was $9.5 billion, exceeding our expectations by about $350 million, and, more importantly, increasing by 36.9% year over year.

The company's forward non-GAAP price-sales ratio is 15.74, which is 318.46% higher than the sector average and 93.43% higher than the average over the past five years. The key reasons for the considerable increase in this multiple are the significant growth in Mounjaro sales and the possible regulatory approval of donanemab for the treatment of patients with Alzheimer's disease.

Eli Lilly is anticipated to release financial results for the fourth quarter of 2023 on Feb. 6, 2024. According to Seeking Alpha, the company's revenue for the quarter is expected to be $8.6 billion to $9.36 billion, slightly less than analysts' expectations for the previous quarter.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

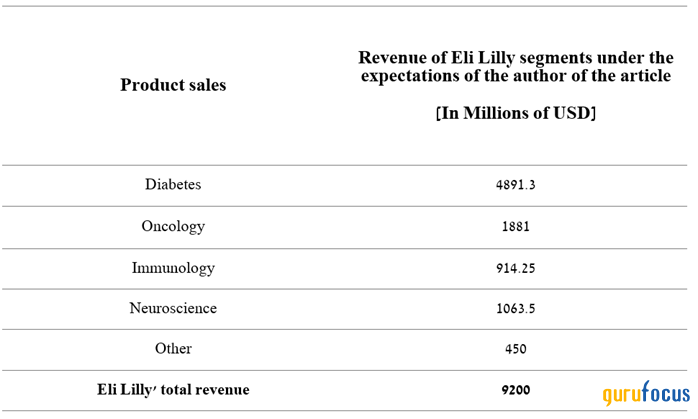

In contrast, according to our model, Eli Lilly's revenue will be slightly above the median of this range and reach $9.2 billion. Key contributors to the company's significant quarter-on-quarter revenue growth will be its diabetes and oncology products.

Created by author.

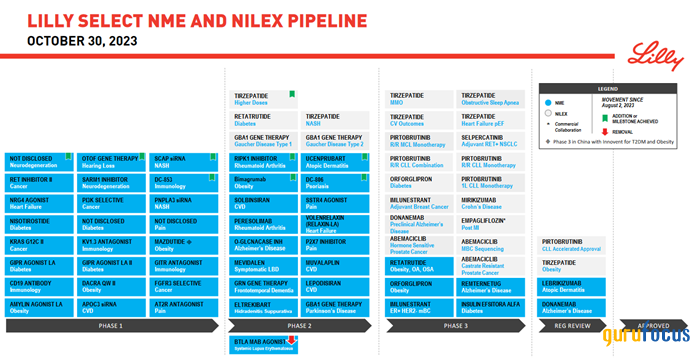

At the same time, we expect the company's operating income margin to reach 33.2% in 2023. Simultaneously, this financial metric will increase to 35.6% by 2024 mainly due to lower inflation in the U.S. and Europe, the strengthening of the euro against the U.S. dollar, increased demand for its key medicines such as Mounjaro, Taltz and Jardiance and the expansion of its portfolio of product candidates.

Source: Eli Lilly and Company

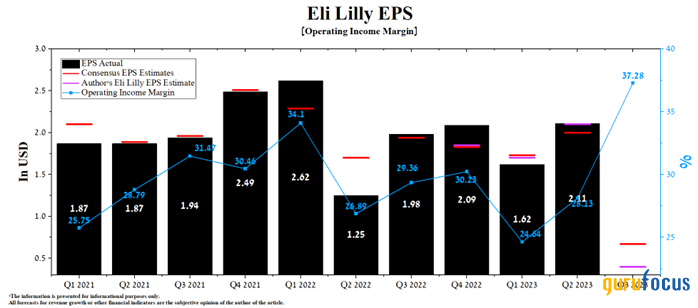

Eli Lilly's third-quarter non-GAAP earnings of 10 cents per share were down 95% year over year, primarily due to the acquisitions of Emergence Therapeutics, DICE Therapeutics and Versanis Bio. Moreover, the company's management lowered its full-year 2023 earnings per share guidance to a range of $5.95 to $6.15, which is also one of the factors why we initiated our coverage of the stock with an outperform rating for the next 12 months.

According to Seeking Alpha, the company's earnings per share in the fourth quarter are expected to be $2.65 to $2.90, which is 33.78% more than the previous year. Nevertheless, we expect its earnings to be slightly below the median of this range and reach $2.70.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

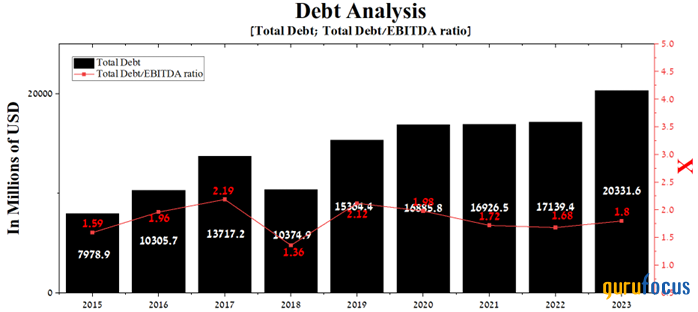

At the end of the third quarter, the company's total debt stood at approximately $20.33 billion, an increase of 18.6% over 2022 due to the issuance of $4 billion of senior notes maturing between 2026 and 2063. However, despite the growth of Eli Lilly's Ebitda in recent years, its total debt/Ebitda ratio increased slightly from 1.68 to 1.80.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

But at the same time, taking into account Eli Lilly's growing free cash flow, the continued extremely high demand for Mounjaro and the label expansions of its blockbusters, we do not expect that it will have difficulties repaying senior notes and the company's management will continue to adhere to active merger and acquisition and research and development policies.

Conclusion

Eli Lilly is an American pharmaceutical company that is one of the leaders in the global diabetes drugs market and is also beginning to take a leading position in the treatment of patients with various types of cancer and autoimmune disorders.

Since the beginning of 2023, the company's share price has risen more than 60%, driven by Mounjaro's strong sales and potential regulatory approval of donanemab to treat patients with Alzheimer's disease. As a result, its forward non-GAAP price-earnings ratio reached 88.67 and the forward price-sales ratio exceeded 15, which is significantly higher than such main competitors in the health care sector as Johnson & Johnson, AstraZeneca (NASDAQ:AZN), Merck (NYSE:MRK) and Novo Nordisk.

Moreover, we believe the hype around weight-loss drugs has begun to wane and, more importantly, many of Eli Lilly's competitors' experimental drugs are demonstrating higher weight-loss rates relative to its blockbuster, which will ultimately negatively impact sales of its diabetes medicines in the long term. These products are Novo Nordisk's CagriSema, Altimmune's (NASDAQ:ALT) pemvidutide, Carmot Therapeutics' CT-388 and Viking Therapeutics' (NASDAQ:VKTX) VK2735.

We initiate our coverage of Eli Lilly with an underperform rating for the next 12 months.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance