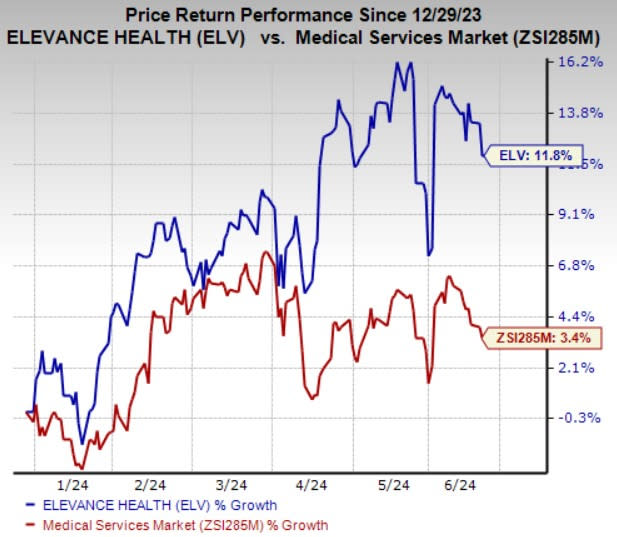

Elevance Health (ELV) Rallies 11.8% YTD: More Room to Run?

Shares of Elevance Health, Inc. ELV have gained 11.8% in the year-to-date period compared with 3.4% growth of the industry it belongs to, thanks to its strong operations, new contracts in its Medicaid business and optimization efforts. Factors such as premium rate increases and inorganic growth initiatives are further enhancing its results, allowing the company to raise its guidance, which has been well-received by investors.

Elevance Health, with a market capitalization of $122.6 billion, is one of the largest publicly traded health benefits providers in the United States. The company also boasts a prudent capital deployment history. These factors are collectively contributing to this Zacks Rank #2 (Buy) company's notable price appreciation.

Image Source: Zacks Investment Research

Can It Retain Momentum?

The ingredients are there, and now let’s get into the details and show you how its estimates for the coming days stand.

The Zacks Consensus Estimate for ELV’s 2024 earnings is pegged at $37.26 per share, which witnessed one upward estimate revision and no downward movement in the past month. The estimate indicates a 12.4% year-over-year increase. Elevance Health beat on earnings in all the last four quarters, with an average surprise of 2.8%.

The consensus mark for full-year 2024 revenues stands at nearly $172.1 billion, suggesting a 1.1% rise from the prior-year reported number. Our estimate indicates increases in product revenues and administrative fees & other revenues, which are likely to support the top-line growth.

We expect the company’s product revenues to rise by 5% year over year in 2024 due to growth in adjusted scripts and revenue per script. Moreover, growing Health Benefits service fees continue to aid administrative fees & other revenues. Commercial margin expansion in the health benefits business is expected to help in bottom-line growth in the future. Moreover, new contracts in its Medicaid business should provide further respite.

Expansion of services to ELV’s customers and new external client wins bodes well for its Carelon business. The company recently partnered with Clayton, Dubilier & Rice in a bid to expand access to high-quality value-based care in local markets. Acquisitions like Paragon Healthcare continue to boost its Carelon performance.

ELV recently entered into an agreement to acquire Kroger’s Specialty Pharmacy business in a bid to enhance Carelon Rx’s access to limited distribution drugs and expand its existing infusion and pharmacy businesses. We expect total operating income from the segment to witness a nearly 12% year-over-year jump in 2024.

Consistent dividend payouts and stock repurchases enhance ELV’s shareholder value. In 2023, the company repurchased shares worth $2.7 billion and an additional $566 million in the first quarter of 2024. As of Mar 31, 2024, it had $3.6 billion remaining under its share buyback authorization. Additionally, it paid out $379 million in quarterly dividends during the first quarter.

These positive factors are likely to help the company maintain its share growth trajectory and continue outperforming the industry.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on.

The company’s total medical membership fell 1.2% year over year in 2023 and 3.9% in the first quarter of 2024. We expect it to decline to 46.4 million for the full year 2024 from 47 million in 2023, which can affect its premium generation. Although the benefit expense ratio improved 20 basis points year over year in the first quarter of 2024, it is still above the pre-pandemic levels, meaning a lower amount remains in hand after paying claims. Nevertheless, we believe that a systematic and strategic plan of action will drive ELV’s growth in the long term.

Other Key Picks

Investors interested in the broader Medical space may look at some other top-ranked players like Sera Prognostics, Inc. SERA, Brookdale Senior Living Inc. BKD and Encompass Health Corporation EHC. Each stock presently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Sera Prognostics’ 2024 bottom line suggests 19% year-over-year growth. SERA‘s average earnings surprise for the past four quarters is at 3.7%. The consensus mark for its current-year revenues indicates a 14.4% year-over-year increase.

The Zacks Consensus Estimate for Brookdale Senior’s 2024 earnings suggests a 38.1% year-over-year improvement. It has witnessed one upward estimate revision over the past month against no movement in the opposite direction. BKD beat earnings estimates in two of the past four quarters and missed on the other occasions.

The Zacks Consensus Estimate for Encompass Health’s 2024 earnings implies a 12.6% increase from the year-ago reported figure. EHC beat earnings estimates in each of the last four quarters, with an average surprise of 18.7%. The consensus mark for its current-year revenues is pegged at $5.3 billion, which indicates a 10.5% year-over-year increase.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Sera Prognostics, Inc. (SERA) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance