Info Edge India And Two More Growth Companies With High Insider Ownership On The Indian Exchange

The Indian market has shown robust performance, gaining 2.7% recently and surging 44% over the past year, with earnings expected to grow by 16% annually. In this thriving environment, stocks like Info Edge India, characterized by high insider ownership, are particularly noteworthy as they often signal strong confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 28.6% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

We'll examine a selection from our screener results.

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited, with a market cap of ₹803.72 billion, operates as an online classifieds company in sectors including recruitment, matrimony, real estate, and education both in India and internationally.

Operations: The company generates revenue from recruitment solutions and real estate services, amounting to ₹18.80 billion and ₹3.51 billion respectively.

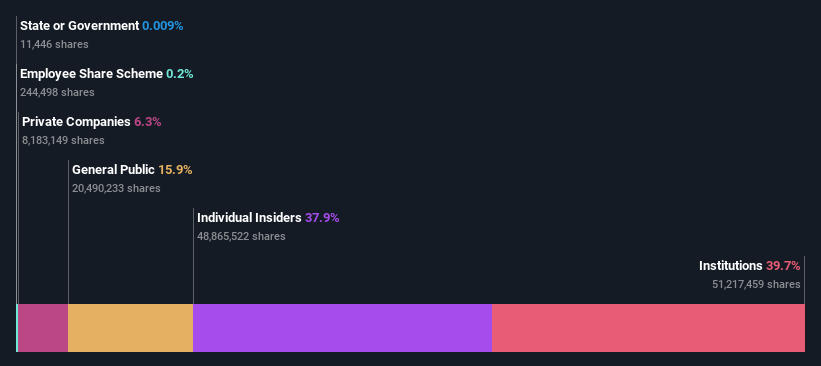

Insider Ownership: 37.9%

Revenue Growth Forecast: 12% p.a.

Info Edge (India) Limited, a company with significant insider transactions, recently reported substantial growth. It became profitable this year with earnings forecasted to grow by 24.22% annually. Despite an unstable dividend record and low projected return on equity of 8.8% in three years, the firm's revenue and earnings growth are outpacing the Indian market averages at 12% and 24.2% per year respectively. Recent activities include a proposed final dividend of INR 12 per share and participation in multiple conferences, signaling active engagement in market communication and shareholder returns management despite regulatory challenges like a recent GST-related order.

Persistent Systems

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited operates as a provider of software products, services, and technology solutions across India, North America, and other international markets, with a market capitalization of approximately ₹56.56 billion.

Operations: The company's revenue is segmented into Healthcare & Life Sciences (₹20.88 billion), Software, Hi-Tech and Emerging Industries (₹45.95 billion), and Banking, Financial Services and Insurance (BFSI) at ₹31.39 billion.

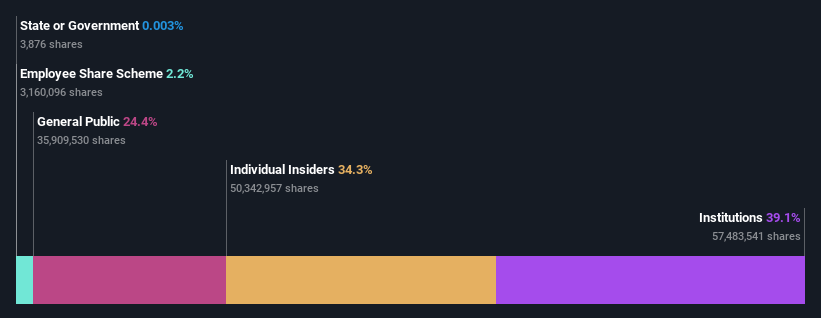

Insider Ownership: 34.3%

Revenue Growth Forecast: 13.2% p.a.

Persistent Systems, a key player in India's tech sector, showcases strong growth with earnings up by 18.7% last year and forecasted to grow at 17.9% annually, outpacing the Indian market's 15.9%. Although its revenue growth of 13.2% annually is robust, it doesn't meet the high-growth benchmark of 20%. The company maintains a healthy forecast return on equity at 26.1% in three years and pays a modest dividend of 0.68%. Recent initiatives like the launch of GenAI Hub highlight its focus on innovative AI solutions, enhancing enterprise AI integration without provider lock-in, despite no significant insider trading activities reported recently.

Varun Beverages

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited operates as a franchisee of PepsiCo, producing and distributing carbonated soft drinks and non-carbonated beverages, with a market capitalization of approximately ₹1.97 trillion.

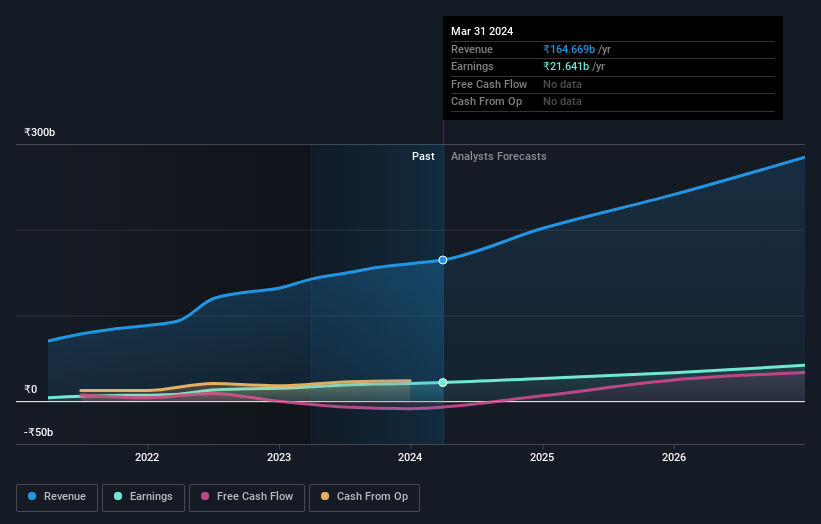

Operations: The company generates revenue primarily through the manufacturing and sale of beverages, totaling approximately ₹164.67 billion.

Insider Ownership: 36.4%

Revenue Growth Forecast: 16.4% p.a.

Varun Beverages demonstrates strong growth potential in India, with earnings and revenue increasing significantly. The company reported a substantial rise in net income and sales for Q1 2024, reflecting robust operational performance. It has also expanded internationally by establishing a subsidiary in Zimbabwe. However, it carries a high level of debt which could be a concern. The recent appointment of Rajesh Chawla as CFO indicates strategic shifts in financial leadership amidst these expansions and financial results.

Click to explore a detailed breakdown of our findings in Varun Beverages' earnings growth report.

Upon reviewing our latest valuation report, Varun Beverages' share price might be too optimistic.

Where To Now?

Reveal the 81 hidden gems among our Fast Growing Indian Companies With High Insider Ownership screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:NAUKRI NSEI:PERSISTENT and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance