ED or PPL: Which Is a Better Utility Electric Power Stock?

Utilities continue to benefit from various favorable factors, such as new electric rates, customer additions, cost management and the implementation of energy-efficiency programs. Also, the ongoing investments to improve the resiliency of electric infrastructure against extreme weather conditions and the ongoing transition to cost-effective, renewable energy sources to produce electricity aid the power industry.

Regardless of economic cycles, there is a relatively constant demand for the services offered by utilities, with the exception of significant weather variations.

Utility companies operating in the United States are taking measures to further strengthen their infrastructure, including the process of generation, transmission, distribution, storage and the sale of electricity to customers.

Still high interest rate is a concern for the capital-intensive utilities. The Fed has not increased the benchmark rate since July 2023 but indicated the possibility of one rate cut in 2024. The likely drop in interest rates in 2024 would be a positive for utility operators planning to make large investments in infrastructure upgrades.

The U.S. electric power sector is gradually moving toward cleaner sources of energy to produce electricity. Per a U.S. Energy Information Administration report, the annual share of U.S. electricity generation from renewable energy sources will be 23% in 2024 and 25% in 2025.

In this blog, we run a comparative analysis on two Zacks Utility — Electric Power companies — Consolidated Edison ED and PPL Corporation PPL — to decide which one is a better pick for your portfolio.

Both the stocks carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Consolidated Edison has a market capitalization of $30.8 billion, while PPL has $20.3 billion.

Growth Projections

The Zacks Consensus Estimate for Consolidated Edison’s 2024 earnings is pegged at $5.33 per share on revenues of $15.11 billion. This indicates year-over-year bottom-line growth of 5.1% and a revenue increase of 3.1%.

The consensus mark for PPL’s 2024 earnings is pinned at $1.71 per share on revenues of $8.26 billion. This implies year-over-year bottom-line growth of 6.9% and a revenue decline of 0.6%.

Price Performance

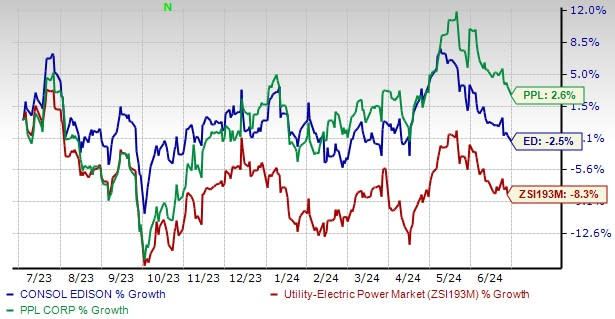

In the past year, PPL’s shares have risen 2.6% against the industry's decline of 8.3%. Shares of ED have lost 2.5% in the same time frame.

Image Source: Zacks Investment Research

Debt Position

The debt-to-capital ratio is a vital indicator of the financial position of a company. It shows the amount of debt used to run a business. Currently, Consolidated Edison and PPL have a debt-to-capital of 50.64% and 53.3%, respectively, compared with the industry’s 61.57%.

The times interest earned (TIE) ratio for ED is 3.1, and the same for PPL is 2.4. Since both companies have a TIE ratio exceeding one, it indicates that they have enough financial flexibility to meet their near-term debt obligations.

Liquidity

A current ratio of greater than one indicates that the company has enough short-term assets to liquidate to cover its short-term liabilities, if necessary. PPL’s current ratio is 1.28, better than the industry’s average of 0.78, while ED’s current ratio is 0.99.

Dividend Yield

Utility companies generally distribute dividends and increase shareholders’ value. Currently, the dividend yield for Consolidated Edison is 3.74%, and the same for PPL is 3.77%. The dividend yields of these companies are better than the Zacks S&P 500 composite’s average of 1.28%.

Outcome

Both Consolidated Edison and PPL are evenly matched and good picks for your portfolio. They have the potential to improve further from their current position and serve the needs of their growing customer base. However, our choice at this moment is PPL, given its better liquidity, dividend yield and price performance than ED.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance