e.l.f. Beauty (ELF) Q4 Earnings Beat Estimates, Sales Rise Y/Y

e.l.f. Beauty ELF reported impressive results for fourth-quarter fiscal 2024, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. Also, these metrics improved from the prior-year quarter.

In the fiscal fourth quarter, e.l.f. Beauty achieved a significant increase in net sales and expanded its market share by 325 basis points (bps). This quarter marks the company's 21st consecutive period of growth in both net sales and market share. Looking forward, ELF is excited about the substantial opportunities that lie ahead in the cosmetics, skincare and international markets.

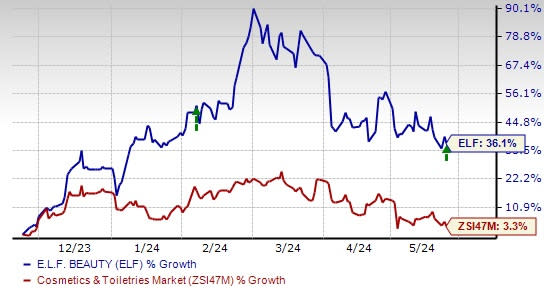

Shares of this Zacks Rank #3 (Hold) company have gained 36.1% in the past six months compared with the industry’s 3.3% growth.

e.l.f. Beauty Price, Consensus and EPS Surprise

e.l.f. Beauty price-consensus-eps-surprise-chart | e.l.f. Beauty Quote

Deeper Insight

This cosmetic company delivered adjusted earnings per share of 53 cents, surpassing the Zacks Consensus Estimate of 35 cents. Also, the bottom line increased 26.2% from the prior-year quarter.

Net sales increased 71.4% year over year to $321.1 million, surpassing the consensus estimate of $292 million. This increase was primarily driven by strength across the company’s retailer and e-commerce channels.

Image Source: Zacks Investment Research

An Insight Into Margins

In the quarter under review, gross profit rose 76% from the prior-year quarter to $227.2 million. Also, the gross margin expanded 180 basis points (bps) to 70.7%, mainly owing to positive foreign exchange effects, price increases internationally, reduced costs associated with retailer activity, cost savings and product mix improvements, and lower transportation expenses. These gains were slightly offset by inventory adjustments.

Adjusted selling, general and administrative (SG&A) expenses were up 72.9% from the fourth-quarter fiscal 2023 level to $196.9 million. As a percentage of net sales, adjusted SG&A deleveraged 50 bps to 61.3% mainly due to increased investments in marketing and digital initiatives, higher compensation and benefits, operations costs, retail fixturing and visual merchandising, and elevated depreciation, amortization and professional fees.

Adjusted EBITDA was $40.9 million, up from $21.2 million in the year-ago quarter. We note that the adjusted EBITDA margin increased 140 bps year over year to 12.7% in the quarter under review.

Other Financial Details

The company ended the quarter with cash and cash equivalents of $108.2 million, long-term debt and finance lease obligations of $161.8 million, and a total shareholders’ equity of $642.6 million. ELF provided net cash of $71.2 million from operating activities in the three months ending Mar 31, 2024.

FY25 Outlook

The company provided the following outlook for fiscal 2025. The outlook for fiscal 2025 indicates an expected 20-22% year-over-year increase in net sales. For fiscal 2025, the company anticipates net sales between $1.23 billion and $1.25 million, up from $1.02 billion in fiscal 2024. Adjusted EBITDA is expected between $285 million and $289 million, indicating an increase from the $235 million reported in the prior year.

The adjusted effective tax rate is projected to be 20-21%. Adjusted net income is forecast between $187 million and $191 million, suggesting a slight year-over-year rise from $184 million. Adjusted earnings per share are expected to be $3.20-$3.25, whereas it reported $3.18 in fiscal 2024. The weighted average shares outstanding are anticipated to be 59 million, indicating a rise from the 58 million reported in the previous year.

Eye These Solid Picks

Some better-ranked stocks are Bath & Body Works BBWI, Casey's General Stores, Inc. CASY and Abercrombie & Fitch Co. ANF.

Bath & Body Works is a specialty retailer. It has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Bath & Body Works’ current fiscal-year sales and earnings indicates a decline of 0.4% and growth of 1.8%, respectively, from the year-ago reported figures. BBWI has a trailing four-quarter average earnings surprise of 23.2%.

Casey's offers a comprehensive range of products and services to meet the needs of its customers. It currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Casey's current financial-year earnings indicates growth of 10.4% from the year-earlier reported levels. CASY has a trailing four-quarter average earnings surprise of 12%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It presently has a Zacks Rank of 2. ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie’s current fiscal-year earnings and sales indicates growth of 22.5% and 6.3%, respectively, from the prior-year actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

Bath & Body Works, Inc. (BBWI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance