DuPont (DD) & Desun Launch Flexible Solar Panels in Germany

DuPont de Nemours, Inc. DD and Desun Energy have launched flexible solar panels with DuPont Tedlar frontsheets at Intersolar Europe 2024 in Munich, Germany.

Tedlar frontsheet is used in a range of flexible solar panel applications, including mobile charging, portable applications and attached applications, as there is an increasing need for flexible solar panels aimed at consumers. Its special properties make it an excellent choice for the protective front of flexible solar panels.

DuPont Tedlar frontsheets have a unique mix of mechanical durability, abrasion resistance, outdoor stability and high light transmittance. End users can enjoy a unique lifestyle thanks to this creative solution.

With Tedlar frontsheet protection, Desun's flexible solar panels are appropriate for a variety of consumer application scenarios, including balcony solar systems, solar-powered recreational vehicles, solar power banks and outdoor power supplies for electric tools. The company may customize these solar panels based on the exact requirements of end consumers.

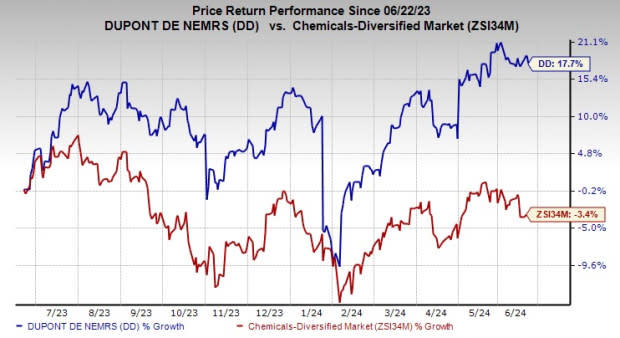

Shares of DuPont have gained 17.7% over the past year compared with a 3.4% decline in its industry.

Image Source: Zacks Investment Research

DuPont, on its first-quarter call, revised its financial outlook for 2024, increasing its projections for net sales, operating EBITDA and adjusted EPS. The company anticipates full-year 2024 net sales to be approximately $12.25 billion, operating EBITDA to be about $2.975 billion and adjusted EPS to be around $3.60 per share, based on the mid-point of the updated guidance.

For the second quarter of 2024, DuPont expects a sequential improvement in sales and earnings, attributed to favorable seasonal factors, continued recovery in the electronics sector and a decline in channel inventory destocking across industrial-based end-markets such as water and medical packaging.

For the second half of 2024, the company expects year-over-year sales and earnings growth, driven by ongoing recovery in the electronics market and a return to volume growth in the Water & Protection segment.

DuPont de Nemours, Inc. Price and Consensus

DuPont de Nemours, Inc. price-consensus-chart | DuPont de Nemours, Inc. Quote

Zacks Rank & Key Picks

DuPont currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. ATI, Carpenter Technology Corporation CRS, and Ecolab Inc. ECL.

ATI carries a Zacks Rank #2 (Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company's shares have soared 31.9% in the past year. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company's shares have soared 85.4% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, a Zacks Rank #2 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company's shares have rallied roughly 34.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance