DRDGOLD And Two Additional Top Dividend Stocks

Amidst a dynamic landscape marked by significant acquisitions, technological advancements in the AI sector, and notable shifts in market valuations, the United States stock market continues to present diverse opportunities and challenges. In this context, understanding the enduring value of dividend stocks becomes especially pertinent for investors seeking stability and consistent returns.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.79% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.24% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.41% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.04% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.08% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.95% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.91% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.84% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.22% | ★★★★★★ |

Credicorp (NYSE:BAP) | 5.78% | ★★★★★☆ |

Click here to see the full list of 208 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DRDGOLD

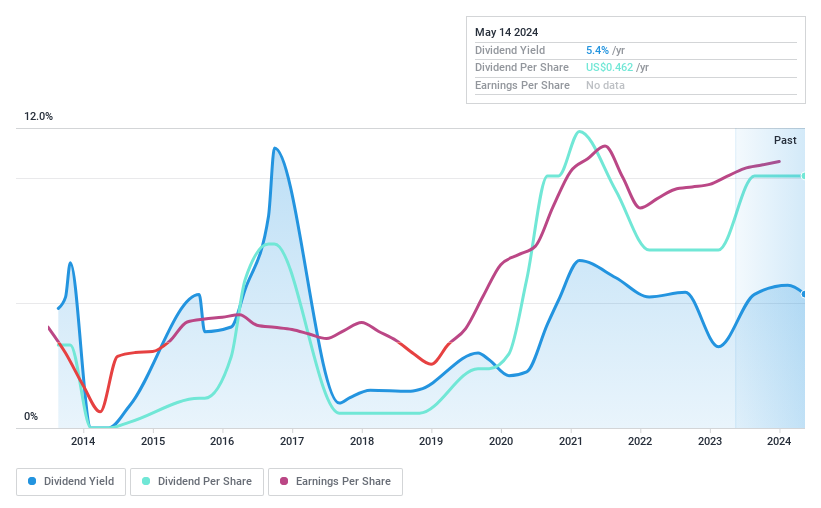

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DRDGOLD Limited is a South African gold mining company specializing in the retreatment of surface gold tailings, with a market capitalization of approximately $723.66 million.

Operations: DRDGOLD Limited generates its revenue primarily through two segments: Ergo, which contributed ZAR 4.34 billion, and FWGR, which added ZAR 1.47 billion.

Dividend Yield: 5.4%

DRDGOLD has shown a 10-year trend of increasing dividends, yet its dividend stability and reliability have been questioned due to historical volatility and periods of unreliable payments. Despite a lower Price-To-Earnings ratio of 10.2x compared to the US market average, concerns arise as dividends are not well supported by free cash flows or earnings, with a payout ratio at 54.8%. Recent production results indicate robust operational activity, but this has not alleviated the fundamental financial concerns regarding dividend sustainability.

Unlock comprehensive insights into our analysis of DRDGOLD stock in this dividend report.

Our valuation report here indicates DRDGOLD may be overvalued.

GeoPark

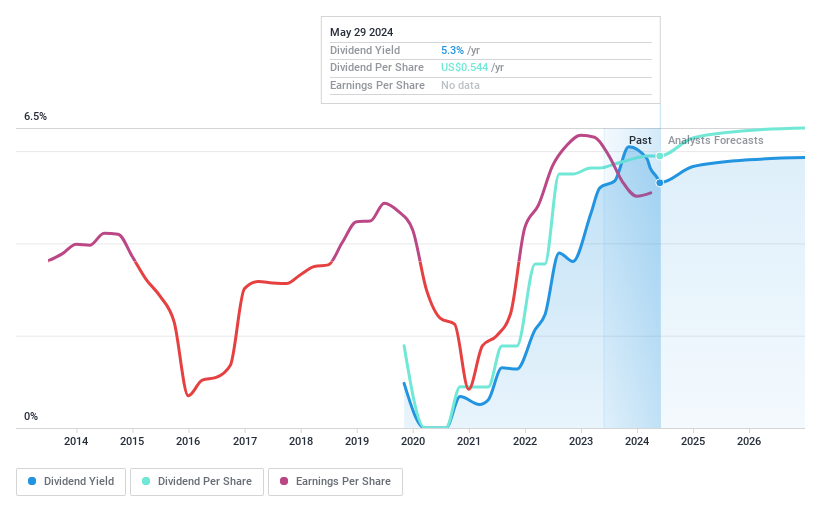

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company active in Latin America, including Chile, Colombia, Brazil, Argentina, and Ecuador, with a market capitalization of approximately $589.70 million.

Operations: GeoPark Limited generates its revenue primarily from oil and gas exploration and production, totaling $741.59 million.

Dividend Yield: 5.1%

GeoPark Limited exhibits a mixed dividend profile, marked by an unstable history and volatility in payments over its five-year dividend-paying period. Despite this, dividends have shown growth and are supported by a low payout ratio of 26.2% from earnings and 32.2% from cash flows, indicating reasonable coverage. Currently trading at a significant discount to estimated fair value, GeoPark offers a higher-than-average yield of 5.07%, placing it in the top quartile of US dividend payers. However, high debt levels and reduced profit margins year-over-year present ongoing financial challenges for the company.

Take a closer look at GeoPark's potential here in our dividend report.

Our valuation report unveils the possibility GeoPark's shares may be trading at a discount.

M&T Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: M&T Bank Corporation serves as a holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association, offering retail and commercial banking products and services across the U.S., with a market capitalization of approximately $24.50 billion.

Operations: M&T Bank Corporation generates revenue through three primary segments: Commercial Banking, which includes commercial banking and commercial real estate, contributing $2.66 billion; Retail Banking, encompassing retail banking, business banking, and residential mortgage banking with $4.98 billion; and Institutional Services and Wealth Management that includes institutional client services and wealth advisory services, adding $1.69 billion.

Dividend Yield: 3.7%

M&T Bank offers a consistent dividend yield of 3.65%, with a stable history over the past decade and recent growth in payments, supported by a low payout ratio of 35%. Despite its reliability, the yield is below the top quartile for US dividend stocks. The bank's earnings increased by 10.7% last year, and dividends are well-covered by earnings with a forecasted payout ratio of 35.4% in three years. However, it trades at a significant discount to fair value and has an allowance for bad loans at 95%, indicating some risk management in place but also room for caution.

Summing It All Up

Click through to start exploring the rest of the 205 Top Dividend Stocks now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:DRD NYSE:GPRK and NYSE:MTB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance