DOW Announces Launch of Bio-Based NORDEL REN EPDM at DKT 2024

Dow Inc. DOW, at the German Rubber Conference (“DKT”) 2024, announced the launch of NORDEL REN Ethylene Propylene Diene Terpolymers ("EPDM"), a bio-based version of Dow's EPDM rubber material used in automotive, infrastructure and consumer applications.

Dow, a key component of automotive weather seals and hoses, not only aims to help the automotive industry to achieve its sustainability goals with the launch of NORDEL REN EPDM, but also plays a vital role in the decarbonization of building and construction, as EPDM is used in building profiles, roofing membranes, wire and cable, and other applications.

NORDEL REN EPDM can help provide a low-carbon product by using bio leftovers from other industries as source material to Dow customers in the rubber industry. Since only waste residues or byproducts from an alternate industrial process are used, the raw materials will not use more land resources or compete with the food chain.

The plant-based EPDM will be manufactured using an ISCC PLUS certified mass balancing system, which tracks the movement of bio-based raw materials through a complicated value chain and credits it using verifiable bookkeeping. The resulting product performs identically to virgin material with no requalification required, allowing customers to accelerate their transition to more sustainable options without incurring additional time or carbon emissions associated with the construction and maintenance of a new parallel production stream.

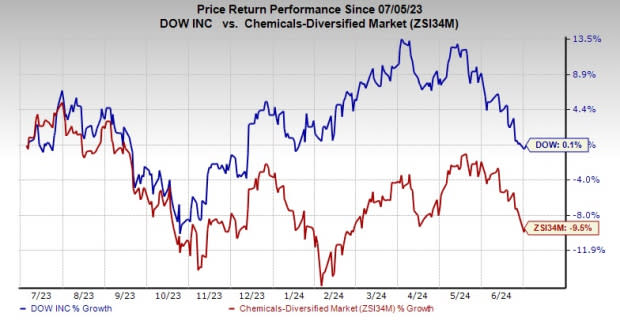

Shares of DOW have gained 0.1% over the past year against its industry’s 9.5% decline.

Image Source: Zacks Investment Research

In the first-quarter call, Dow said that demand in key end-use markets, such as packaging, mobility and energy applications, is trending higher sequentially, which is in sync with its expectations at the beginning of the year.

The company expects its high-value organic growth investments and advantaged portfolio to deliver earnings growth and increased shareholder value as the economic recovery gains strength. This provides DOW with the financial flexibility to advance its Decarbonize and Grow and Transform the Waste strategies, expected to deliver more than $3 billion in underlying earnings improvement annually by 2030.

Zacks Rank & Key Picks

Dow currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Carpenter Technology Corporation CRS, Ecolab Inc. ECL and Kronos Worldwide, Inc. KRO.

Carpenter Technology currently sports a Zacks Rank #1 (Strong Buy). CRS beat on earnings in each of the trailing four quarters, the average surprise being 15.1%. The company's shares have soared 86.9% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. The consensus estimate for ECL's current-year earnings has gone up in the past 30 days. ECL, which currently carries a Zacks Rank #2 (Buy), beat on earnings in each of the last four quarters, the average surprise being 1.3%. The company's shares have rallied almost 26.3% in the past year.

Kronos Worldwide currently carries a Zacks Rank of 2. KRO has an earnings growth rate of 297.7% for the current year. The company’s shares have gained around 49% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance