Don’t Buy a Home in These Arizona and Texas Cities That Will Drop in Value Quickly

As the summer heats up, so does the housing market across the greater United States. In some places, it is hotter than others, and in a few, it’s downright cold. Two states that have some cities to steer clear of buying a house in are Arizona and Texas. And that’s not just because these Southern states crank up the temperature from May to September. There are a slew of reasons for staying out of some of the lesser-known cities in both of these states.

“These cities in Arizona and Texas may not be ideal for property investment in 2024 due to economic challenges, high crime rates, environmental risks and limited amenities,” explained Colten Claus, an associate broker with 8z Real Estate. “Potential buyers should carefully consider these factors and conduct thorough research before making a purchase.”

GOBankingRates reached out to Claus and a few other real estate experts to get their takes on cities in Texas and Arizona that are not worth your time or money in the 2024 housing market. Here’s what they had to say, along with the median home prices in each city, sourced from Zillow.

Learn More: Don’t Buy a House in These 5 US Cities That Have Shrinking Populations and Fewer Buyers

Read Next: Become a Real Estate Investor for Just $1K Using This Bezos-Backed Startup

5 Cities in Arizona To Avoid Buying Property

These Arizona cities may be a little too rural — or too expensive — than what you’d aim for as a homebuyer.

Check Out: I’m a Real Estate Investor: 10 Places I Would Never Buy Property

Trending Now: Don’t Buy a House in These 3 Cities Facing a ‘Climate Change Real Estate Bubble’

Wealthy people know the best money secrets. Learn how to copy them.

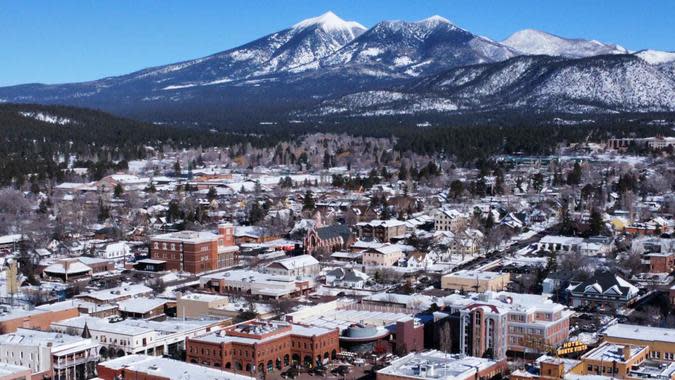

Flagstaff, Arizona

Median home price: $662,265

“Flagstaff experiences harsh winters and limited economic diversity with its high elevation and mountainous terrain,” said Alex Locklear, a realtor and the founder of NC Cash Home Buyers. He also mentioned that the median home price of around $662,265 may not justify the potential drawbacks for some investors.

Locklear pointed to a Numbeo finding that the monthly average rent of a one-bedroom apartment in Flagstaff’s city center is $1,900.

“I would never recommend investing in property in Flagstaff due to not yielding significant returns despite its undeniable natural beauty,” Locklear said.

Try This: Don’t Buy a House in These 10 US Cities: Growing Populations and Overcrowding

Kingman, Arizona

Median home price: $271,871

The remote location of Kingsman means fewer amenities and longer travel times to major cities. And that’s not exactly a ringing endorsement for property buyers. But, according to Claus, economic stagnation is also a mark against Kingman.

“Kingman’s economy has not experienced significant growth, leading to fewer job opportunities and slower population growth,” Claus explained. “This can affect property values and long-term investment potential.”

Payson, Arizona

Median home price: $451,644

“I have seen that this city experiences challenges such as limited job opportunities and high living costs, which can impact property values and investment prospects,” Locklear said.

And the median home price sitting at over $450,000 is another reason to think twice. “The overall affordability and economic outlook may not justify the investment for some buyers while median home prices are relatively high at around $451,644 as per the report of Zillow,” Locklear said.

According to Locklear, Payson may not be an ideal choice for real estate investment in 2024.

Winslow, Arizona

Median home price: $191,659

“Winslow has not seen significant economic growth, which can impact property values and investment potential,” Claus said. He noted that it’s not just the money that’s drying up, but also the natural resources around Winslow.

Along with the economy, climate change and environmental concerns are among the top reasons to stay away from buying a house in Winslow. Currently, the city faces environmental issues, including water scarcity that is impacting not just the local housing market but the quality of life.

Be Aware: 10 Dangerous Cities You Shouldn’t Buy a Home in No Matter the Price

Douglas, Arizona

Median home price: $164,201

Douglas has two major strikes against it for potential real estate buyers: a local economy on the decline and a crime rate that is steadily rising.

“Douglas has higher crime rates compared to other Arizona cities, which can impact the quality of life and property values,” Claus said. Additionally, the city “struggles with economic development, leading to limited job opportunities and slower growth,” according to Claus.

5 Cities in Texas To Stay Away From

Similarly, these Texas cities aren’t the best for investing in property, according to real estate experts.

Tyler, Texas

Median home price: $253,098

Tyler, Texas, can be a good option for affordable real estate, but consider the limitations, said Brady Bridges, owner of Reside Real Estate.

Bridges pointed out that the job market in Tyler is not very diverse, seasonal allergies can be rough and frequent flyers may find the regional airport inconvenient.

“Lastly, some might consider Tyler’s relative isolation as a downside,” Bridges said. “The city is far from major urban centers, which can limit access to certain amenities and experiences commonly found in larger cities.”

Find Out: 5 Midwest Cities Where You Can Buy Luxury Homes For $100,000 or Less

El Paso, Texas

Median home price: $222,888

El Paso offers a price tag that feels too good to be true. That’s because it might not be a gold mine for real estate investors, according to Bridges. While El Paso is affordable compared with Austin or Dallas, the “appreciation potential seems limited,” Bridges said.

“The job market is rising, but some industries might lag behind bigger cities,” Bridges said. “El Paso’s charm and affordability are undeniable, but carefully weigh these aspects against the investment goals before moving.”

Waco, Texas

Median home price: $201,570

“Waco has faced economic challenges, such as high poverty rates, which can impact property values and investment prospects,” Locklear said, noting that the median home price in Waco is approximately $201,570 on Zillow, which reflects the challenges this city is facing.

According to the Bureau of Labor Statistics, the unemployment rate in Waco was 5.2% in January 2024, which was higher than the national average.

“I would recommend avoiding investing in property in Waco for now with limited job opportunities and a declining economy,” Locklear added.

McAllen, Texas

Median home price: $225,857

You see, McAllen has struggled with economic stagnation and high crime rates, which can impact property values and investment prospects. The median home price in McAllen is approximately $225,857, according to Zillow, which may not be reflective of the economic reality of this city.

Citing data from Numbeo, Locklear highlighted that the average monthly rent for a one-bedroom apartment in the city center is $900.

“The crime rate in McAllen is also significantly higher than the national average,” Locklear said.

Read More: 7 Locations Where Housing Prices Are Plummeting Post-Pandemic

Beaumont, Texas

Median home price: $151,424

Don’t let the low price tag of a house in Beaumont fool you. It’s dirt-cheap for a good reason.

Beaumont is subject to not only economic challenges due to its reliance on the oil industry but also frequent flooding, making it less attractive for Texas property investments.

More From GOBankingRates

5 Places in America To Retire That Are Just as Cheap as Mexico, Portugal and Costa Rica

This is The Single Most Overlooked Tool for Becoming Debt-Free

This article originally appeared on GOBankingRates.com: Don’t Buy a Home in These Arizona and Texas Cities That Will Drop in Value Quickly

Yahoo Finance

Yahoo Finance