Does monday.com's (MNDY) Strong Portfolio Make the Stock a Buy?

Shares of monday.com MNDY have gained 21.7% year to date, outperforming the Zacks Computer & Technology sector's rise of 8%. The outperformance was driven by the robust adoption of its cutting-edge products, strategic growth initiatives and resilient operational management. These strengths have positioned monday.com as an attractive investment opportunity for investors seeking exposure to the thriving technology sector.

MNDY provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools.

MNDY’s efficient go-to-market model continues to drive new logo acquisitions. Net dollar retention rates remain over 110%, showcasing the stickiness and pricing power of monday.com’s products.

With a strong R&D budget, top technical talent and an open platform, MNDY is well-positioned to drive the future of work and eat into sprawling legacy productivity suite revenues. Strong product roadmap should help the company extend its lead and sustain durable 40%+ growth in the years to come.

With a best-in-class product, viral go-to-market engine and massive $117 billion addressable market in workplace operating systems and workflow apps, MNDY appears poised for long-term revenue growth. In addition, the company remains on schedule to launch the new monday service product in late 2024.

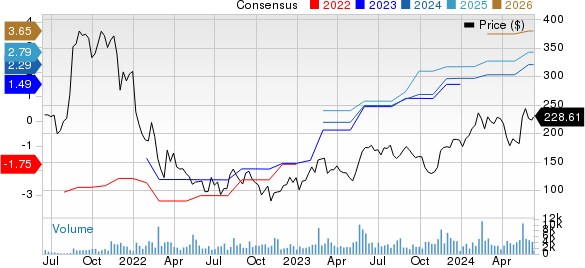

monday.com Ltd. Price and Consensus

monday.com Ltd. price-consensus-chart | monday.com Ltd. Quote

Stellar Q1 Results Show Strength

monday.com started 2024 on a high note, delivering better-than-expected first-quarter results. Revenues grew 34% year over year to $216.9 million which beat the Zacks Consensus estimate by 3.13%.

The full-year revenue guidance was raised substantially to be in the range of $942 million to $948 million, implying year-over-year growth of 29% to 30%, higher than the previously guided range of $926 million to $932 million, which indicated year-over-year growth of 27% to 28%.

The stellar results underscored monday.com’s durable growth drivers even in a challenging macro backdrop. The company boasted steady new customer additions in the first quarter across all customer segments — enterprise, mid-market and SMBs.

Total monday sales CRM accounts at the end of the quarter accelerated to 16,976, representing 27% growth from the prior quarter. Total monday dev accounts at the end of the quarter rose to 2,090, representing 44% growth from the prior quarter.

Efficient Business Model Drives Leverage

What really stands out about monday.com is its remarkably capital-efficient business model. Unlike many of its software peers, MNDY generated a record free cash flow of $89.9 million in the first quarter. This was driven by the company's low customer acquisition costs, high gross margins of around 90% and disciplined spending on go-to-market investments.

With a strong balance sheet and minimal cash burn profile, MNDY is self-funding its future growth and innovation investments. This gives it the flexibility to prioritize top-line growth over profits in the near term without having to dilute shareholder value or take on debt. As revenues scale up, monday.com's high operating leverage should translate into substantial margin expansion and profits.

Speaking of profits, MNDY now appears to be firmly on a path to achieve sustainable non-GAAP operating profitability in 2024 based on its latest guidance. The company is projected to exit 2024 with a non-GAAP operating margin of 8% to 9%.

Conclusion

monday.com appears to have strong product differentiation, efficient customer acquisition economics and a resilient business model to power through future headwinds including increasing competition from the likes of Microsoft and Google. It has built a powerful competitive "moat" in workflow customization and virality that should be challenging for large suites to replicate.

Bulls will want to see the company sustain its momentum and hit key profitability milestones over the next year. But for investors willing to be patient, this erstwhile high-flyer seems ready to take flight again for the long term.

The stock sports a Zacks Rank #1 (Strong Buy) and has a Growth Score of A, a combination that offers a good investment opportunity, per the Zacks proprietary methodology. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

monday.com Ltd. (MNDY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance