Does CrowdStrike's (CRWD) Strong Portfolio Make the Stock a Buy?

CrowdStrike CRWD shares have gained 128.1% year to date compared with the Zacks Computer & Technology sector's growth of 39.2%. The uptick can be attributed to CrowdStrike’s impressive financial performance in recent quarters, driven by an expanding cybersecurity market, strong partner base, innovative product developments and the expanding cybersecurity market.

According to a Markets and Markets report, the cybersecurity space in which CrowdStrike operates is projected to grow at 9.4% from 2023 to 2028. There is a growing gap in the cybersecurity market due to the increasing frequency and sophistication of cyber crimes.

CrowdStrike is capitalizing on this opportunity by rolling out innovative features for its Falcon platform that are keeping it ahead of its competitors.

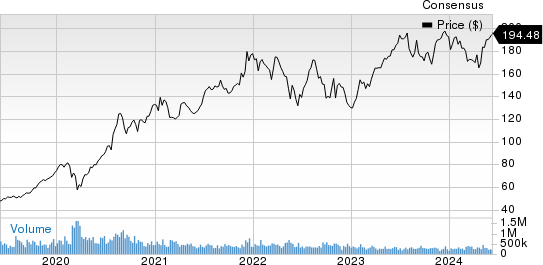

CrowdStrike Price and Consensus

CrowdStrike price-consensus-chart | CrowdStrike Quote

So far in 2024, CRWD has been able to upgrade its Falcon platform to integrate data from 500-plus independent software vendors, including Amazon Web Services, Cloudflare NET, Cribl, ExtraHop, Okta, Rubrik and Zscaler.

CrowdStrike also integrated its Application Security Posture Management into its Cloud-Native Application Protection Platform to mitigate code-to-cloud security breaches. The company also provided its customers with the perk of free 10 gigabytes of third-party data ingestion per day on its Falcon Next-Gen SIEM. With all these features, CrowdStrike is focusing on enriching its customer experience.

CRWD recently introduced a program, Falcon for Insurability. It enables insurers to offer cyber insurance at preferred rates. The program reduces underwriting risk for CrowdStrike’s insurer partners as they are leveraging the reliable Falcon platform. This benefits both parties and could potentially lead to increased subscriptions due to this advantage.

CrowdStrike Enhances its Products Through Partnerships

CrowdStrike has launched the Falcon for Insurability program in partnership with leading insurers such as Ascot Group, AXA XL, Beazley Insurance, Berkley Cyber Risk Solutions, Coalition and Resilience. This marks one of CrowdStrike's largest partnerships this year, complementing numerous other collaborations, including the ones with NVIDIA NVDA and Cloudflare.

Recently, CrowdStrike partnered with Cloudflare to integrate Cloudflare One Zero Trust protection and CrowdStrike Falcon Next-Gen SIEM to ensure security from devices to network, improve the Security Operations Center, mitigate large-scale breaches and simplify the task of joint channel partners.

CRWD also merged its Falcon platform data with NVIDIA's GPU-optimized AI pipelines and NVIDIA NIM microservices enabling their shared customers to seamlessly create custom and secure generative AI models.

CrowdStrike also benefited from the windfall of customers shifting to its Falcon platform when it expanded its collaboration with eSentire. eSentire had a significant portion of its customer base using Broadcom AVGO Carbon Black, and it is migrating its customers from there to the Falcon platform.

Since Carbon Black went public, it has been through acquisitions by VMware and then Broadcom. After VMware’s acquisition by Broadcom, the company merged Carbon Black with Symantec and formed a new business unit. Multiple handovers of Carbon Black in past few years, raised concerns about the solution’s reliability for eSentire, prompting the company to migrate its client base to CRWD’s Falcon platform.

Strong Growth Prospects

With a rising number of crucial partnerships, client base and deepened product portfolio, CrowdStrike is on a strong growth trajectory and that is reflected in the company’s last four earnings. The company’s non-GAAP earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 15.8%.

In its last-reported first-quarter fiscal 2025 earnings, CRWD beat the consensus mark both for earnings and revenues and witnessed significant year-over-year improvement.

For fiscal 2025, CRWD now expects revenues between $3,976.3-$4,010.7 million. The consensus mark for fiscal 2025 revenues is pegged at $4 billion, indicating growth of a whopping 30.8% year over year.

Non-GAAP earnings for 2025 are anticipated in the band of $3.93-$4.03 per share. The consensus mark for fiscal non-GAAP earnings is $3.92 cents per share, suggesting growth of 27% year over year.

Conclusion

CrowdStrike’s diversified product portfolio, strong partner base and expanding clientele make it an important player in this sphere. These strengths, coupled with its solid financial performance, position CrowdStrike as a promising opportunity for long-term growth.

However, investors should wait for a better entry point for CrowdStrike, which currently has a Zacks Rank #3 (Hold), given the stretched valuation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CRWD is trading at a premium with a forward 12-month P/S of 19.05X compared with the Zacks Internet Software industry’s 2.59X and higher than the median of 15.25X.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance