Does Allegion (NYSE:ALLE) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Allegion (NYSE:ALLE), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Allegion

How Fast Is Allegion Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Allegion has managed to grow EPS by 22% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

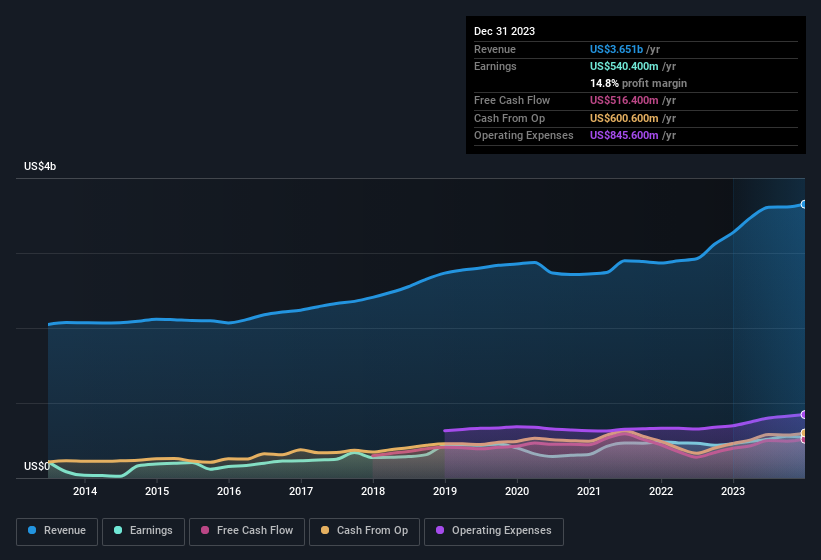

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Allegion maintained stable EBIT margins over the last year, all while growing revenue 12% to US$3.7b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Allegion's forecast profits?

Are Allegion Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While we did see insider selling of Allegion stock in the last year, one single insider spent plenty more buying. To be exact, President John Stone put their money where their mouth is, paying US$3.4m at an average of price of US$122 per share That can definitely be seen as a sign of conviction.

On top of the insider buying, it's good to see that Allegion insiders have a valuable investment in the business. To be specific, they have US$43m worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.4%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, John Stone is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Allegion, with market caps over US$8.0b, is around US$13m.

Allegion's CEO took home a total compensation package worth US$9.3m in the year leading up to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Allegion To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Allegion's strong EPS growth. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. So it's fair to say that this stock may well deserve a spot on your watchlist. We should say that we've discovered 2 warning signs for Allegion that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Allegion, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance