DocuSign And Two Other Stocks That May Be Priced Below Their Estimated True Value

As global markets navigate through a period of relative calm with anticipation for upcoming earnings reports and central bank activities, investors continue to assess the shifting landscape. In such an environment, identifying stocks that may be undervalued becomes particularly crucial, offering potential opportunities for those looking to invest in assets that might be priced below their intrinsic value given current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

SouthState (NYSE:SSB) | US$75.80 | US$151.58 | 50% |

Truecaller (OM:TRUE B) | SEK35.80 | SEK71.36 | 49.8% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥14.67 | CN¥29.33 | 50% |

DO & CO (WBAG:DOC) | €166.60 | €332.57 | 49.9% |

Macromill (TSE:3978) | ¥828.00 | ¥1655.93 | 50% |

InPost (ENXTAM:INPST) | €16.25 | €32.50 | 50% |

Humble Group (OM:HUMBLE) | SEK10.06 | SEK20.11 | 50% |

Elkem (OB:ELK) | NOK20.48 | NOK40.94 | 50% |

Dr. Hönle (XTRA:HNL) | €17.00 | €33.96 | 49.9% |

Levima Advanced Materials (SZSE:003022) | CN¥13.80 | CN¥27.55 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener

DocuSign

Overview: DocuSign, Inc. operates globally, offering electronic signature solutions and has a market capitalization of approximately $10.95 billion.

Operations: The company generates its revenue primarily from software and programming services, totaling approximately $2.81 billion.

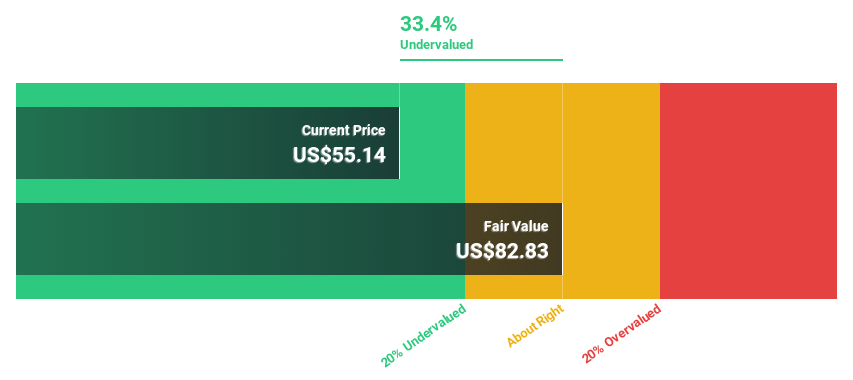

Estimated Discount To Fair Value: 33.4%

DocuSign, currently priced at US$55.14, trades below its estimated fair value of US$82.83, indicating a significant undervaluation based on discounted cash flow analysis. Despite this, DOCU's revenue growth forecast of 5.8% per year lags behind the broader U.S. market projection of 8.6%. However, earnings are expected to surge by an impressive 27.08% annually over the next three years, outpacing the market's average growth rate and suggesting potential for substantial value realization if these projections hold true amidst recent strategic expansions and product launches aimed at enhancing workflow efficiencies in various sectors.

According our earnings growth report, there's an indication that DocuSign might be ready to expand.

Click to explore a detailed breakdown of our findings in DocuSign's balance sheet health report.

BILL Holdings

Overview: BILL Holdings, Inc. operates globally, offering financial automation software to small and midsize businesses with a market capitalization of approximately $5.53 billion.

Operations: The company generates its revenue primarily from its software and programming segment, totaling approximately $1.24 billion.

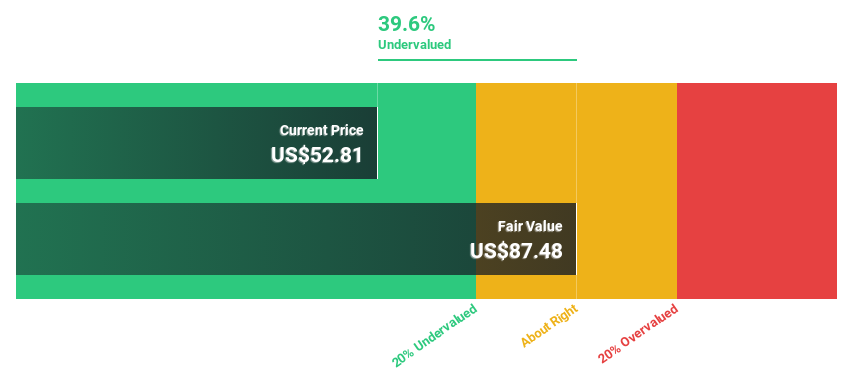

Estimated Discount To Fair Value: 39.6%

BILL Holdings, trading at US$52.81, is perceived as undervalued with its price sitting 39.6% below the estimated fair value of US$87.48 based on discounted cash flow analysis. While the company's revenue growth is expected to be robust at 13% annually, surpassing the U.S market average of 8.6%, its return on equity in three years is projected to be modest at 7.2%. Recent strategic moves include appointing Sarah Acton as CCO and launching Regions CashFlowIQSM, enhancing BILL's market position despite a forecasted lower-than-desired profitability trajectory over the next few years.

FIT Hon Teng

Overview: FIT Hon Teng Limited is a company based in Taiwan that manufactures and sells mobile and wireless devices and connectors globally, with a market capitalization of approximately HK$24.59 billion.

Operations: The company's revenue is primarily derived from consumer products, generating $0.71 billion, and intermediate products which contribute $3.63 billion.

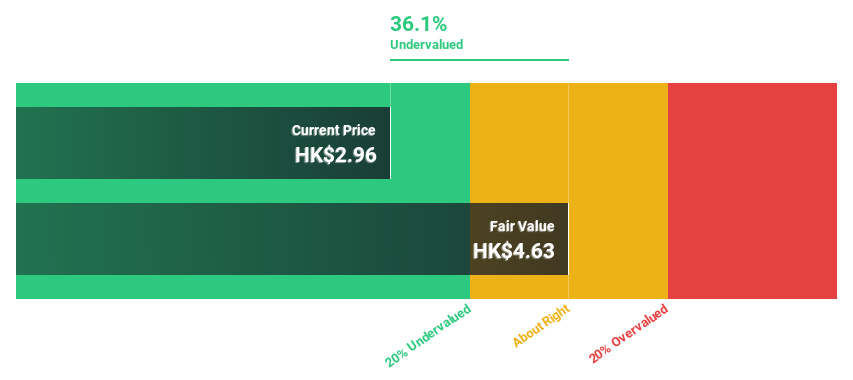

Estimated Discount To Fair Value: 21.3%

FIT Hon Teng's stock, priced at HK$3.63, shows potential undervaluation, trading 21.3% below the estimated fair value of HK$4.61 based on discounted cash flow analysis. The company anticipates robust earnings growth of 32.48% annually over the next three years, significantly outpacing the Hong Kong market's forecasted 11.3%. However, its return on equity is expected to remain low at 12%. Recent corporate changes include board reshuffles and amendments to company bylaws aimed at aligning with updated listing rules.

Make It Happen

Click here to access our complete index of 950 Undervalued Stocks Based On Cash Flows.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:DOCU NYSE:BILL and SEHK:6088.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance