Dividend policies, external appraisals for directors still lacking among Singapore listcos: Sias

94% of listcos did not use external parties to conduct appraisal of their boards. This must improve, says SIAS CEO David Gerald.

Big listed companies in Singapore with market capitalisation of at least $1 billion have improved their corporate governance standards after two years of stagnation. But overall, companies here are lacking in external board appraisals, risk disclosures and dividend policies.

Even though overall scores may have risen and there are isolated bright spots, there is still room for improvement, says David Gerald, founder, president and chief executive officer of the Securities Investors Association (Singapore), or Sias. “Today, more than ever before, Sias has an important role to play in augmenting the efforts of the regulators in enhancing corporate governance standards.”

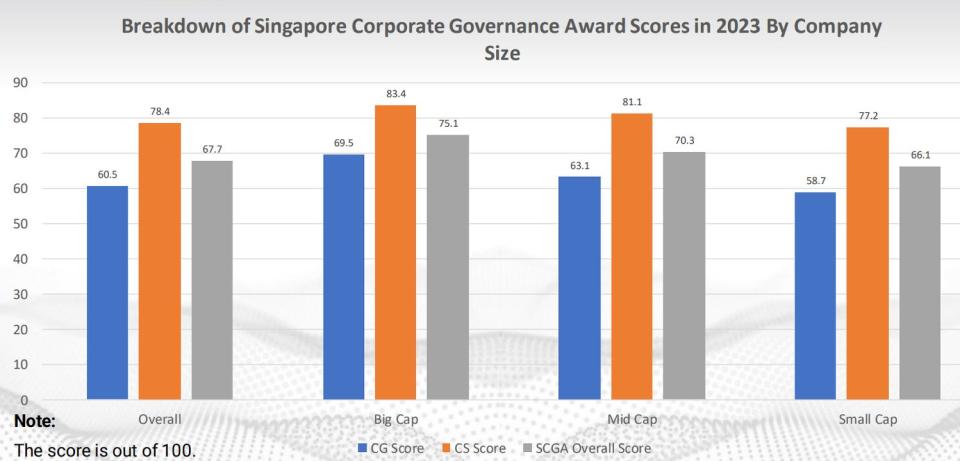

Speaking at Sias’s Corporate Governance Conference 2023 on Nov 6, Gerald says big listcos climbed back to an average score of 69.5% for the year ended Dec 31, 2022 after two years of stable results — 65.4% in 2021 and 65.7% in 2022 — in Sias’s Singapore corporate governance scoring system.

Taken together with mid-caps and small-caps, Singapore’s listcos scored an average of 60.5% this year, up from 55.3% in 2022 and 52.9% in 2021.

Sias, in collaboration with the NUS Business School’s Centre for Governance and Sustainability, conducts research on listcos’ corporate governance practices.

The Singapore Corporate Governance scorecard combines listcos’ corporate governance and corporate sustainability scores, and the ratings are used as part of the selection process for the annual Sias Investor Choice Awards.

This year’s research found that some 94% of listcos did not use external parties to conduct appraisal of their boards. This must improve, says Gerald.

This year, only 6.3% of listcos disclosed the use of external parties to conduct the board or individual director appraisal. In addition, just 6.3% of listcos released their notice of AGM with detailed agenda and explanatory circulars via bourse filings at least 28 days before the meeting.

Furthermore, 63.3% of listcos did not disclose their key risks, including operational risks and how these risks were assessed and managed; while slightly more than 3% disclosed that their management committees have not considered linking risk management and remuneration.

On dividends, slightly more than two-thirds of listcos did not disclose a policy on dividend payouts if they have paid dividends for their most recent financial year.

We can do better, says Gerald. “In a market that relies on the principle of ‘caveat emptor’ or ‘buyer beware’, where shareholders and investors are ultimately the buyers who have to beware, I must say that these numbers are uncomfortably high.”

Gerald cites a paper published in the Columbia Journal of Asian Law in 2015, which revealed that over 90% of Singapore listcos have “block shareholders who exercise controlling power”. “This concentrated shareholding structure presents unique challenges in ensuring the accountability of controlling shareholders and protecting minority shareholder interests.”

Several controlling shareholders have, in recent years, attempted to privatise their companies at prices that Sias felt were “clearly too low and unfair”, says Gerald. “Sias has, therefore, been actively involved in appealing for better prices in several privatisation exercises.”

According to Gerald, Sias succeeded in securing higher prices for minorities in three cases this year: Boustead Projects Avm, Golden Energy and Lian Beng.

Gerald believes regulations in Singapore are now formulated with greater protection for minorities in mind. “For example, there is now a hard, nine-year limit to the tenure of independent directors and soon, all companies will have to disclose executive remuneration in full.”

With the theme of “Building trust through effective corporate governance: navigating legal, ethical and social challenges”, Ravi Menon, managing director of the Monetary Authority of Singapore (MAS) delivered the opening address as guest-of-honour.

Corporate boards can do better in two areas — introspection and diversity, says Menon. He cites a 2022 KPMG survey commissioned by the Corporate Governance Advisory Committee, which found that around half of listcos are still providing boilerplate disclosures and are unwilling to disclose any objective performance criteria.

The contributions of board members are often limited to their rate of attendance at board meetings, and boards often do not address the outcome of any assessments and the actions taken to address any gaps identified, says Menon.

“Introspection on performance has been an area of missed opportunity for most listed companies here,” adds Menon. “The board evaluation process is a critical area for boards to do better in and gain the trust of their stakeholders.”

Corporate boards should also look into improving their diversity in skills and expertise, says Menon. “Boards need to look beyond the more traditional areas of expertise such as accounting and legal expertise and consider bringing in experts in emerging areas like technology and sustainability.”

Gerald also presented Menon with an award for “outstanding contributions to the investing community”. After 12 years at the helm of Singapore’s central bank and regulator, Menon will step down at the end of the year.

“MAS, under Mr Menon’s leadership, has made significant efforts to promote financial literacy and investor education among retail investors,” says Gerald. “Further, Mr Menon has always supported the work of Sias and other industry partners in our efforts to advocate for higher corporate governance standards.”

Prof Kishore Mahbubani, Singapore’s former permanent representative to the United Nations, also spoke in a subsequent fireside chat.

The conference marks the launch of Sias’s Corporate Governance Week, which also features forums to discuss best practices and trends in corporate governance for industry professionals and companies.

Photos: Albert Chua/The Edge Singapore

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Asean offers Singapore companies 'biggest protection' against US-China 'crossfire': Mahbubani

Singapore set to direct DBS to fix 'unacceptable' online outages

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance