Like Dividend Aristocrats? Try These 3 Dividend Kings Stocks

Most are familiar with Dividend Aristocrats, companies that have increased dividend payouts for at least 25 consecutive years.

However, a step above that is the elite Dividend Kings group, which consists of companies that have boosted their payouts for a minimum of 50 consecutive years.

These companies have shown incredible resilience historically, surviving through many economic periods while also continuously increasingly rewarding shareholders.

For those seeking a steady income stream, several members of the club, including Genuine Parts GPC, Procter & Gamble PG, and Emerson Electric EMR, could all be considered. Let’s take a closer look at each.

Genuine Parts Upgrades Outlook

Genuine Parts, a current Zacks Rank #2 (Buy), distributes automotive and industrial replacement parts and materials. The company has been benefiting nicely from an aging fleet of vehicles, with consumers holding onto their cars for longer periods at a historically high rate.

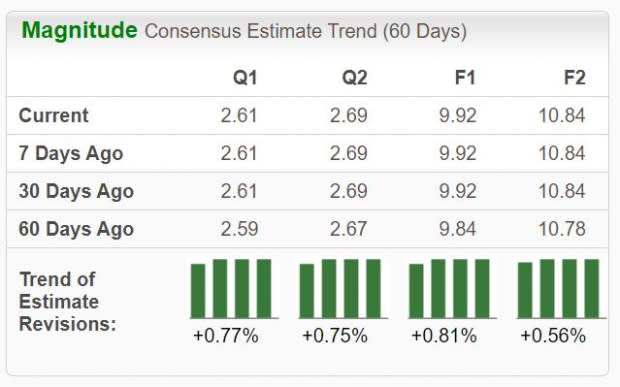

Analysts have adjusted their earnings expectations, painting a bullish near-term picture for the company.

Image Source: Zacks Investment Research

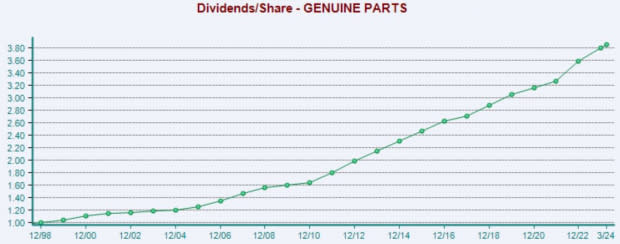

The company’s shareholder-friendly nature is illustrated below, which tracks dividends paid for the last 25 years. Shares currently yield a solid 2.9% annually, with the company’s 43% payout ratio remaining sustainable.

Please note that the last value is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

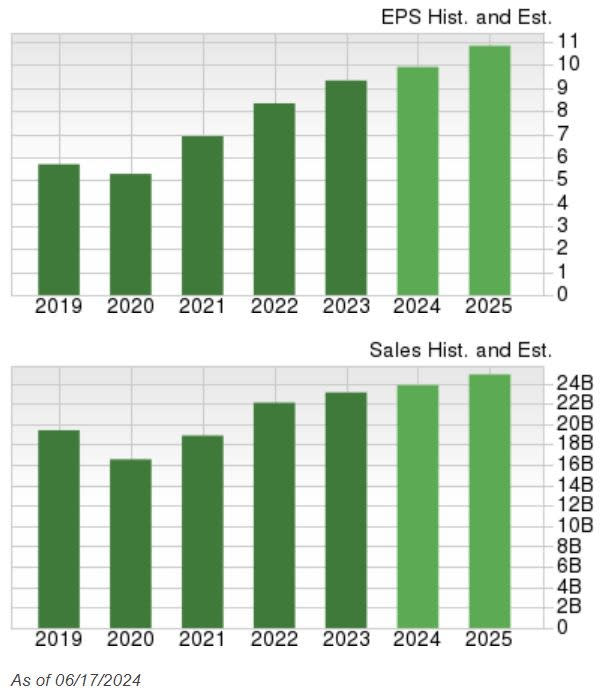

Growth is expected to remain positive, with consensus expectations for its current fiscal year suggesting 6% EPS growth on 3% higher sales. The company has been performing nicely overall, reaffirming its 2024 sales guidance while also upping its EPS outlook into a band of $9.80 - $9.95 per share (previously $9.70 - $9.90 per share).

Analysts’ positive revisions reflect the guidance upgrade.

Image Source: Zacks Investment Research

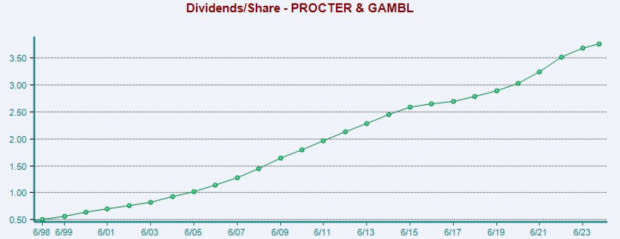

Procter & Gamble Flexes Defensive Capabilities

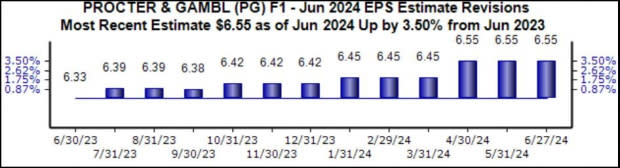

Procter & Gamble, also commonly known as P&G, is a branded consumer products company with an extensive product portfolio. The stock presently sports a favorable Zacks Rank #2 (Buy), with the revisions trend positively stable for its current fiscal year up nearly 4% to $6.55 per share over the last year.

Positive revisions have also hit the tape for its next fiscal year (FY25).

Image Source: Zacks Investment Research

The company has long been a favorite among income-focused investors thanks to its defensive nature, which allows it to generate consistent demand in many economic situations. Its established nature provides an ability to consistently increasingly reward shareholders, as its high-growth days are in the rearview.

Shares presently yield 2.4% annually, beating out the S&P 500’s current yield of 1.3%.

Image Source: Zacks Investment Research

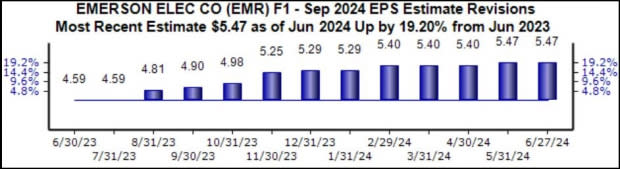

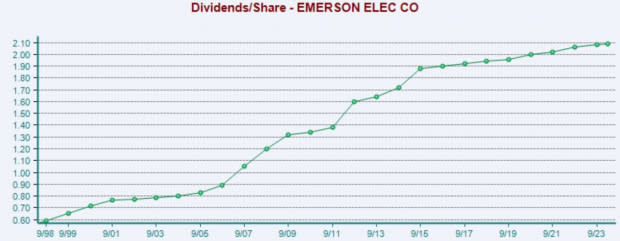

Emerson Electric Expected to See 23% Annual Earnings Growth

Emerson Electric is a global technology and engineering company providing innovative solutions for customers in industrial, commercial, and residential markets. Like PG, the earnings estimate revisions trend has been bullish for its current fiscal year, up 20% to $5.47 per share over the last year and suggesting 23% year-over-year growth.

Image Source: Zacks Investment Research

EMR’s latest set of quarterly results were positive, leading it to update its FY24 outlook. Notably, free cash flow saw a considerable boost, improving 32% year-over-year alongside margin expansion. Improved cash-generating abilities allow the company to keep its dividend payouts coming, with shares currently yielding 2% annually.

Image Source: Zacks Investment Research

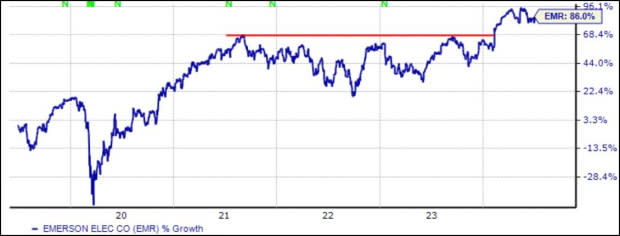

It’s worth noting that shares have recently broken out of a multi-year range and are now trading near all-time highs. Stocks making new highs tend to make even higher highs, particularly when positive earnings estimate revisions hit the tape.

Image Source: Zacks Investment Research

Bottom Line

While the Dividend Aristocrats group is a favorite among income-focused investors, a step above is the elite Dividend Kings group, a club reserved for companies with a minimum of 50+ years of higher payouts.

For income-focused investors seeking reliability, all three members of the club above – Genuine Parts GPC, Procter & Gamble PG, and Emerson Electric EMR – have displayed precisely that.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Genuine Parts Company (GPC): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance